To recap my story from last week…

I decided to major in accounting since people told me that it was stable and the job opportunities were endless. At the University of Houston, I took financial accounting, one of the core business courses required by all business school students, and I was intrigued. Debits have to equal credits! Making T-accounts! Financial accounting got me hooked, and I knew accounting was the right choice.

I was a member and became an officer for the Filipino Students Association (FSA)

Many big universities in Texas have the same organization, and every March there is a dance and sports tournament where each school would compete. By being an active participant in the organization, I gained many friendships. All of my friends I’ve known since middle school, high school, or college I’ve met through playing basketball or through FSA. Here’s some unsolicited advice to current college students – Join one or two students organizations, and be active. Take advantage of networking opportunities because you will have an advantage when you know somebody when it comes to getting an internship or landing a job interview.

My last semester at the University of Houston was fall 2008

I know I had to attend as many business school career fairs and accounting mixers as possible. I took a basic audit class and individual taxation class during my last semester, and I was more fascinated by what I learned in the tax class. This is how I decided to do tax in public accounting. I didn’t realize that people pay professionals to prepare their tax return, and that’s part of the reason why accounting is such a steady career.

I interviewed with a number of public accounting firms

There was a meet the firms night, and I remember an audit manager told me, “You have a great personality for an auditor.” I think I have a great personality overall, so this comment did not make me consider switching to audit. I interviewed at a locally-owned, mid-sized firm that has been around for over 40 years. Three people interviewed me – a senior, a manager, and a partner. I wasn’t nervous at all, and the interview lasted two hours. I haven’t been on many interviews, but I think an interview goes well when the interview seems more like an everyday conversation. Nobody asked me to prepare a journal entry or to calculate depreciation (I hoped this wouldn’t happen in an actual interview). I got an office tour and received a job offer a few days later as a staff tax associate. I accepted the job and began my accounting career in January 2009.

After becoming CPA eligible in fall 2010…

I purchased my first CPA review materials in January 2011. I asked some of my colleagues for their opinion on which section I should study for first. The answers varied of course, and I decided to begin studying for Business Environment and Concepts (BEC). BEC is the only section that has a written portion, so I wanted to get that over with first. It is also the potpourri section of the CPA exam because none of the topics relate to each other, which pretty much means studying for five different subjects.

I took BEC many times and couldn’t pass

I decided to move on and study for Regulation. Since I work in tax, I knew this section was going to be a piece of cake. I passed Regulation in October 2012 but unfortunately lost credit in May 2014. One of my best friends is a CPA (her husband is a CPA as well), and she offered her help with BEC. I’ve known this friend since middle school, and she admired my perseverance with the CPA exam. My friend was one of the few people in my life to really understand what it takes to study for the CPA exam. I went to Abilene in November 2013 and stayed at her house for a week. She helped me go through the practice questions and talked me through each answer choice. It’s good to know why the right answer is right and why the wrong answers are wrong, especially when you’re dealing with concept questions rather than calculation problems. This is me studying hard, and it is not an advertisement for Chick Fil-A. I took BEC at the end of November 2013 and received a 74, which was the closest I’ve ever gotten to passing. Since BEC was still fresh in my mind, I re-studied in December, which was challenging to do around the holiday season. I finally passed BEC in early January 2014.

I made the switch to Roger CPA Review because I realized that the review material I was using wasn’t getting through to me

I heard wonderful things from my colleagues that they passed all four parts using Roger CPA Review. I watched a sample lecture on the website, and I liked Roger’s enthusiasm. I purchased the course for Financial Accounting and Reporting (FAR) and began studying soon after the spring tax deadline in 2014. I made sure to purchase the material using the fresh start discount, which provides a discount to those who previously used another CPA review program.

I study well in environments where there are no distractions, so studying at home was challenging

I may start cleaning my room or start watching TV, so I did most of my studying at a library. I wasn’t able to spend much time with my family, my boyfriend, or my friends during my CPA studying marathons. I didn’t have the energy to go out on a Saturday night after studying all day. Thank you to my loved ones for having patience and understanding as I got through the CPA Exam.

I took all of June 2014 off from work to study for FAR

And it was a mix of paid time off and time off without pay. I explained to my managers that studying is my main focus, and work may pre-occupy my mind as I’m trying to focus on studying. The firm I work for knew how much I was struggling, and they allowed me to take a month off from work. I went to Abilene for a week again during that month, and this time I didn’t ask my friend for help. I did better with practice questions when they had to do with calculations.

I love Roger’s teaching method

He’s perky and makes the topics more exciting than other CPA review lecturers. I really enjoy the fact that Roger teaches with a dry-erase board to mimic a classroom setting. His corny jokes are hilarious and help keep me going no matter how long I’ve been studying. I also like that the lectures are split up in manageable pieces (one lecture can range from five minutes to 30 minutes). Roger explains things that I can easily understand, and he repeats himself, which is a great way of learning anything.

I passed FAR in July 2014

Many people say FAR is the hardest section because there’s so much material to study for, but I still think BEC is the hardest one. After passing FAR, I couldn’t believe that I was half-way done with the exam. I kept thinking to myself, “Why didn’t I switch to Roger CPA Review sooner?” I now make sure to tell the new staff at my job to use Roger CPA Review.

I passed Audit in November 2014 and passed Regulation in February 2015

I did the same studying marathon for Audit and Regulation where I took a month off from work for each section. I’m so lucky that my firm allowed me to take that much time off from work to focus on studying. Before taking the month off from work, I also studied in one of the conference rooms at work, and below shows my work laptop, Roger CPA Review Regulation book, and my awesome Minnie Mouse case that held my pencil, eraser, highlighter, and Post-It flags (the case was a gift from my best friend).

I woke up at 4 am to find out my last exam score, and I didn’t have to set an alarm. My body knew to wake up at the time to check my score online. I screamed and immediately told my sister that I passed my last exam. I sent a bunch of text messages to my family and friends and didn’t care what time it was. I got to work earlier than normal because I couldn’t go back to sleep. I emailed my colleagues that I passed the last part of the exam, and I received a ton of congratulatory emails.

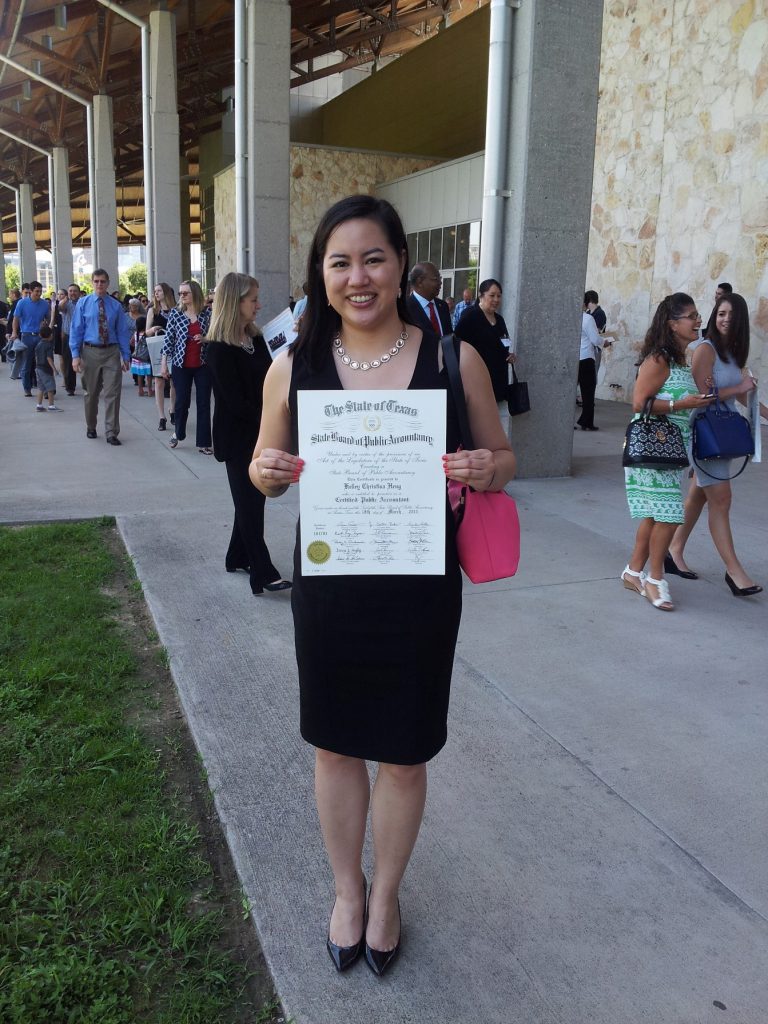

I attended the CPA swearing-in ceremony in May 2015 in Austin

And my family and boyfriend also attended. I love the fact that the ceremony is similar to a commencement ceremony where you get to hear your name called, walk across a stage, and get your certificate. It was almost a four-year long journey to get my CPA license. I shed many tears as I kept getting non-passing scores and sometimes thought I wasn’t smart enough. I now know that studying for the CPA exam isn’t about being smart. It’s about persistence, dedication, and discipline to learn the material. I am so proud to be able to call myself a CPA. I hope you guys enjoyed my CPA Exam journey and that it helped you realize that you can do anything with some hard work and dedication! Although it took me a long time to finish the CPA Exam, it was well worth it. Never underestimate your ability to succeed! Thank you Roger CPA Review for helping me get there!

-Kelley Heng