UWorld CPA Exam Practice Questions (QBank)

Unlimited Practice Tests for AUD, REG, FAR, ISC, TCP & BAR

Roger CPA Review and Wiley CPA Review have joined UWorld to create the ultimate set of CPA practice questions.

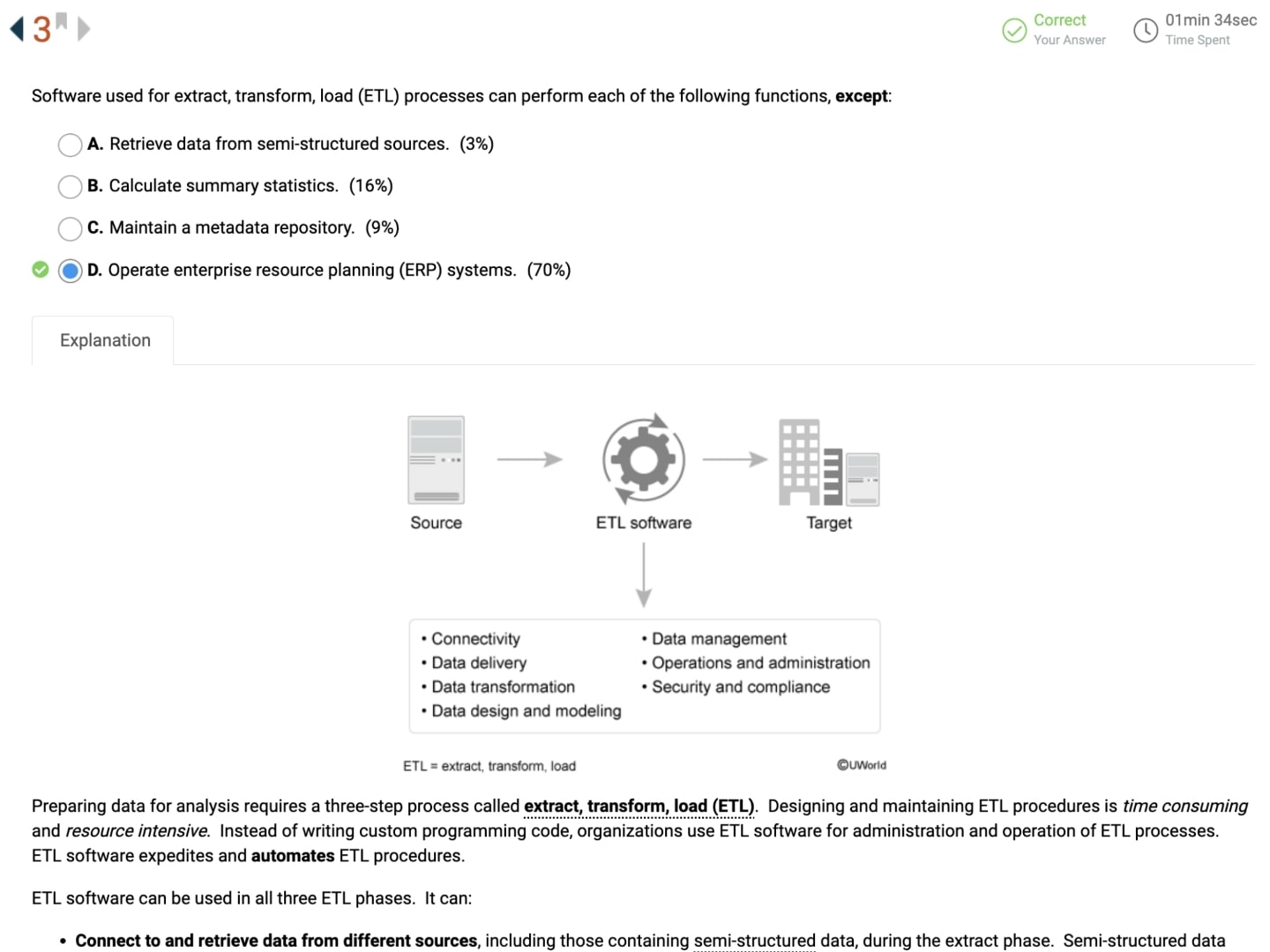

Practice is one of the best ways to prepare for and pass the CPA Exam. Study with the most comprehensive bank of multiple-choice questions, task-based simulations, and unlimited practice tests across all six exam sections.

*No Credit Card Required

Practice Your Way To Passing The Exam

Learn by Doing

Create Custom Quizzes

Understand the Why

Simulate Exam

Conditions

Turn Weaknesses

into Strengths

Replicate the Exam Environment

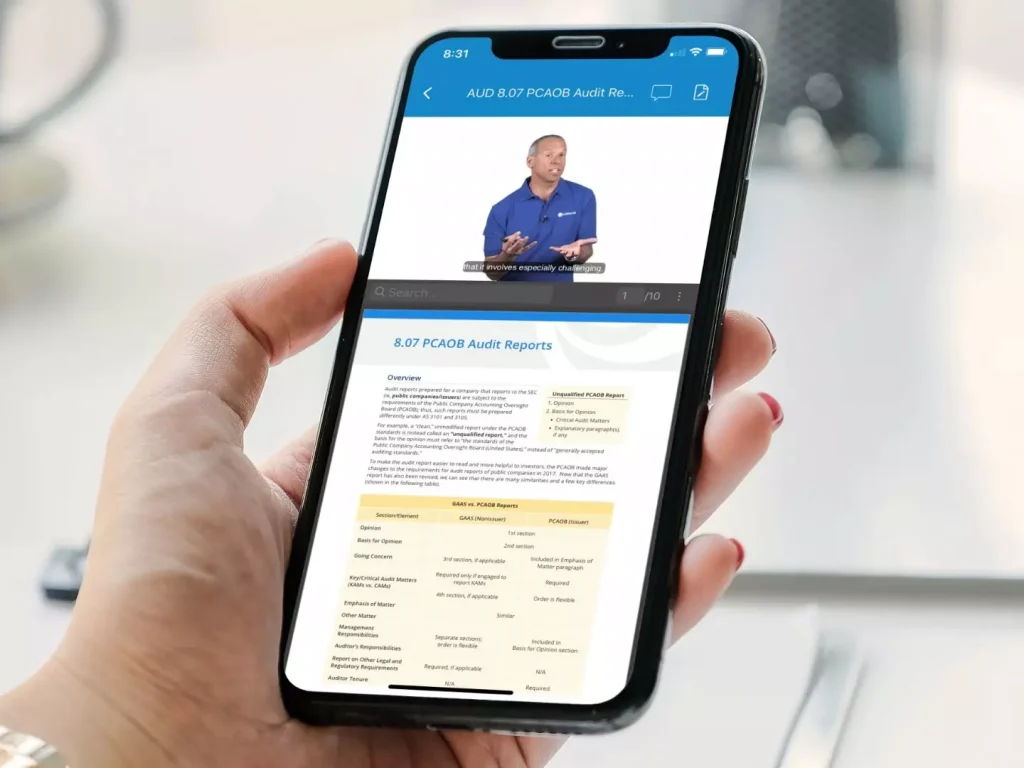

Understand Difficult Concepts with Visual Learning

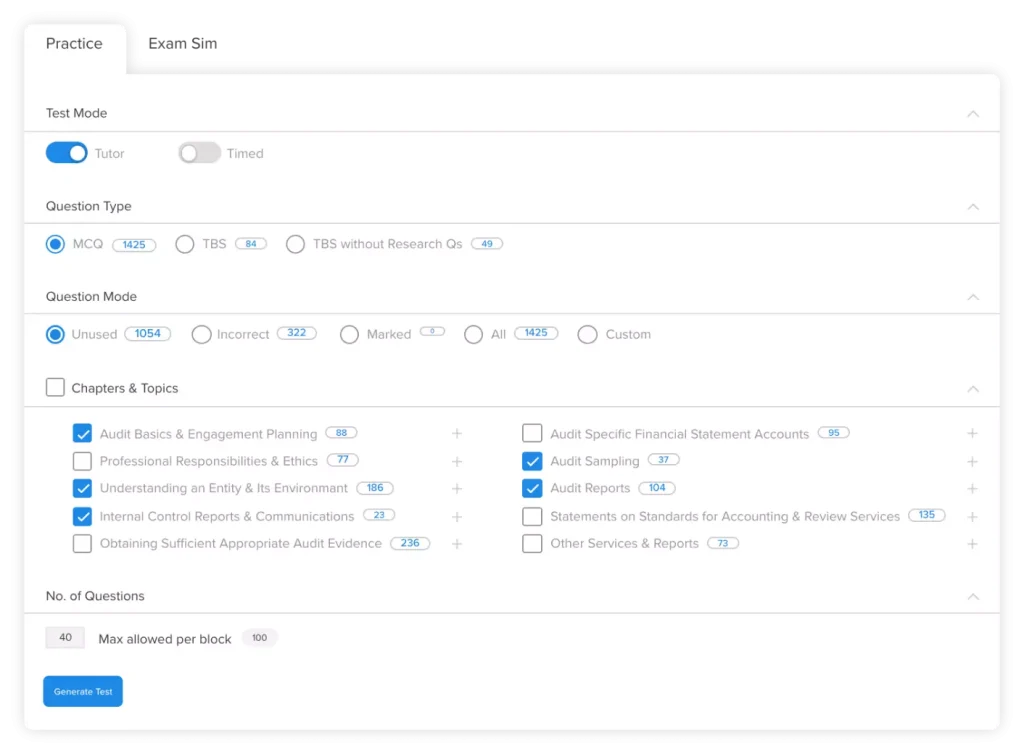

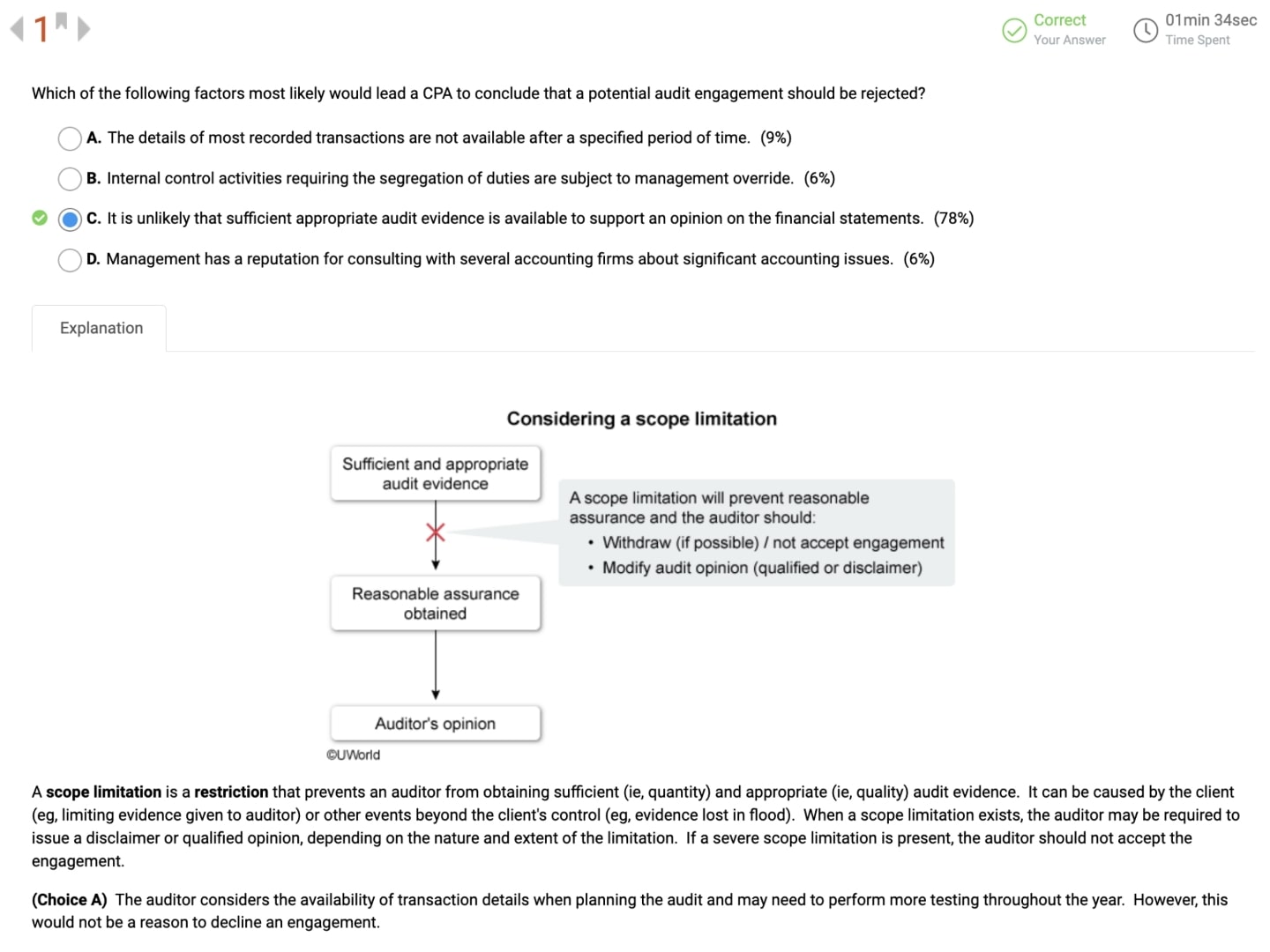

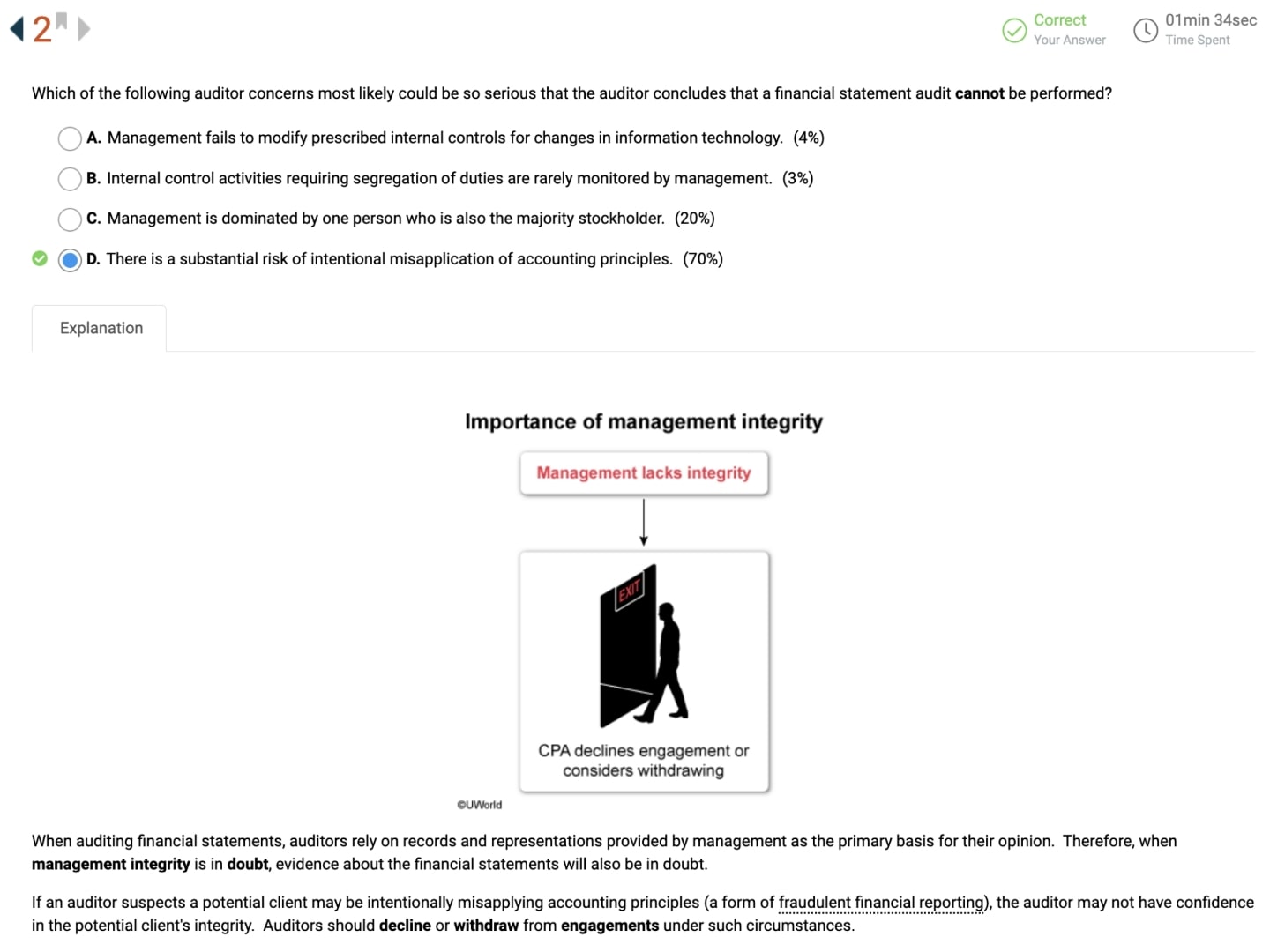

High-quality questions and detailed answer explanations – written by practicing CPAs and accounting educators – include vivid illustrations, diagrams, flowcharts, and tables that provide immediate feedback and bring tough CPA Exam topics to life.

8,000+ CPA Exam Questions

With Unlimited Full-length CPA Practice Exams containing a comprehensive repository of multiple-choice questions, task-based simulations, and in-depth explanations, our Qbank is an indispensable tool that helps sharpen your skills, identify your strengths and weaknesses, and help refine your time management skills and knowledge retention.

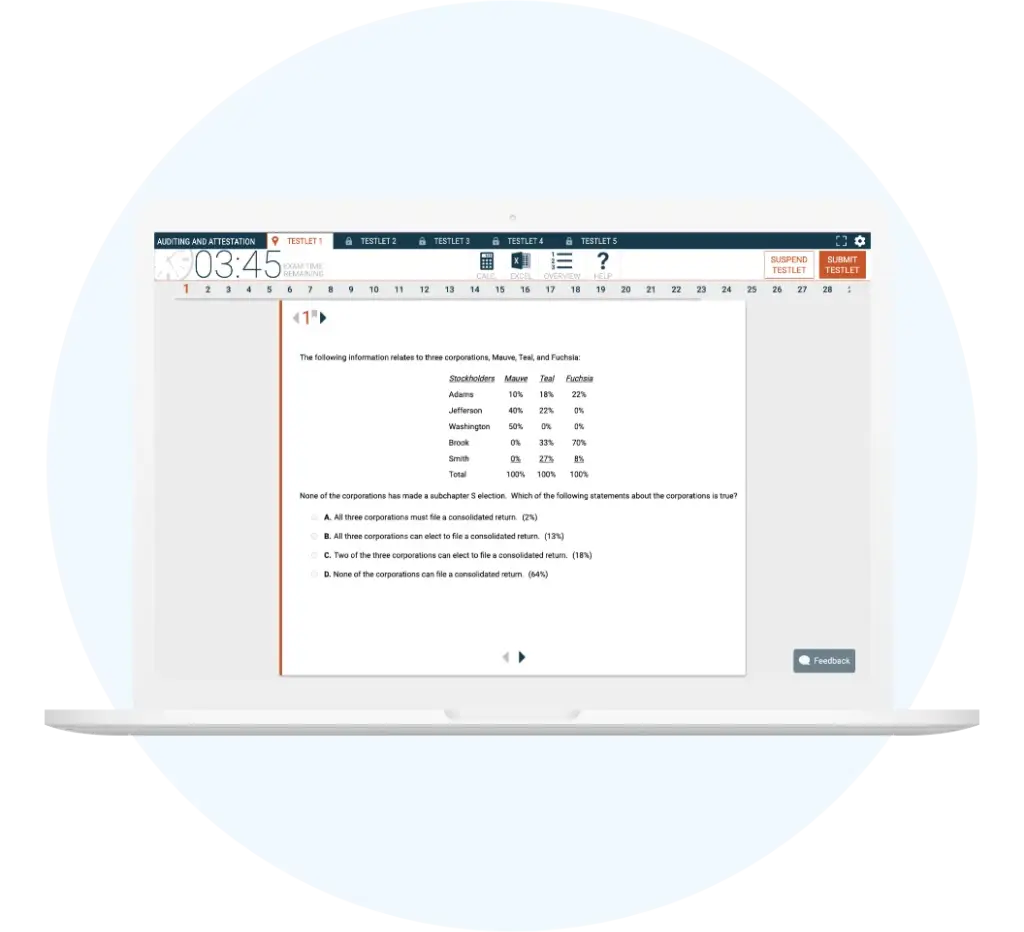

Practice With an Interface That Simulates the Real CPA Exam

Practice With an Interface That Simulates the Real CPA Exam

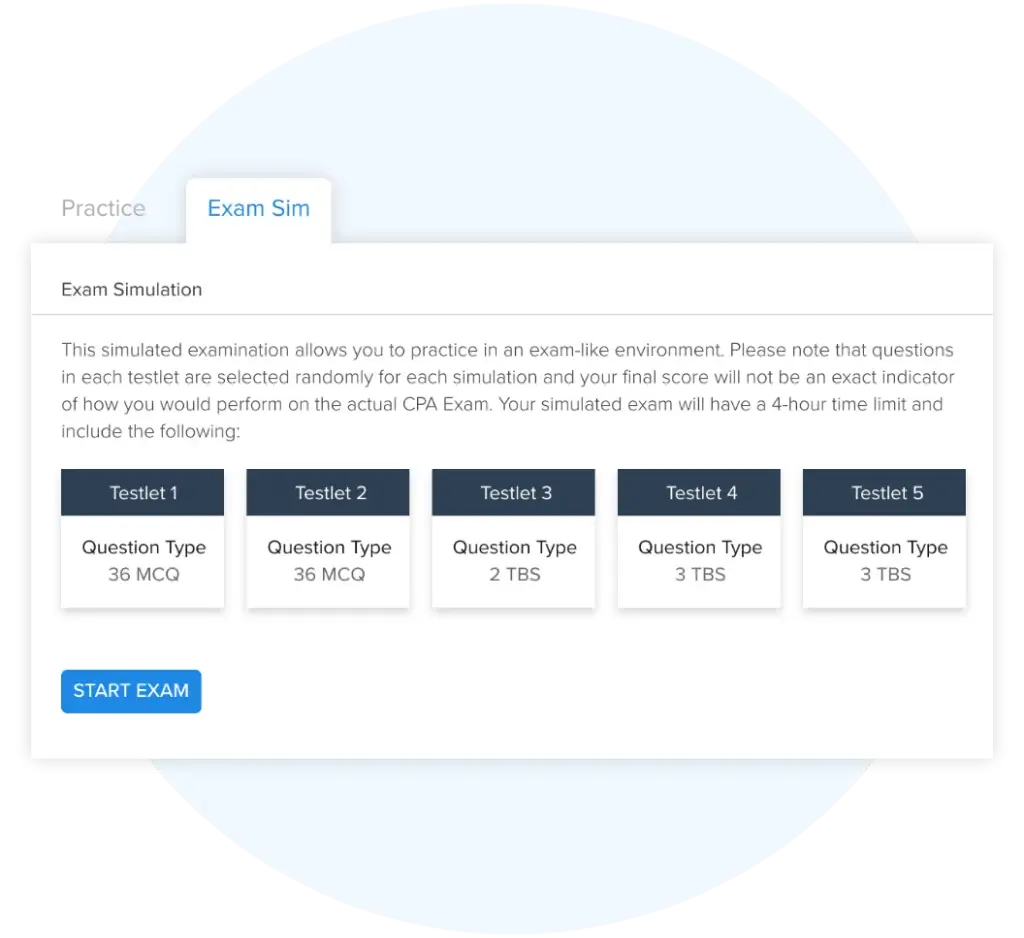

Take Full-Length Practice Exams

Take Full-Length Practice Exams

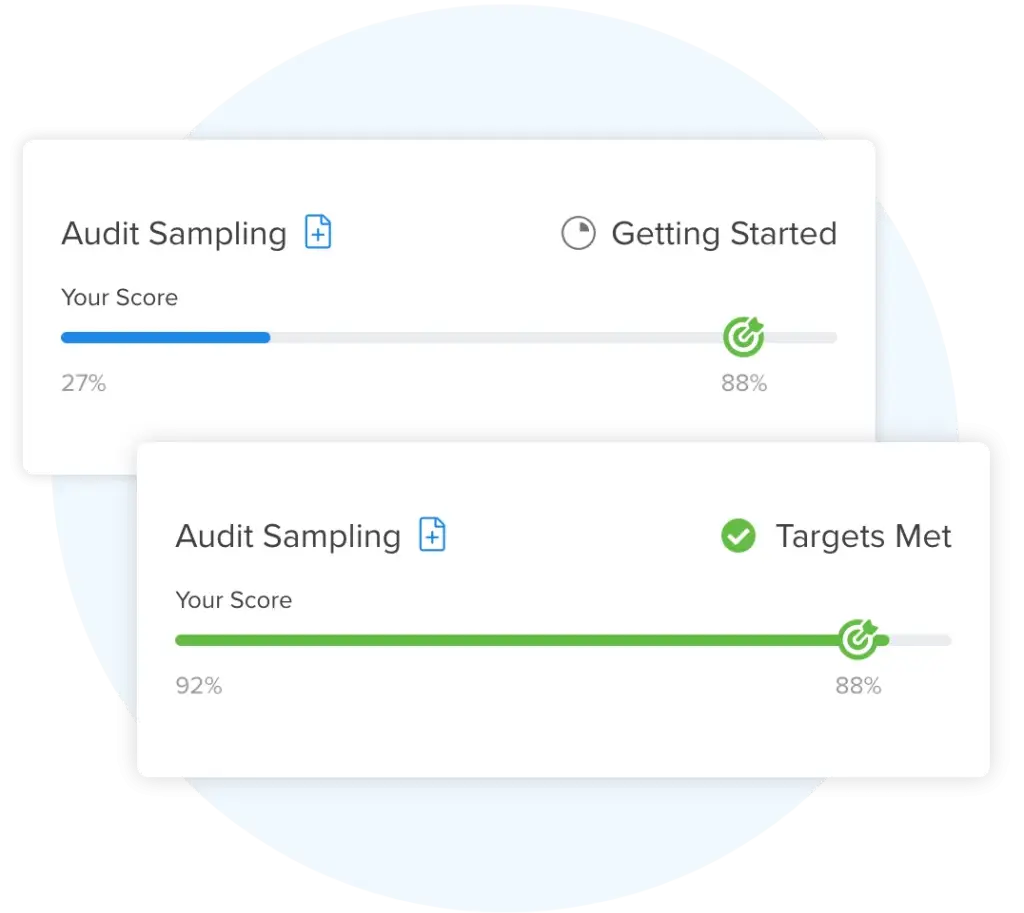

Track Your Progress With SmartPath

Track Your Progress With SmartPath

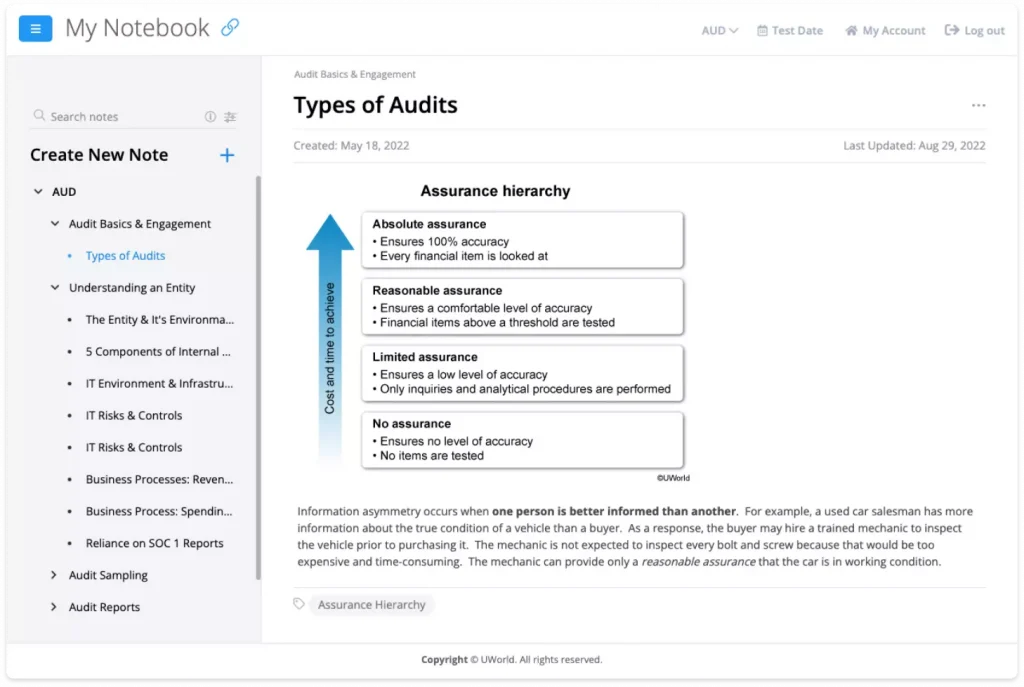

Create a Comprehensive Digital Notebook

Create a Comprehensive Digital Notebook

Practice CPA Practice Questions Anywhere at Any Time

Practice CPA Practice Questions Anywhere at Any Time

Purchase CPA QBank by Section

All UWorld CPA Review Courses include four QBanks, or you may purchase as a stand-alone QBank by exam section below.

Hear From Our Past Candidates

I am thoroughly challenged by the questions presented. I also love the detailed explanation after each question as they are descriptive and clear. It has been extremely beneficial to me understanding the concepts presented in the lectures and how to apply them to specific situations. I also love the ease of creating and navigating through all of the tests that I have created. They reinforce the information learned in the chapters."

Thank you UWorld for the hours of entertaining lessons that helped me truly learn the material and not just memorize it, combined with the excellent explanations to the practice questions, really helped me grasp the most difficult concepts. I also love all the statistics built into the question bank - they helped me study so much smarter. I passed all 4 sections on my first try and can add those lovely 3 letters to the end of my name now - CPA!"

I have passed all 4 parts of the Uniform CPA Exam on the first try by using the UWorld CPA Review course only. MCQs and TBS banks are of high quality and followed by excellent explanations and references to online lectures and books. Overall, this program follows the AICPA blueprint to a T. I have been out of college for at least 20 years and can highly recommend this course to any CPA candidate who is serious about passing CPA exams!"