Discover which credentials — the Certified Public Accountant (CPA), Certified Management Accountant (CMA®), or Chartered Financial Analyst (CFA®) — are right for you with expert guidance.

The accounting and finance fields offer endless opportunities. With its rapid growth and global reach, the industry’s wide range of career options and credentials can be dizzying. With so many choices, where do you begin? In our recent Choices, Choices, Choices webinar, our instructors offer guidance on which industry designations — the CPA, CMA, and/or CFA — will help you achieve your goals.

Meet Your Instructors

Our recent webinar featured 3 distinguished instructors who shared the opportunities a CPA license, CMA certification, and CFA charter can unlock. As dedicated members of the UWorld Accounting instructor team, they are passionate about supporting you every step of the way as you prepare for a lifelong career in accounting and finance.

CGMA

“You’re going to feel overwhelmed … and that’s normal. But if you trust the process and stay focused, you’ll achieve something extraordinary.” — Roger Philipp

CPA, CGMA

“I’ve got a bunch of letters behind my name … but I care about the letters that [will] appear behind your name. Let’s get together, get this done, and have a fun time doing it.” — Monte Swain

(inactive)

“When I’m teaching, you’re not just going to watch. That’s like watching me on the treadmill … to help you get in shape. You’re going to put pen to paper, because what you write, you’ll remember.” — Peter Olinto

The CPA – The Limitless Highway

The CPA is often seen as the gold standard in accounting designations. It is best envisioned as a trustworthy industrial highway — a reliable and direct route to prestigious roles in public accounting, private corporations, and government agencies. Focused on accounting, auditing, and taxation laws, the CPA emphasizes rule-based practices, compliance with standards, and preparing external financial statements.

Unlike the CFA and CMA's more analytical and strategic focus, the CPA offers a more linear, structured path to mastering core accounting principles and tax laws, making it a highly respected choice if you’re seeking definition and precision in an accounting career.

While CPA is technically a license for practice within the U.S., it is recognized by many governing bodies worldwide, including the European Union (EU).4

Roger’s thoughts: "Becoming a CPA is about more than numbers. It’s about being part of a respected profession that offers limitless potential."

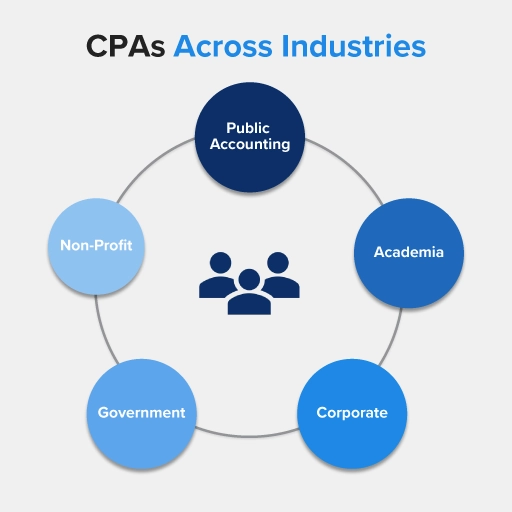

Career Opportunities

CPAs fill many industry roles and perform critical financial tasks, ensuring the compliance, accuracy, and integrity of financial systems. Career opportunities for CPAs fit into many categories across industries.

Specific CPA Roles

| Tax Accountant | Public Accountant | Senior Auditor | Finance Director |

| Corporate Accountant | Staff Accountant | Treasury Analyst | Corporate Controller |

| Forensic Accountant | Internal Auditor | Senior Financial Analyst | Accounting Professor |

| Cost Accountant | Compliance Auditor | Personal Financial Advisor | Accounting Manager |

Roger’s thoughts: "Passing the CPA Exam isn’t easy, but it opens doors to public, private, governmental, and even academia roles, offering lifelong career security and advancement."

Earning Potential

The average salary for a CPA is $82,000 to $129,000, depending on the specific industry and role filled.5 Additionally, CPAs enjoy substantially higher lifetime earnings than non-CPAs. As experience grows, so does compensation. Senior CPAs can earn between $119,000 and $200,000, and those in management roles often command salaries upward of $240,000.5

Location and industry significantly influence CPA salaries, with regions such as Washington D.C., New York, and New Jersey offering the highest averages and industries such as manufacturing leading in pay. Over a lifetime, CPAs can earn up to $1 million more than non-CPAs, making the credential a worthwhile investment. While earnings vary based on multiple factors, the CPA designation opens doors to achieving your financial goals.6

Exam Relevance

The CPA Exam prepares you for a successful accounting career by providing coverage of vital topics such as auditing, financial reporting, taxation, and regulatory compliance. It is structured to help you consider your career prospects before taking the exam.

When taking the CPA Exam, you must select 1 of 3 disciplines to be tested alongside the core subjects already covered. Those disciplines are Information Systems and Controls (ISC), which focuses on technology and IT auditing; Business Analysis and Reporting (BAR), centered on advanced financial reporting and analysis; and Tax Compliance and Planning (TCP), which delves into tax rules and planning strategies.

Each discipline aligns with specific career paths, offering you a chance to tailor your expertise. If you’re unsure which to choose, you can switch later and use the process to explore your career interests.

The exam also emphasizes professional ethics, analytical thinking, and technological competence, equipping you to navigate the increasingly tech-driven and ethical challenges in the accounting field. By testing critical skill levels such as application, analysis, and evaluation, passing the CPA Exam ensures you’re prepared to thrive in a constantly evolving industry.7

Become highly skilled at:

| Tax Preparation | Consulting/Advisory |

| Tax Planning | Auditing |

| Business Analysis and Reporting | Data Analysis |

Roger’s thoughts: "The CPA Exam is not an IQ test. It’s a discipline test. If you study, you will pass. Our job is to motivate you through the hundreds of hours it takes to accomplish this goal."

The CMA – The Mountain View

Envision the CMA certification as a mountain trail, leading you upward to leadership roles with a strategic view of your specific organization’s financial landscape. This path is ideal if you aspire to oversee systems, analyze performance, and make decisions that drive an organization’s internal operational success. The CMA equips you to guide an organization toward strategic expansion and financial security.

While not necessarily more challenging than the CPA, the CMA prepares you to navigate more nuanced, complex organizational challenges. It gives you the tools to shape your organization's future with the financial expertise with strategic insight that will guide their internal decision-making processes.

If you aim to improve internal organizational performance and thrive in strategic thinking and problem-solving, the CMA will provide the skills to advise financial operations and guide business strategy.

Monte’s thoughts:"The CMA is all about using accounting and finance to build and sustain value [within] organizations. It’s for those who want to lead and influence decision-making in management roles."

Career Opportunities

CMAs are highly regarded for their financial planning, analysis, and strategic decision-making skills, making them indispensable across many business environments. They often begin their careers in entry-level roles such as internal auditors or financial analysts.

As you gain experience, you can progress to leadership roles such as financial controller or team manager. With significant expertise, you may even advance to senior positions like treasurer or CFO.8

Specific roles include:

| Financial Manager | Management Accountant | Risk Manager | Treasurer |

| Financial Controller | Cost Accountant | Internal Auditor | Chief Financial Officer (CFO) |

| Financial Analyst | Corporate Controller | Finance Director | Budget Analyst |

Monte’s thoughts: "Controllers, CFOs, and finance managers often hold the CMA. It’s a certification that accelerates your leadership journey."

Earning Potential

CMAs enjoy strong earning potential, with average base salaries between $76,000 and $133,000 in the U.S. and entry-level roles starting at $80,000.9 Experienced CMAs can earn about $125,000, while top roles such as CFO command salaries ranging from $84,000 to $239,000.

CMAs consistently earn more than non-CMAs. Salaries vary by location, with Texas CMAs averaging $98,702 and top earners reaching $149,530. This certification significantly boosts career prospects and long-term income potential.

Exam Relevance

The CMA exam prepares you for a successful career in management accounting by covering a broad range of topics, including financial planning, performance analytics, and strategic financial management. With 2 exam parts, it equips you with necessary skills like financial analysis, risk management, and decision-making, ensuring you’re ready for real-world challenges.

The exam also emphasizes ethical internal decision-making and global financial reporting, preparing you for leadership roles in today’s interconnected business environment. Passing the CMA exam helps you build a well-rounded skill set aligned with the demands of modern management accounting.

Become highly skilled in:

| Strategic Financial Planning and Analysis | Decision Support and Advisory |

| Internal Controls and Data Analytics | Forecasting and Risk Management |

Monte’s thoughts: "The 2-part exam focuses on financial planning and analytics in Part 1, and strategic financial management in Part 2. [Both parts] equip you to be an influencer and impact leader."

The CFA® Charter – The Premier Global Expedition

Imagine the CFA charter as a global expedition, guiding you on a borderless journey through interconnected financial landscapes and international markets. This prestigious credential provides a bird’s-eye view of global finance, focusing on analyzing financial statements from the user’s perspective. This allows CFA charterholders to provide clients with strategic financial advice as they make critical investment decisions in the ever-evolving global market.

The CFA charter offers deep insights into how financial data informs decisions across organizations, industries, and country borders. It will prepare you for high-stakes roles in investment firms, banks, and financial institutions and equip you with the expertise to excel in investment management, financial analysis, and portfolio management.

As you progress through this rigorous path, you’ll learn to analyze investments, manage portfolios, and navigate ethical practices internationally. You’ll gain the analytical tools and global wisdom needed to provide informed advice to important players in the competitive world of finance.

Peter’s thoughts: "The CFA charter is globally recognized, with 170,000 charterholders in 28 nations. If you want mobility in your career, this is the credential to pursue."

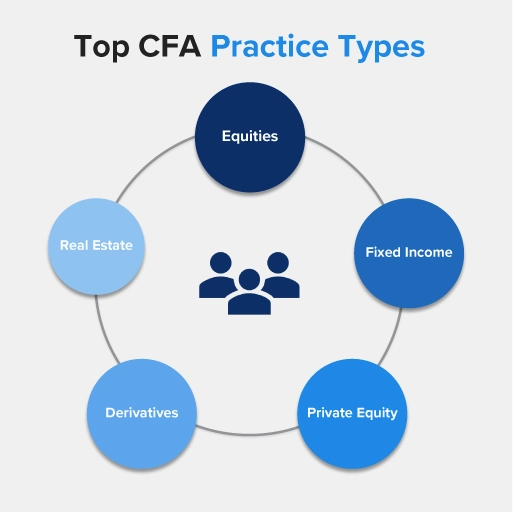

Career Opportunities

Becoming a CFA charterholder is a prestigious choice if you’re pursuing a career in global finance, distinguishing you as a highly skilled professional adept at tackling complex challenges. CFA charterholders have diverse career opportunities across the finance industry, from investment management to corporate finance and consulting.

Valued for their expertise in investment analysis, portfolio management, and ethical decision-making expertise, charterholders often begin in roles such as financial analyst or research associate. With experience, CFA charterholders can advance to senior positions such as portfolio manager or C-suite executive.10

Specific roles include:

| Portfolio Manager | Risk Manager | Market Research Analyst |

| Research Analyst |

Consultant |

Relationship Manager/Account Manager |

| Financial Analyst | Corporate Financial Analyst | Private Equity General Partner |

| Investment Strategist | Equity Research Analys | Hedge Fund Manager |

Peter’s thoughts: "The CFA opens doors to equity research, investment banking, risk management, and more. It’s a smorgasbord of choices, letting you find your niche in the financial world."

Earning Potential

CFA charterholders enjoy impressive earning potential, with average salaries ranging from $88,111 to $102,000 annually in the U.S. Entry-level CFA charterholders earn around $85,000.11 At the same time, mid-career professionals make approximately $80,000, and those with 10-19 years of experience can earn up to $147,395.

The total compensation, including bonuses and equity, averages $300,000 for U.S. charterholders. Salaries vary by location and education, with higher earnings in major financial hubs and among those with advanced degrees. Globally, the CFA designation significantly boosts earning potential across finance roles and regions.

Exam Relevance

The CFA exam equips you for a successful finance career by offering in-depth coverage of key industry issues like ethics, economics, financial analysis, and portfolio management across 3 levels that increase in their complexity. Its progressive structure deepens your understanding of the global market and mirrors the increasing responsibilities in finance roles. The exams emphasize practical application through real-world scenarios, with a strong focus on ethical standards that prepare you for responsible global decision-making.

With content on international financial reporting and specialized pathways such as Private Wealth and Private Markets, the CFA exam aligns your expertise with global and industry-specific demands. It also sharpens critical analytical skills, builds time management, and fosters continuous learning, ensuring you thrive in the evolving, tech-driven finance industry.

Become highly skilled in:

| Financial Analysis and Valuation | Expert Consulting on Investment Decisions |

| Portfolio Strategy | Ethical Decision-Making |

Peter’s thoughts: "The CFA [exam] goes beyond theory; [it teaches] you how to use financial statements to assess risk, growth, and value in real-world scenarios."

Choosing Between the CPA, CMA, and CFA Exams

The CPA, CMA, and CFA credentials represent 3 specialized routes that support different career aspirations and types of critical thinking. Choosing the ideal path depends on your passions, talents, natural skills, long-term goals, and desired professional milestones.

At the end of the day, there isn’t one wrong or right decision. Your career path is unique to you, we’re here to help you with industry-leading learning tools, advice, and expert support to achieve your independent aspirations.

FAQs

What is more challenging: CPA, CMA, or CFA?

The CPA Exam focuses on accounting and requires specific coursework to qualify, whereas the CFA covers broader finance topics, requiring candidates to master a wider range of subjects. The CMA often overlaps with CPA content but emphasizes management accounting. Each exam presents unique challenges; choose based on your career goals.

Will my bachelor’s degree from 32 years ago count toward CPA education requirements?

Yes. Your bachelor’s degree in Business Administration from 32 years ago can likely count toward your CPA education requirements. However, specific requirements vary by state. Contact your state’s Board of Accountancy to confirm and ensure you meet the 150-credit-hour requirement.

What strategies can help me prepare for CFA Level 2 after a long break?

Preparing for CFA Level 2 after a 5-year gap may require additional study hours to refresh your knowledge from Level 1. Allocate around 100 hours to review foundational concepts like financial statement analysis and portfolio management. Consider reaching out to UWorld for intensive review resources.

Does FP&A experience qualify for CMA requirements?

Yes. Experience in Financial Planning & Analysis (FP&A) qualifies for CMA requirements. Accepted experience includes roles such as financial statement preparation, budgeting, auditing, and cost management. Your bachelor’s degree also satisfies the educational prerequisite.

Should I pursue CPA or CFE first if I’m interested in both?

Prioritizing the CPA is generally recommended, as it provides a broader foundation in accounting and finance. If you’re specifically interested in fraud examination, adding the CFE certification afterward can complement your CPA.

Does CPA work experience qualify for CMA requirements?

Yes, in many cases, work experience qualifying for the CPA can also meet CMA requirements. Ensure your experience aligns with CMA standards, such as financial planning, cost accounting, or corporate financial management.

Does the CFA Level 1 exam overlap with FAR?

Yes. There’s significant overlap in accounting-related topics. FAR covers financial reporting concepts essential for corporate finance and equity valuation, which are also tested in CFA Level 1.

How long does it take to complete the CPA after a master’s?

Most candidates take about 18 months to pass all 4 CPA Exam sections. Some states allow up to 36 months to complete the exams. Check your state’s timeline here.

Are there prerequisites for the CFA?

To sit for CFA Level 1, you need a bachelor’s degree or be in the final year of your undergraduate program. Progressing to Level 2 requires completion of your degree.

Do graduates from top schools such as Wharton need a CFA?

While a degree from a top institution such as Wharton provides a strong foundation, pursuing the CFA adds value and recognition in the finance industry. Choose based on your career goals.

Can I earn a CMA with my MBA, or do I need a master’s in accounting?

Your MBA satisfies the educational requirement for the CMA. You can begin working toward the CMA without pursuing an additional master’s degree.

Can I pursue CMA without additional degrees?

Yes. Your bachelor’s degree qualifies you to pursue CMA certification. Since you already have an MBA, you’re well-prepared to start the process.

References

- American Institute of Certified Public Accountants. (n.d.). CPA exam digital brochure. Retrieved from https://us.aicpa.org/content/dam/aicpa/becomeacpa/cpaexam/downloadabledocuments/cpa-exam-digital-brochure.pdf

- Institute of Management Accountants. (n.d.). Enroll in the CMA. Retrieved from https://www.imanet.org/ima-certifications/cma-certification/enroll-in-the-cma

- CFA Institute. (n.d.). CFA program exam. Retrieved from https://www.cfainstitute.org/programs/cfa-program/exam

- Investopedia. (2022, May 14). How much do CPAs make?. Retrieved from https://www.investopedia.com/articles/investing/051415/how-much-do-cpas-make.asp

- Big 4 Accounting Firms. (n.d.). Average CPA salary, compensation, and benefits. Retrieved from https://big4accountingfirms.org/average-cpa-salary-compensation-benefits/

- National Association of State Boards of Accountancy. (2020, December 8). Four CPA exam sections. Retrieved from https://nasba.org/blog/2020/12/08/four-cpa-exam-sections/

- Institute of Management Accountants. (n.d.). Roles in management accounting and finance. Retrieved from https://www.imanet.org/career-resources/roles

- CMA Exam Academy. (n.d.). Certified management accountant salary in the USA. Retrieved from https://cmaexamacademy.com/certified-management-accountant-salary-in-the-usa/

- CFA Institute. (n.d.). Portfolio manager. Retrieved from https://www.cfainstitute.org/programs/cfa-program/careers/portfolio-manager

- U.S. Bureau of Labor Statistics. (n.d.). Financial analysts. Retrieved from https://www.bls.gov/ooh/business-and-financial/financial-analysts.htm