Every year, the National Association of State Boards of Accountancy (NASBA) releases CPA Exam candidate data in an annual report. Recently, NASBA published the “2017 Candidate Performance on the Uniform CPA Examination”, and while there is plenty of interesting data worth mentioning, here are a few that resonated with us the most.

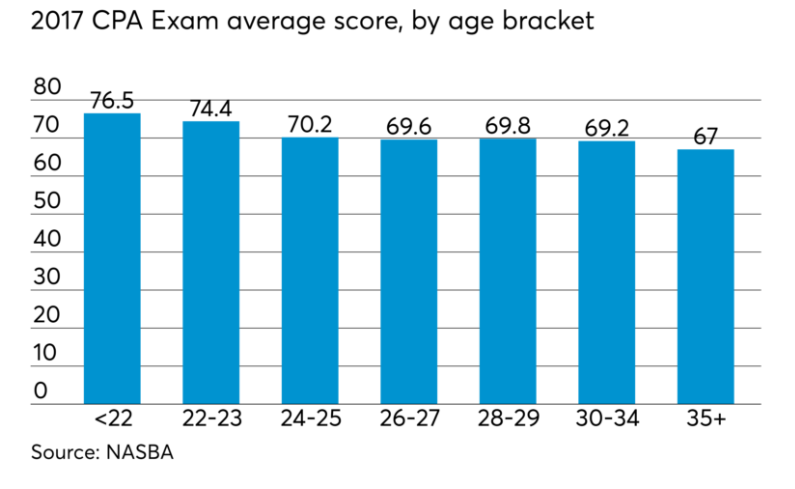

Take the CPA Exam as Early as Possible

If there was one piece of information that we could deem as the most important thing to know from these NASBA reports, it’s this: candidates perform much better on the CPA Exam the closer they are to their educational experience. This is because recent college graduates are still in school and study mode, and take advantage of this mindset to prepare for the CPA Exam which requires the same amount (if not more) of dedication and discipline it takes to receive a degree. The longer candidates wait to take the exam after they have graduated, the more difficult it can be since life only gets increasingly more busy and licensure begins to conflict with other priorities like work or family.

Therefore, we cannot stress this point enough: take the CPA Exam as soon as possible. The numbers show that the longer you wait, the longer it may take you to retain the same amount of self-discipline and accounting knowledge you had fresh out of school.

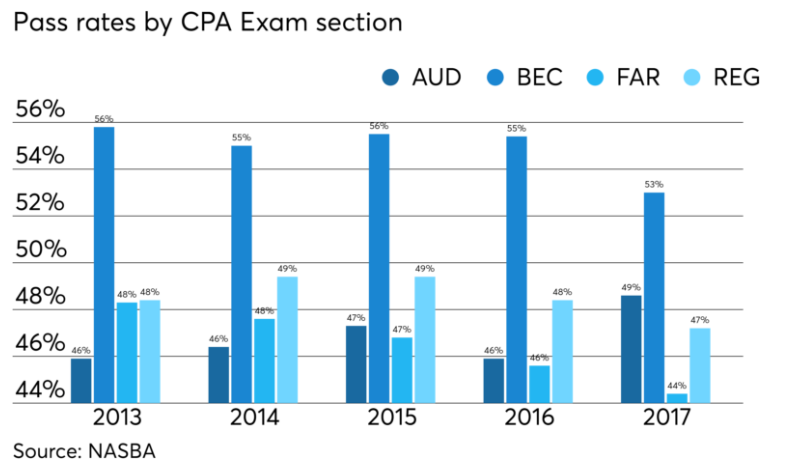

Changes Challenge Candidates

Another advantage for taking the exam as soon as possible is to avoid exam changes that reflect changing laws and technology that changes business protocol and procedures. In the graph below, you’ll see that pass rates dropped for the BEC, FAR, and REG sections during the major 2017 CPA Exam changes–the biggest change the exam underwent since it transitioned to computerized testing.

This shows that new content changes can be difficult for candidates to navigate–which is why we highly recommend taking the REG section of the CPA Exam now. With the new Tax Cuts and Jobs Act (TCJA) that was passed last year, the REG section of the exam is undergoing monumental changes to reflect the new Tax Reform beginning January 1, 2019. Avoid having to re-learn new tax laws and information by sitting for and passing REG in 2018.

The good news is that there’s still plenty of time to do so. And if you need help fitting it into your schedule in a timely and efficient manner, our new SmartPath Predictive Technology will help you pass faster than ever before. This tool takes the guesswork out of CPA Exam preparation, showing you exactly what you need to study and how much. Once you’ve hit all the targets, you’ll be adequately prepared for Exam Day.

Learn more about how SmartPath works and try it for free today.

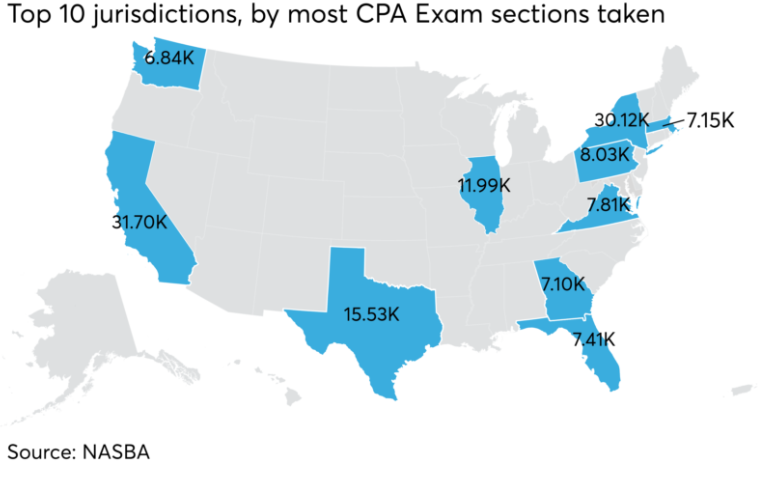

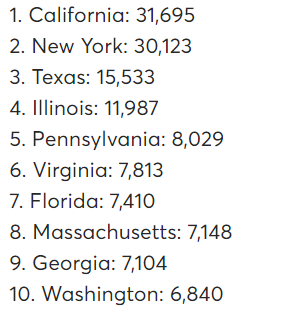

Top 10 Jurisdictions for CPA Exam Candidates

Here are the top 10 states that show where a majority of candidates are taking the exam and becoming CPAs in. The top 5 states consistently represent just over 40% of all CPA Exam section annual volume.

Number of sections taken:

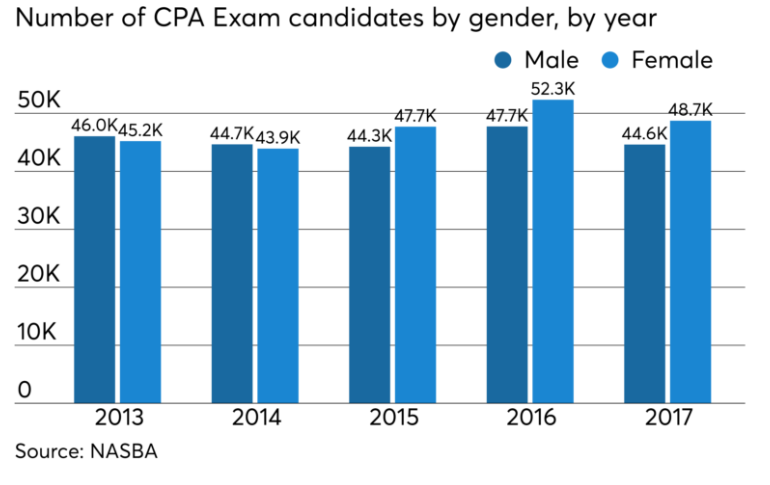

Still a Popular Career for Women

While male and female candidates usually range 50/50, for the last 3 years, the number of female candidates has stayed steadily ahead of their male candidates. This shows us that the CPA designation isn’t only a popular career choice, but is also steadily growing among women, which is great considering the profession is trying to retain and advance more females in this field.

We look forward to NASBA’s 2018 CPA Exam Candidate report and hope you found this information as valuable as we did!

Source: Test Results: The CPA Exam in 2017