Strom acquired a 25% interest in Ace Partnership by contributing land having an adjusted basis of $40,000 and a fair market value of $75,000. The land was subject to a $60,000 mortgage, which was assumed by Ace. No other liabilities existed at the time of the contribution. What amount of gain was recognized by Strom as a result of the contribution?

Below is the code for an example image modal link

Flashcards

/* -- Un-comment the code below to show all parts of question -- */

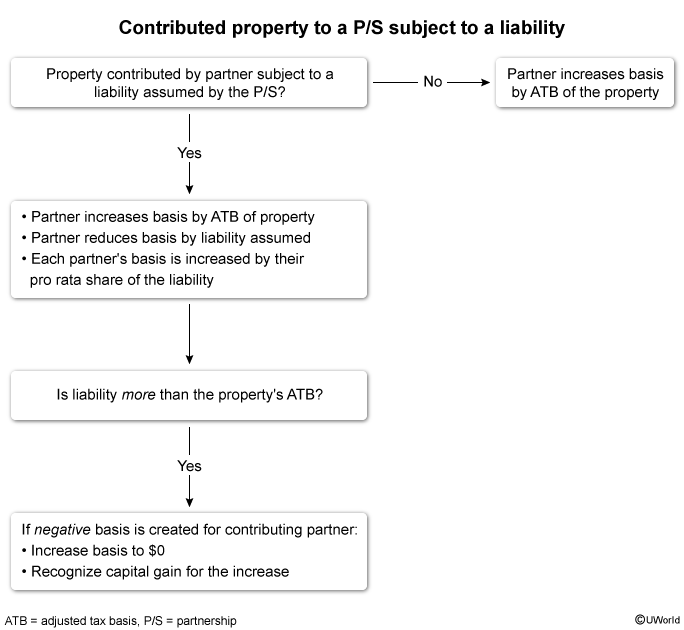

A partner's contribution of property in exchange for a partnership (P/S) A formal or informal arrangement in which two or more parties agree to operate a for-profit business as co-owners. interest generally results in no gain or loss recognized by the partner. Because the exchange is generally nontaxable, the outside basisThe tax basis of an individual partner's interest in a partnership. It is adjusted each period for the partner's share of the partnership's income and liabilities, additional contributions, and distributions received. of the partner's P/S interest equals the adjusted tax basisThe amount used to value property in tax transactions. It is the property's purchase price (ie, cost) less accumulated depreciation. The cost may be adjusted for subsequent capitalized costs or recoveries. (not FMV) of the property contributed. A partner's basis can never be negative.

If property contributed is subject to a liability (eg, mortgage) assumed by the P/S, the contributing partner's basis is reduced by the liability. Each partner's basis is then increased by their pro rataA term meaning "in proportion" used to describe the fractional share of ownership by which an amount will be divided or distributed. share of the new P/S liability.

However, if the property contributed has a liability exceeding its adjusted tax basis, a negative basis could result for the contributing partner. If this occurs, the partner will recognize The reportable gain or loss included in a taxable income calculation. It may differ from the realized gain or loss. a capital gainThe difference between the amount realized and an asset's adjusted tax basis when disposing of a capital asset. equal to the required adjustment to bring the basis up to $0.

In this scenario, Strom's contribution creates a negative basis. Because basis cannot be negative, the basis is increased to $0, and a $5,000 gain is recognized.

| Strom's basis for contributed land | $40,000 |

| Less: Mortgage assumed by P/S | (60,000) |

| Plus: Strom's 25% share of P/S mortgage | 15,000 |

| Basis before adjustment for gain | ($5,000) |

| Capital gain recognized | $5,000 |

| Strom's basis in P/S | $0 |

Things to remember:

When a partner contributes property with a liability assumed by the partnership, the liability reduces the partner's basis. This basis is then increased by the partner's pro rata share of the liability. If the liability exceeds the property's adjusted basis, a negative basis could result for the partner. If this occurs, the partner will recognize a capital gain equal to the adjustment required to bring the basis up to $0.

JS & CSS for popup modals