When I was growing up, I didn’t tell my mom, “I would like to be a tax accountant!” When you go to Toys R Us or the toy department of Target, there aren’t any accountant play kits like they have for doctors. I had a doctor play kit, and I pretended to be a doctor and help make my stuffed animals feel better. If there is an accountant play kit for children, please let me know. I would love to see it. I’ll tell you how I decided to choose accounting as a career later. First, I’ll tell you about myself.

I was born in Houston, Texas and grew up in Sugar Land

It’s a suburb southwest of Houston. My parents met in Pensacola, Florida, moved to Houston together, and got married in October 1979. I am one of four children, and my mom only went through two pregnancies. How is that so? My parents had two sets of identical twins. I’ve Googled the odds of having two sets of identical twins, and they are one in 70,000. My brothers were born in September 1983, and my sister and I were born in January 1986. My mom said she cried when she found out she was having her second set of twins. Below was one of many family photos we took as it’s quite challenging to get four children to look in the same direction.

While going to elementary and middle school, my sister and I were not placed in the same classes

It’s probably better that way because we made our own friends and learned to be independent of each other. It was also confusing to some friends because one person may say hello to who they think is me, and that person finds out later that it was actually my sister they greeted. As an identical twin, sometimes you just go with the flow and pretend to be your sister. My sister and I didn’t have the heart to correct people if they called us by the wrong name.

My sister and I no longer looked identical beginning in middle school, and we have very different personalities. My siblings and I played basketball in middle and high school. My sister and I stopped playing basketball after tenth grade because my mom said, “What’s the point in playing if you’re not going to play in college or play professionally?” I know I wasn’t going to be the next Sheryl Swoopes or Cynthia Cooper. Rest in peace Houston Comets.

When I was 17 years old, I got my first job as a cashier at a local grocery store

My dad bought my first cell phone, and he said I would have to get a job to pay the monthly bill. By doing this, it taught me how to manage money wisely, and I learned how to set a budget.

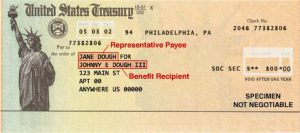

After my first year working, I received a W-2 in the mail in January 2004 and wondered what to do with it. A week or two later, I received a Form 1040-EZ booklet in the mail. I asked my parents what to do with them, and they told me to follow the instructions and fill out Form 1040-EZ myself. After reading the instructions, I learned that I just needed to get two numbers from my W-2 and write them on the correct lines on the tax return. I signed and dated Form 1040-EZ, and mailed it to the Department of the Treasury. About a month later, I received a check from the U.S. Department of Treasury for the withholding amount that I wrote in, and I was ecstatic to get any money back, especially when you’re a high school student getting paid minimum wage.

I graduated high school and attended the University of Houston (UH) as a pre-pharmacy major

Go Coogs! I wasn’t sure of my major and knew I didn’t want to start as an undeclared college major. My mom mentioned pharmacy, so that’s why I chose it. After my first year, I realized I did not enjoy science. I decided to choose a major in the business school. One of my brothers attended UH, and he was a finance major. When you’re a twin, you try not to do the same thing as your sibling as it may steal his/her thunder. Instead of choosing finance, I decided on accounting. I was always good with numbers, and I was told the job opportunities for accounting were endless. Learn more about how I discovered my niche in accounting and what I went through to pass the CPA Exam in next week’s installment!