CPA Review Courses by UWorld (2026)

*No Credit Card Required

Choose Your 2026 CPA Course Package

Thousands of CPA candidates choose UWorld because every package is fully mapped to the official CPA Exam Blueprints and includes the tools real candidates need to study smarter, stay on track, and pass with confidence.

Unlimited Access to 6 Sections

Unlimited Access to 4 Sections

18-Month Access to 4 Sections

6 Print + eBooks

4 Print + eBooks

4 eBooks

Learn more.

Choose Your 2026 CPA Course Package

Thousands of CPA candidates choose UWorld because every package is fully mapped to the official CPA Exam Blueprints and includes the tools real candidates need to study smarter, stay on track, and pass with confidence.

Unlimited Access

Elite‑Unlimited+

with Money-Back Pass Guarantee

|

Unlimited Access to 6 Sections |

|

6 Print + eBooks |

Our comprehensive QBank includes 9,000+ multiple-choice questions and 500+ task-based simulations spanning all six CPA Exam sections.

Get the motivation you need to pass your CPA Exam with video lectures from the industry’s most dynamic instructors, including Roger Philipp, Peter Olinto, and others.

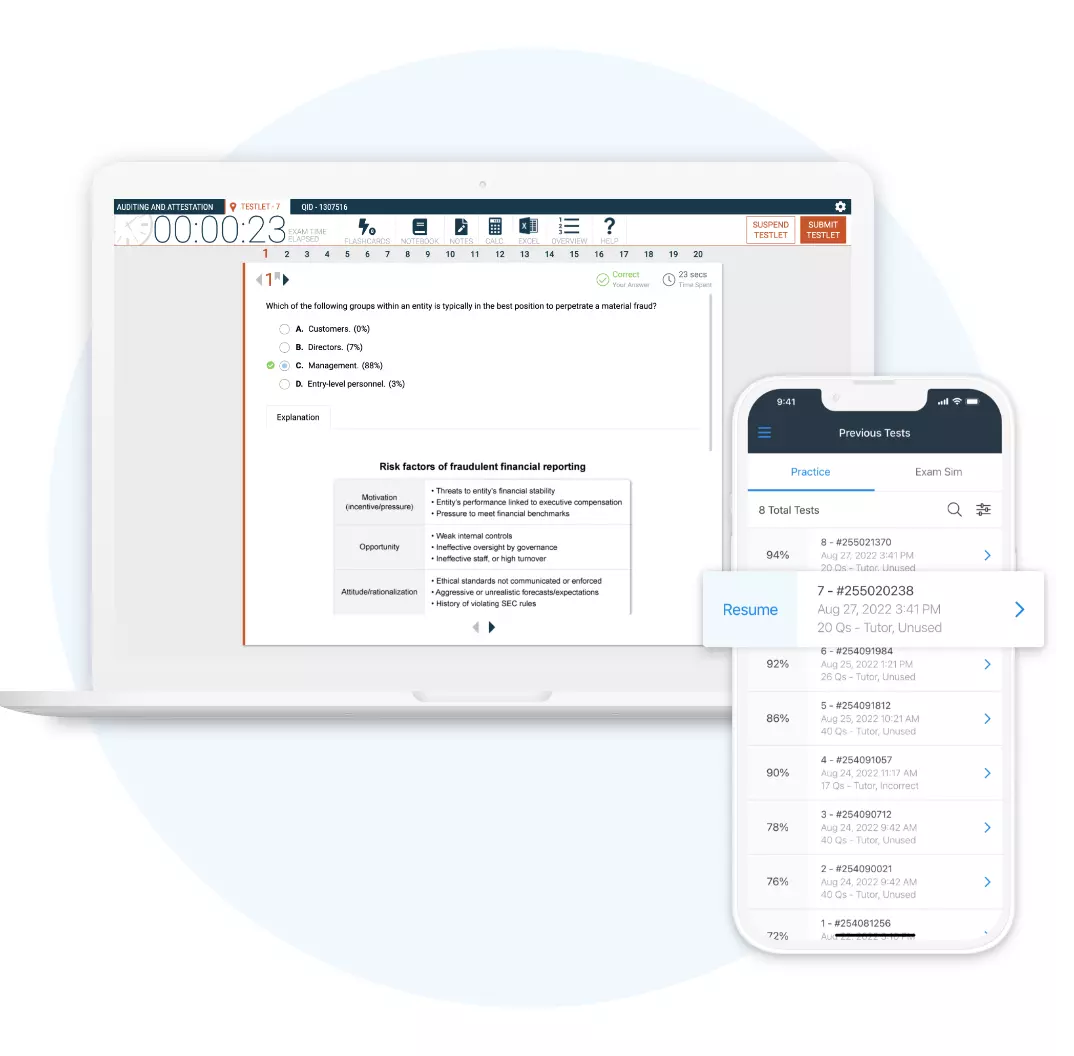

Sharpen your skills, stamina, and time management with unlimited full-length practice exams and fully customizable quizzes. Target your weakest areas by creating quizzes down to the sub-topic level, so you focus where it matters most.

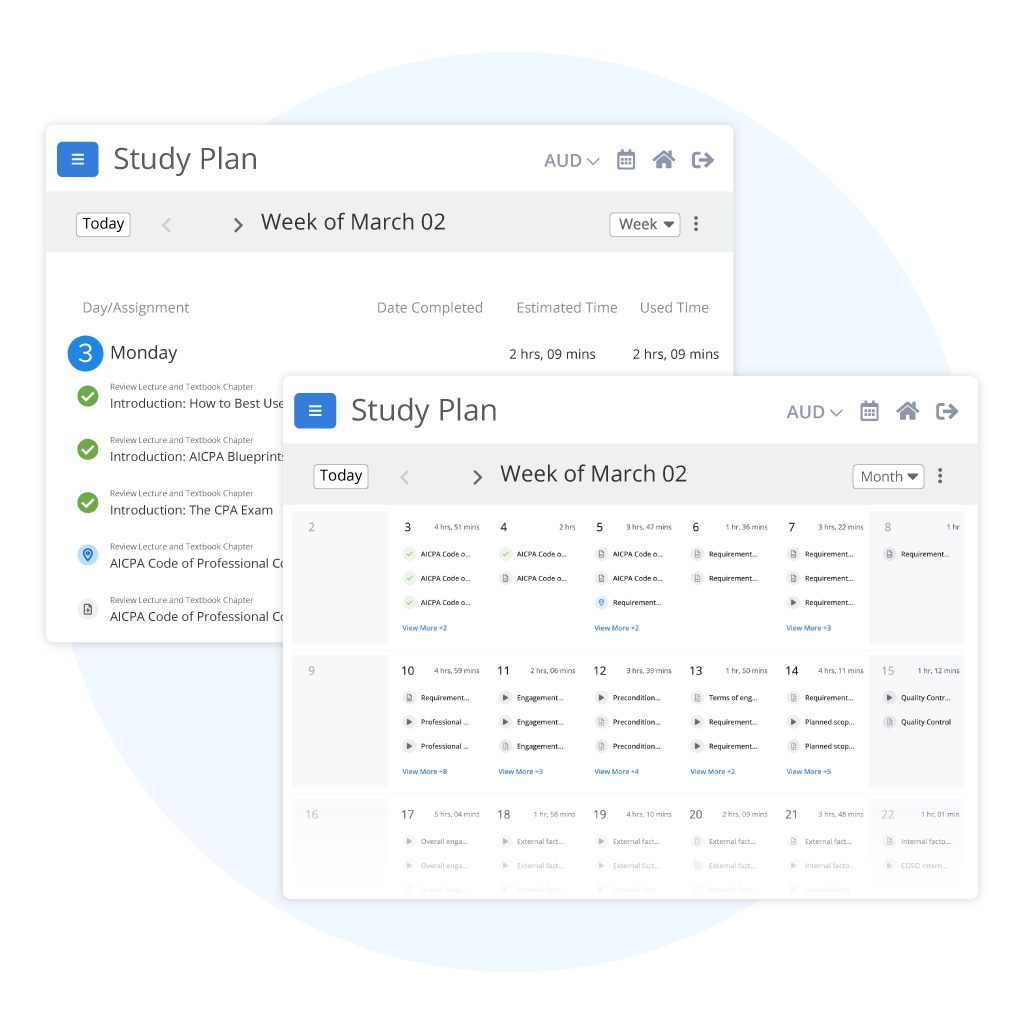

Create a personalized study plan by entering your exam date and available study hours. Choose from three options — a set plan with full course coverage, a flexible plan that lets you customize key elements, or an entirely customized schedule built from scratch.

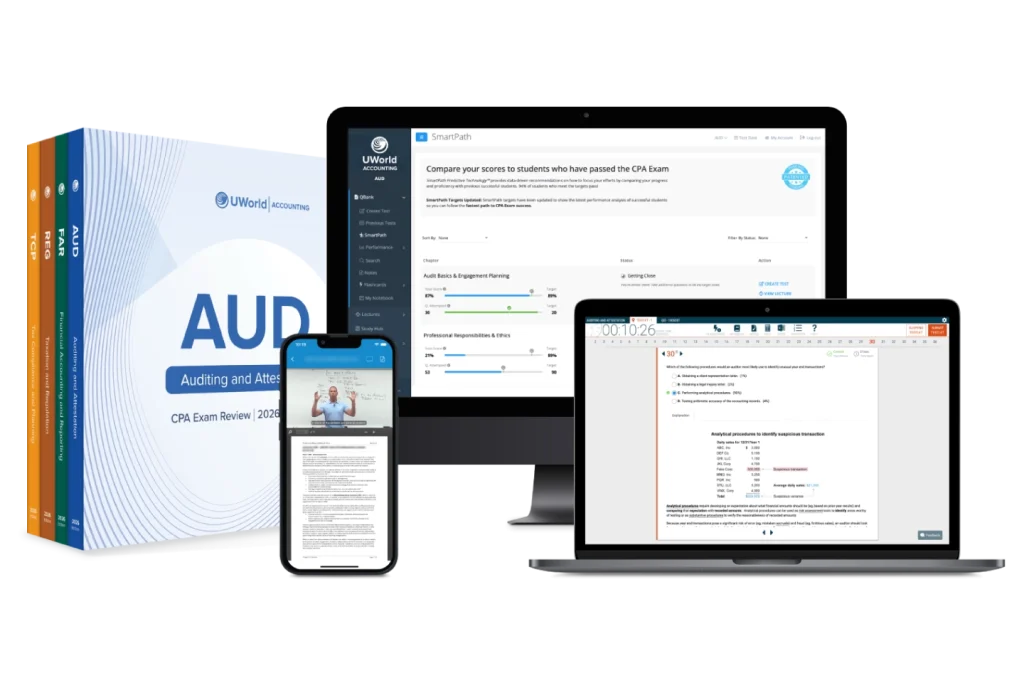

Compare your progress to that of previous students who have passed the CPA Exam with our data-driven tool. Students who meet SmartPath™ targets have a 90% average pass rate!

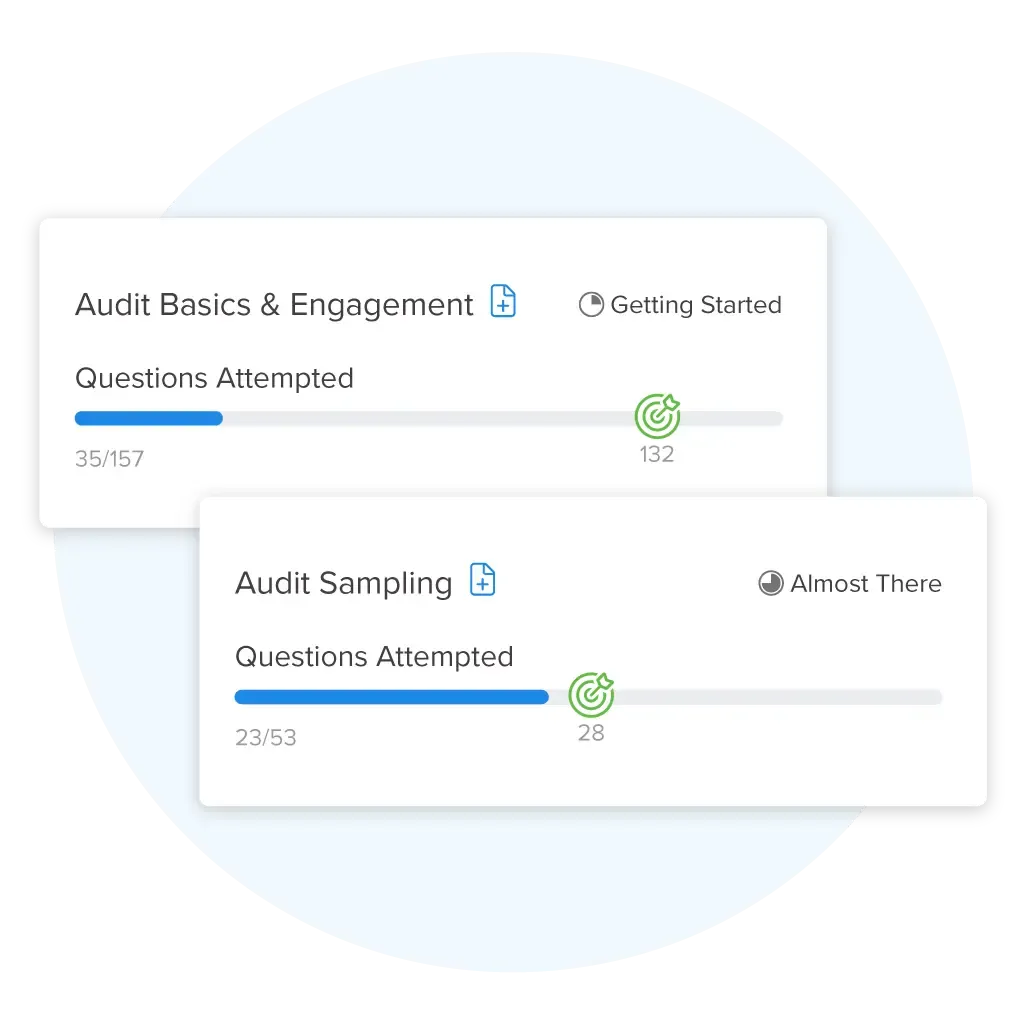

Identify your strengths and areas needing improvement with detailed performance tracking by topic.

Study on the go with mobile app access to all your CPA course materials. Available on Android and Apple.

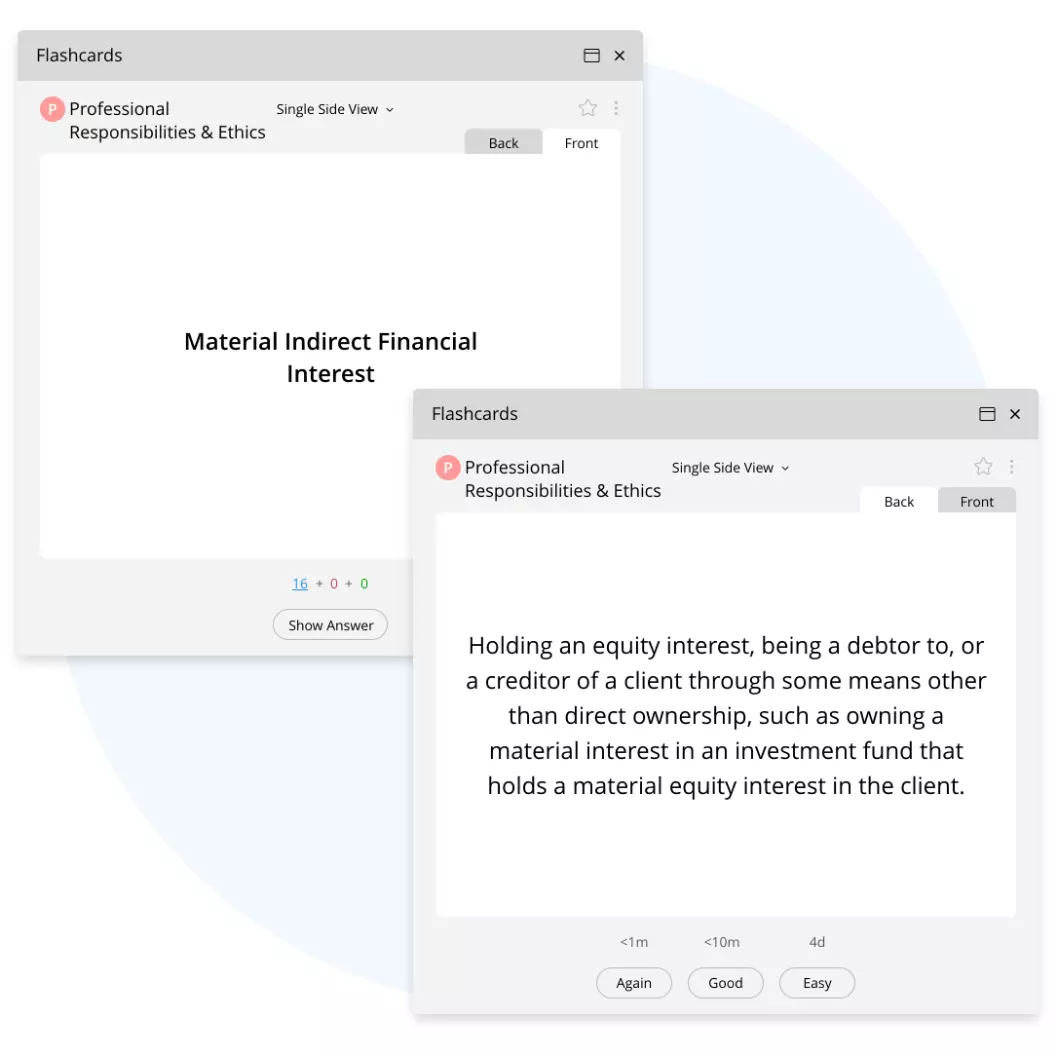

Create unlimited digital flashcards or use pre-curated ReadyDecks to review concepts. Spaced-repetition technology adjusts frequency based on your mastery.

Use strategic, guided videos to tackle any TBS variation on the CPA Exam.

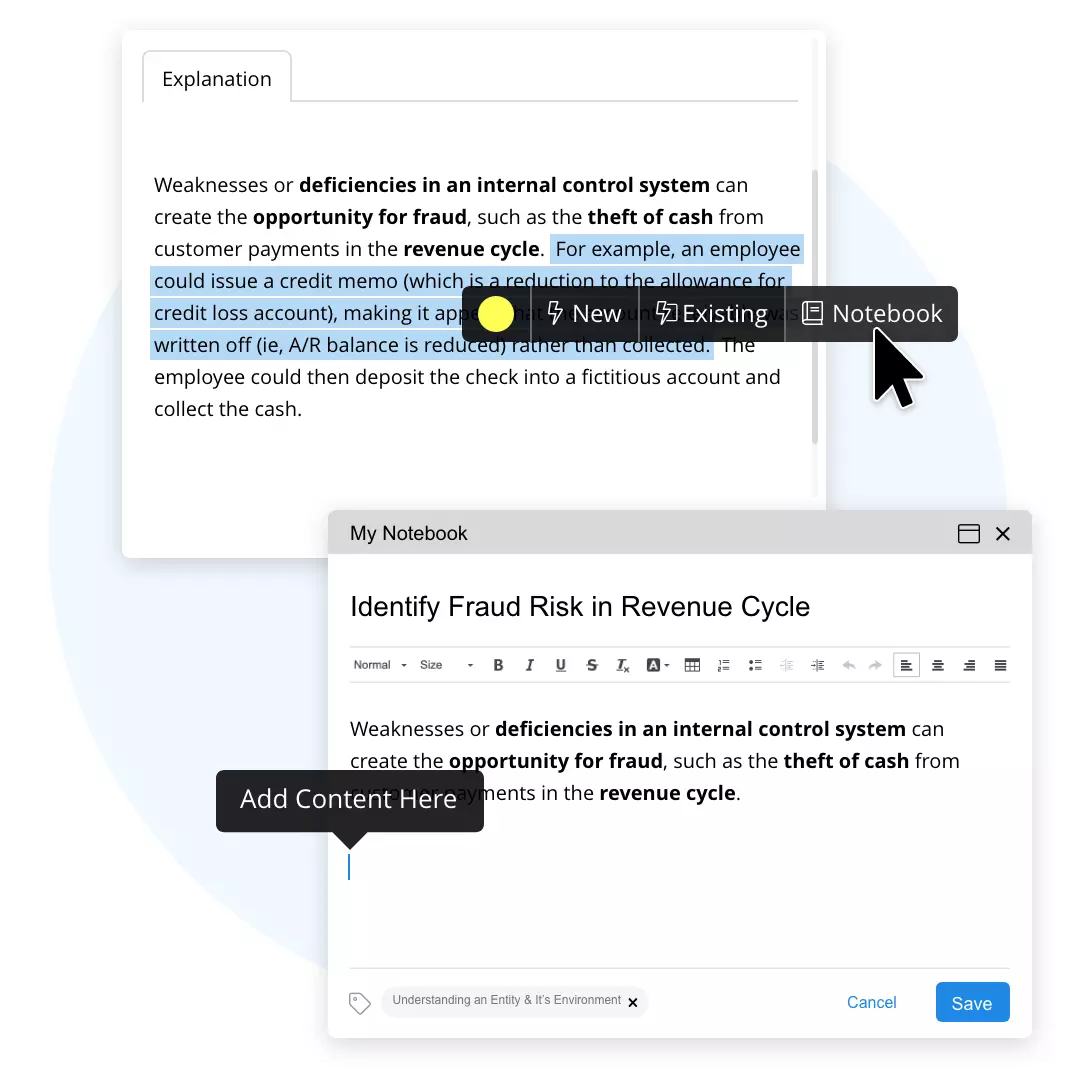

Copy text and graphics from CPA study material, personalize the content, and review it on the go across devices with My Notebook.

Optimize your study time in the crucial lead-up to exam day with final review videos that cover the most testable topics in the core sections.

Experience the exam before exam day — identical interface, format, difficulty, timing, and topic weighting, all with brand-new questions not seen before in the course. Includes 2 full mock exams per core section and 1 per discipline.

Get unlimited course access until you pass — including free online updates through our StudyPass™ Program.

Get a $250 refund per section in the unlikely event you don’t pass. That’s up to $1,000 back!

Unlimited Access

Elite‑Unlimited

|

Unlimited Access to 4 Sections |

|

4 Print + eBooks |

Our comprehensive QBank includes 9,000+ multiple-choice questions and 500+ task-based simulations spanning all six CPA Exam sections.

Get the motivation you need to pass your CPA Exam with video lectures from the industry’s most dynamic instructors, including Roger Philipp, Peter Olinto, and others.

Sharpen your skills, stamina, and time management with unlimited full-length practice exams and fully customizable quizzes. Target your weakest areas by creating quizzes down to the sub-topic level, so you focus where it matters most.

Create a personalized study plan by entering your exam date and available study hours. Choose from three options — a set plan with full course coverage, a flexible plan that lets you customize key elements, or an entirely customized schedule built from scratch.

Compare your progress to that of previous students who have passed the CPA Exam with our data-driven tool. Students who meet SmartPath™ targets have a 90% average pass rate!

Identify your strengths and areas needing improvement with detailed performance tracking by topic.

Study on the go with mobile app access to all your CPA course materials. Available on Android and Apple.

Create unlimited digital flashcards or use pre-curated ReadyDecks to review concepts. Spaced-repetition technology adjusts frequency based on your mastery.

Use strategic, guided videos to tackle any TBS variation on the CPA Exam.

Copy text and graphics from CPA study material, personalize the content, and review it on the go across devices with My Notebook.

Optimize your study time in the crucial lead-up to exam day with final review videos that cover the most testable topics in the core sections.

Experience the exam before exam day — identical interface, format, difficulty, timing, and topic weighting, all with brand-new questions not seen before in the course. Includes 2 full mock exams per core section and 1 per discipline.

Join our instructors as they lead live, online sessions for every section of the CPA Exam. Tackle the toughest MCQs and TBSs and get all your questions answered. See the 2026 class schedule.

Get unlimited course access until you pass — including free online updates through our StudyPass™ Program.

|

18-Month Access to 4 Sections |

|

4 eBooks |

Our comprehensive QBank includes 9,000+ multiple-choice questions and 500+ task-based simulations spanning all six CPA Exam sections.

Get the motivation you need to pass your CPA Exam with video lectures from the industry’s most dynamic instructors, including Roger Philipp, Peter Olinto, and others.

Sharpen your skills, stamina, and time management with unlimited full-length practice exams and fully customizable quizzes. Target your weakest areas by creating quizzes down to the sub-topic level, so you focus where it matters most.

Create a personalized study plan by entering your exam date and available study hours. Choose from three options — a set plan with full course coverage, a flexible plan that lets you customize key elements, or an entirely customized schedule built from scratch.

Compare your progress to that of previous students who have passed the CPA Exam with our data-driven tool. Students who meet SmartPath™ targets have a 90% average pass rate!

Identify your strengths and areas needing improvement with detailed performance tracking by topic.

Study on the go with mobile app access to all your CPA course materials. Available on Android and Apple.

Create unlimited digital flashcards or use pre-curated ReadyDecks to review concepts. Spaced-repetition technology adjusts frequency based on your mastery.

Use strategic, guided videos to tackle any TBS variation on the CPA Exam.

Copy text and graphics from CPA study material, personalize the content, and review it on the go across devices with My Notebook.

Optimize your study time in the crucial lead-up to exam day with final review videos that cover the most testable topics in the core sections.

Looking for a Single Section Review?

Refresh your knowledge or prepare for one section at a time.

Our 4-Step Method to Pass CPA First Try

UWorld’s CPA review courses combine expert-led instruction, blueprint-aligned content, realistic mock exams, and smart learning technology to maximize retention and efficiency. Every tool is designed to mirror the real CPA Exam and focus only on what truly matters. Prepare with confidence knowing your CPA review course is precise, adaptive, and exam-ready.

Videos by Legendary CPA Instructors

UWorld’s video lectures, led by Roger Philipp and Peter Olinto, break down complex accounting into clear, engaging, and memorable lessons. Using humor, real-world examples, and proven mnemonics, they make tough topics intuitive. Our popular TBS mastery videos guide you step-by-step through strategy and trap avoidance.

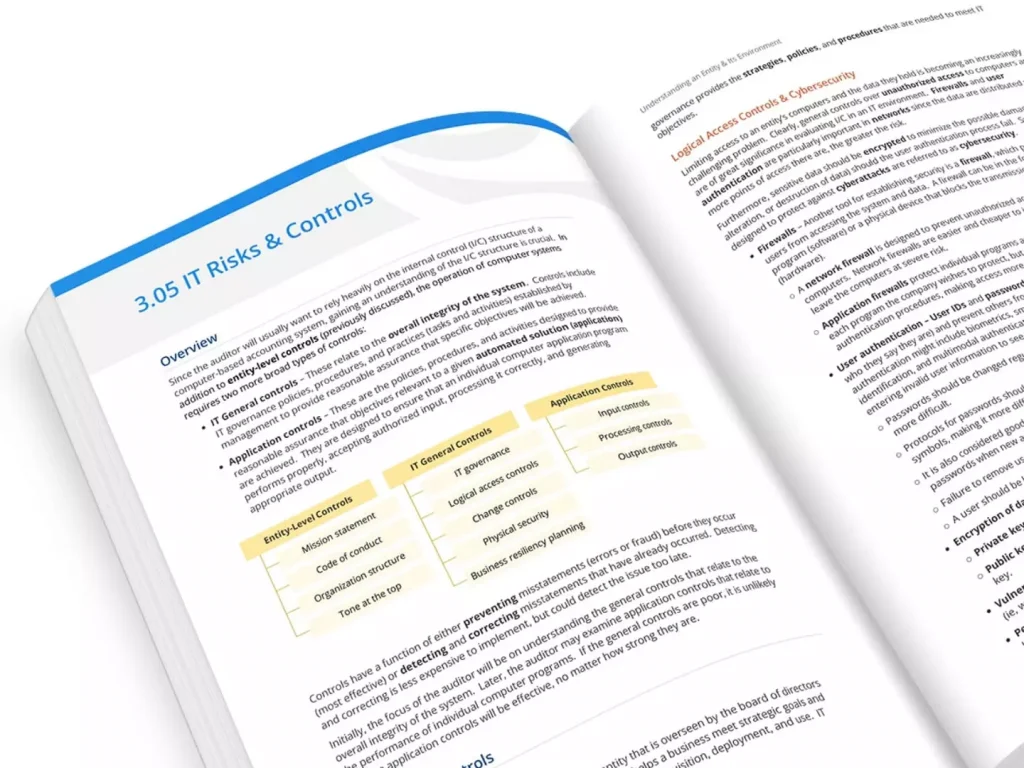

Study Guides: 100% Blueprint-Aligned

UWorld’s CPA textbooks precisely follow AICPA representative tasks and Blueprints, covering only tested material and updating continuously. These visually engaging study guides work with our video lectures and practice questions, using real-world examples, color-coded layouts, tables, charts, and diagrams to reinforce concepts. The clear, practical presentation aids full understanding, not just memorization.

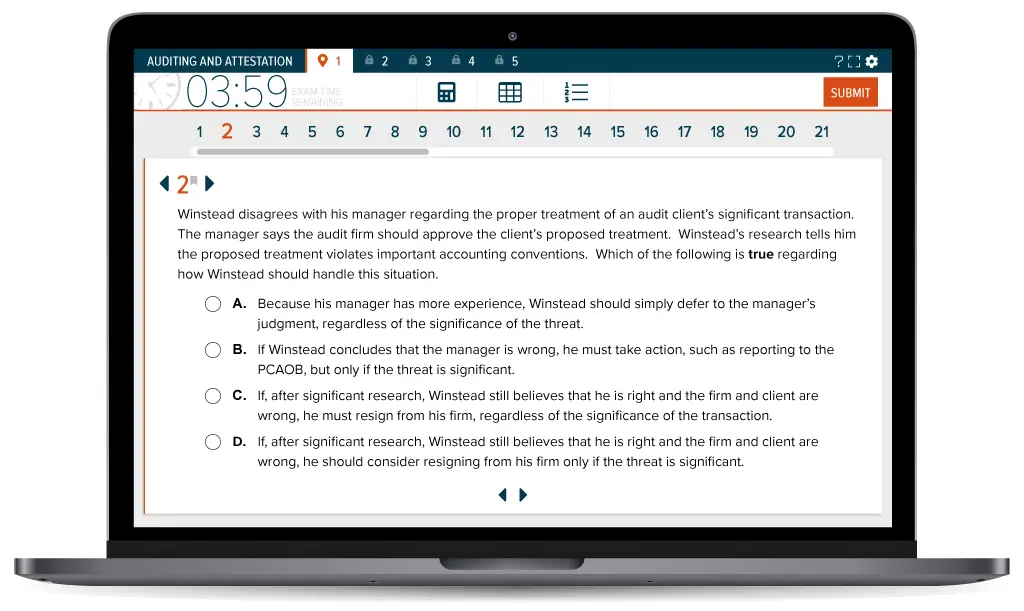

9,000+ Exam-Like Questions with Visuals

UWorld’s question bank is designed to match the wording, difficulty, and feel of the official CPA Exam, so nothing feels unfamiliar on test day. Every topic is covered in depth and tested in multiple ways, with large question banks that eliminate surprises. Written by full-time CPA educators, each explanation teaches the entire concept using visuals, charts, tables, and mnemonics—so you’re prepared no matter how the exam asks the question.

See why thousands of candidates trust UWorld. Answer sample questions and experience real CPA Exam conditions.

Which of the following is an input control designed to ensure the reliability and accuracy of data?

| Limit Test | Validity Check Test | |||

| A. | Yes | Yes | ||

| B. | Yes | No | ||

| C. | No | Yes | ||

| D. | No | No |

Explanation:

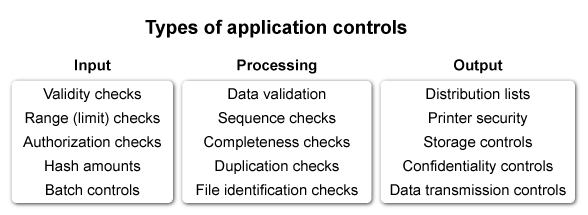

Input controls are designed to provide reasonable assurance that data received have been properly authorized and accurately entered or converted for processing. These controls also provide the opportunity for entity personnel to correct and resubmit data that were initially rejected for being erroneous.

A limit test is designed to assure that all input falls within an appropriate range. If the input falls outside of the range (eg, a birth date before 1900), it is rejected. A validity check is designed to match data input to a predetermined list of valid data. If the input doesn’t match the list (eg, “USA” entered as a state code), it is rejected. Both of these controls are intended to ensure the reliability and accuracy of data input (Choices B, C, and D).

Things to remember:

Limit tests and validity checks are input controls, which are designed to provide reasonable assurance that input is accurate before being processed. Limit tests ensure input is within an appropriate range, while validity checks match data input to a predetermined list of valid data.

- AUD 10.02 : Understanding an entity’s controls: Control environment, IT general controls, and entity-level controls

An auditor decides to use the blank form of accounts receivable confirmation. The auditor should be aware that the blank form may be less efficient because

| A. It does not provide positive third-party confirmation of account balances. | ||

| B. It is more likely to require a reconciliation of responses with client information. | ||

| C. It is not as reliable as other forms of account confirmations. | ||

| D. It is more difficult to prepare. |

Explanation:

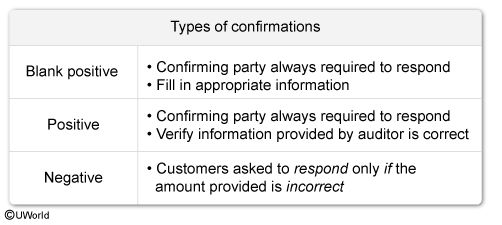

External confirmations are one of the more reliable sources of audit evidence because they are obtained directly from parties outside the entity and exist in documentary form, which is more reliable than oral evidence. A/R confirmations can provide audit evidence associated with the existence, rights and obligations, allocations and valuations, and completeness assertions.

Confirmations can be negative, positive, or blank. Blank confirmations are a type of positive confirmation where the customer is asked to record the amount they owe to the client (Choice A). Positive confirmation is more reliable than negative because the customer indicates either agreement or disagreement with the client’s recorded A/R balance (Choice C). Because blank confirmations show only customer names and addresses without the A/R balances, they are easier to prepare (Choice D).

Negative and positive confirmations ask the customer to confirm or indicate any differences in the A/R balance recorded by the client. Blank confirmations do not contain any indication from the client of the customer’s A/R balance, so they may be less efficient and more difficult for the auditor to reconcile customer responses with client information. For example, returned items in transit may be included in the customer’s version of their amount due but not yet received by the client and reflected in the A/R balance.

Things to remember:

Because blank confirmations do not contain any indication from the client of the customer’s A/R balance, they may be less efficient and more difficult for the auditor to reconcile customer responses with client information.

- AUD 18.03 : Procedures to obtain sufficient appropriate evidence: External confirmations

An auditor’s objective in the performance of audit procedures is to obtain evidence that either supports or refutes management assertions. Which of the following is an action designed to achieve this objective?

| A. Comparing financial and nonfinancial data. | ||

| B. Developing and maintaining a system of quality control. | ||

| C. Preparing adequate and appropriate documentation. | ||

| D. Increasing the desired level of detection risk. |

Explanation:

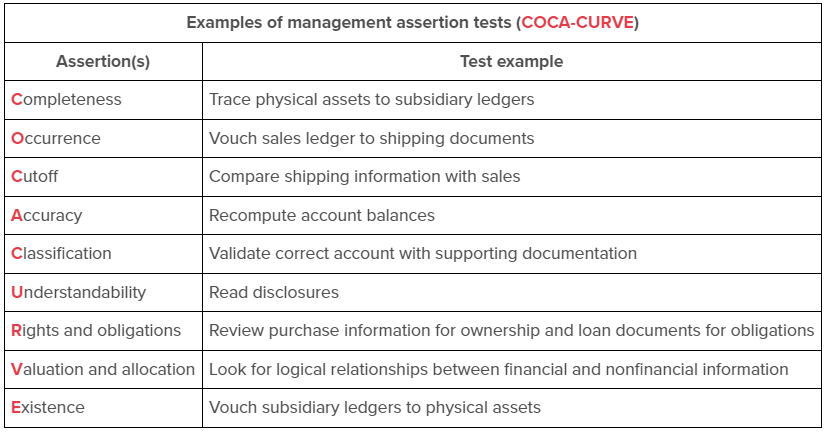

During an audit, client management asserts that the financial statements are complete, clear, correct, and in compliance with GAAP or an acceptable financial reporting framework. The auditor then gathers evidence to either support or refute these assertions.

The auditor may compare financial (eg, equipment depreciation expense) and nonfinancial (eg, vendor information about equipment’s expected useful life) information. This comparison can provide evidence regarding the validity of the valuation assertion (eg, depreciation expense is based on reasonable estimates).

(Choices B and C) The audit firm must develop a system of quality control, and the auditors must create adequate, appropriate documentation to provide evidence that the audit complies with professional standards. These activities do not provide evidence that supports or refutes management assertions regarding the financial statements.

(Choice D) The desired or acceptable level of detection risk might decrease when there is greater risk of material misstatement. This action would occur after the auditor obtains evidence that refutes management’s assertions.

Things to remember:

A comparison of financial (eg, equipment depreciation expense) and nonfinancial (eg, vendor information about equipment useful lives) information can provide audit evidence that either supports or refutes management assertions regarding financial statements.

- AUD 16.01 : Sufficient appropriate evidence

An auditor uses the assessed level of control risk to

| A. Evaluate the effectiveness of an entity’s internal control policies and procedures. | ||

| B. Identify transactions and account balances in which inherent risk is at the maximum. | ||

| C. Indicate whether materiality thresholds for planning and evaluation purposes are sufficiently high. | ||

| D. Determine the acceptable level of detection risk. |

Explanation:

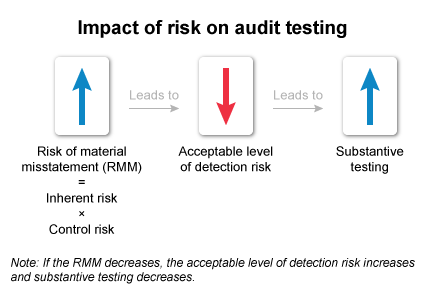

Control risk (CR) is the risk that internal control will fail to prevent a material misstatement. Along with inherent risk, CR determines the risk that a material misstatement exists in the financial statements. The higher the risk of material misstatement (RMM), the less risk auditors are willing to take that the audit will fail to identify a material misstatement (ie, detection risk). Detection risk can be lowered by the application of additional substantive procedures.

(Choice A) An auditor evaluates the effectiveness of an entity’s internal control to assess CR, not the other way around.

(Choice B) Inherent risk is the RMM due to factors other than internal control (eg, complexity of transactions). It does not affect, and is not affected by, the assessed level of CR.

(Choice C) If RMM is high, the auditor may design procedures to detect smaller individual misstatements (ie, lower tolerable misstatement), thereby reducing the risk that the combined effect of individual misstatements is material. Materiality thresholds are based on the type or amount of misstatement that might influence the decisions made by users of the financial statements. Materiality is not affected by RMM.

Things to remember:

The risk of material misstatement (RMM) is a function of control risk and inherent risk. As RMM increases, the acceptable level of detection risk is decreased. As RMM decreases, the acceptable level of detection risk is increased.

- AUD 12.01 : Assessing and responding to risks of material misstatement, whether due to fraud or error

Which of the following is the annual report that is filed with the United States Securities and Exchange Commission?

| A. Form 8-K. | ||

| B. Form 10-K. | ||

| C. Form S-1. | ||

| D. Form 10-Q. |

Explanation:

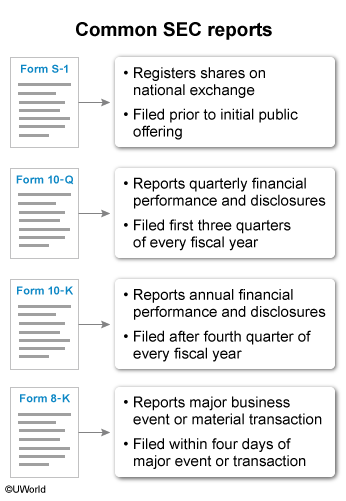

Publicly traded companies must file reports with the SEC so investors and the public receive material information in a timely manner. Users of this information must make vital decisions about providing resources (eg, investing or providing credit) to the company.

Form 10-K is filed annually after the fourth quarter of the fiscal year and has several requirements, including audited financial statements, management analysis, market risk disclosures, and internal controls information.

(Choice A) Form 8-K must be filed within four days of a major business event. These events may include merger and acquisition activity; securities sales; bankruptcy; and a change in directors, principal officers, or auditing firms.

(Choice C) Form S-1 is a registration form required as part of the initial public offering process and must be filed before shares can be listed on a national exchange.

(Choice D) Form 10-Q is similar to Form 10-K except that it is filed quarterly for the first three quarters of the fiscal year. In addition, Form 10-Q is more limited in scope and is less comprehensive than Form 10-K.

Things to remember:

Publicly traded companies must file reports with the SEC so investors and the public receive important information in a timely manner. Form 10-K is filed annually and has several requirements, including financial statements, management analysis, market risk disclosures, and internal controls information.

- FAR 4.01 : Public company reporting: Public company reporting topics

What is the purpose of reporting comprehensive income?

| A. To summarize all changes in equity from nonowner sources. | ||

| B. To reconcile the difference between net income and cash flows provided from operating activities. | ||

| C. To provide a consolidation of the income of the firm’s segments. | ||

| D. To provide information for each segment of the business. |

Explanation:

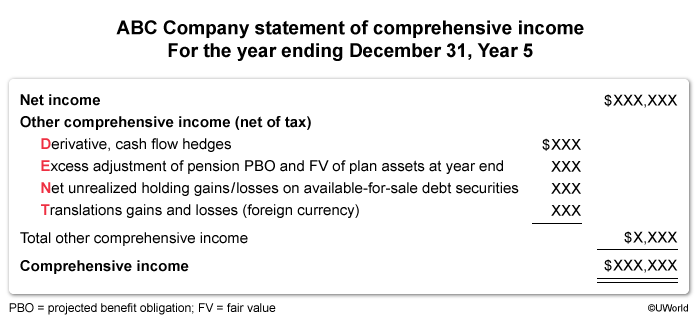

An entity’s comprehensive income is the total of its net income (loss) and other comprehensive income (OCI). Net income (loss) is closed annually to an entity’s retained earnings. However, because OCI reports the unrealized portion of certain transactions that may or may not be realized in the future, it is transferred to accumulated OCI, a separate component of stockholders’ equity.

The purpose of comprehensive income is to report all changes in equity from nonowner sources. Therefore, by including OCI, comprehensive income provides a more complete accounting of all changes from nonowner sources.

(Choice B) Reconciling the difference between net income and cash flows provided from operating activities will show transactions reported using the accrual basis versus the cash basis of accounting.

(Choices C and D) All entities, including those with business segments, are required to report comprehensive income. Information regarding business segments is provided in the notes to the financial statements.

Things to remember:

An entity’s comprehensive income is the total of its net income (loss) and other comprehensive income (the unrealized portion of certain transactions). The purpose of comprehensive income is to report all changes in equity from nonowner sources.

- FAR 1.03 : General-Purpose Financial Reporting: For-Profit Business Entities: Statement of comprehensive income

Wall Corp. offers an employee stock purchase plan through which employees can elect to have money withheld from their paychecks to purchase Wall stock. Wall’s plan specifies the following:

| For every $1 contributed from employees’ wages for the purchase of Wall’s common stock, Wall contributes $2. |

| The stock is purchased from Wall’s treasury stock at market price on the date of purchase. |

The following information pertains to the plan’s Year 1 transactions:

| Employee contributions for the year | $ 350,000 |

| Market value of 150,000 shares issued | 1,050,000 |

| Carrying amount of 150,000 shares of treasury stock issued (cost) | 900,000 |

Before payroll taxes, what amount should Wall recognize as expense in Year 1 for the stock purchase plan?

| A. $150,000 | ||

| B. $700,000 | ||

| C. $900,000 | ||

| D. $1,050,000 |

Explanation:

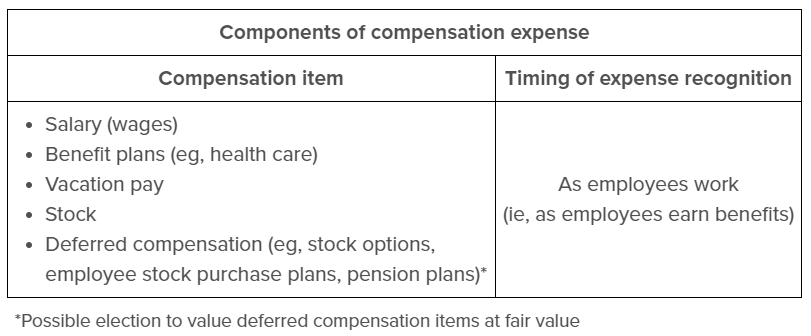

GAAP requires that expenses (or losses) be recognized as they are incurred or when the loss of a future benefit is discovered. Costs associated with employee compensation are recorded as employees work (eg, salary expense) or earn benefits (eg, vesting pension benefits).

The market price of the stock issued under the employee stock purchase plan (ESPP) is $1,050,000. However, $350,000 of this cost was contributed by the employees, and is therefore not an expense for Wall Corp. Only the amount contributed by Wall is an expense for the company (Choice D).

Wall must contribute $2 to the ESPP for each $1 contributed by employees. Therefore, Wall’s cost is incurred as employees contribute. Since employee contributions were $350,000 for Year 1, Wall’s expense recorded is $700,000 ($350,000 × $2).

(Choice A) Expense of $150,000 is the difference between the market price of the 150,000 shares of stock issued under the ESPP and the cost of the treasury stock. This amount is not recorded as an expense, but is instead booked to additional paid-in capital when the stock is reissued.

(Choice C) The cost of the 150,000 treasury shares issued is $900,000; however, this amount is not recorded as an expense. Instead, the expense recorded is based on Wall’s financial contribution to the ESPP.

Things to remember:

Expenses (or losses) are recognized when incurred or when the loss of a future benefit is discovered. Costs associated with employee compensation (including benefits such as stock purchase plans) are recorded as employees work/earn benefits.

- BAR 6.01 : Stock compensation

The following financial ratios and calculations were based on information from Kohl Co.’s financial statements for the current year:

| Accounts receivable turnover |

| Ten times during the year |

| Total assets turnover |

| Two times during the year |

| Average receivables during the year |

| $200,000 |

Kohl made all sales on credit. What was Kohl’s average total assets for the year?

| A. $2,000,000 | ||

| B. $1,000,000 | ||

| C. $400,000 | ||

| D. $200,000 |

Explanation:

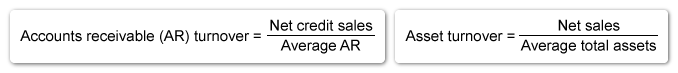

A variety of activity ratios can be used to evaluate the performance of a company. For example, the asset turnover ratio measures how efficiently an entity’s assets are used to generate sales (net sales divided by average total assets). Meanwhile, the accounts receivable (AR) turnover ratio measures how efficiently a company collects debts from credit sales to customers (net credit sales divided by average AR). If an entity has only credit sales, the numerator will be the same in both ratios.

In this scenario, both ratios, combined with the information Kohl provided, can be used to solve for the average total assets for the year. Because all of Kohl’s sales were on credit, the numerator in the AR turnover and asset turnover ratios will be the same. Kohl will report average total assets of $1,000,000, calculated as follows:

Given information:

AR turnover = 101 Asset turnover = 21 Average AR = $200,000

Use average AR and AR turnover ratio to solve for net credit sales:

AR turnover = Net credit salesAverage AR 10 = Net credit sales$200,000 Net credit sales = $2,000,000

Use net credit sales and asset turnover ratio to solve for average total assets:

Asset turnover = Net salesAverage total assets 2 = $2,000,000Average total assets Average total assets = $1,000,000

(Choice A) Kohl’s total sales for the year are $2,000,000.

(Choice C) Average assets of $400,000 is incorrectly calculated by multiplying the asset turnover ratio (2:1) by the average receivables ($200,000).

(Choice D) Kohl’s average AR for the year are $200,000.

Things to remember:

The accounts receivable (AR) turnover ratio measures how efficiently a company collects debts from credit sales to customers (net credit sales divided by average AR). The asset turnover ratio measures how efficiently an entity’s assets are used to generate sales (net sales divided by average total assets). If an entity has only credit sales, the numerator will be the same in both ratios.

- FAR 6.01 : Financial Statement Ratios and Performance Metrics: Financial Statement Ratios and Performance Metrics

On June 1, 20X5, Rusk Corp. was petitioned involuntarily into bankruptcy. At the time of the filing, Rusk had the following creditors:

- Safe Bank, for the balance due on the secured note and mortgage on Rusk’s warehouse.

- Employee salary claims.

- 20X4 federal income taxes due.

- Accountant’s fees outstanding.

- Utility bills outstanding.

Prior to the bankruptcy filing, but while insolvent, Rusk engaged in the following transactions:

- On February 1, 20X5, Rusk repaid all corporate directors’ loans made to the corporation.

- On May 1, 20X5, Rusk purchased raw materials for use in its manufacturing business and paid cash to the supplier.

Required:

Below is relate to Rusk’s creditors and the February 1 and May 1 transactions. For each item, determine whether only statement I is correct, whether only statement II is correct, whether both statements I and II are correct, or whether neither statement I nor II is correct.

| Item | Answer |

|---|---|

|

|

|

|

|

|

|

|

|

|

Explanation:

| Item | Answer | |

|---|---|---|

| 1 |

|

I only. |

| 2 |

|

II only. |

| 3 |

|

II only. |

| 4 |

|

Both I and II. |

| 5 |

|

I only. |

(Row 1) As a secured creditor, Safe will be entitled to the collateral before any distributions are made to other creditors. Safe will receive the entire amount of the mortgage due if the proceeds from the sale of the warehouse are sufficient, in which case any remaining proceeds would be available for distribution to other creditors. If the proceeds from the sale of the warehouse are not sufficient to pay the entire mortgage, Safe will receive all of the proceeds and will be an unsecured creditor as to the remaining balance of the mortgage.

(Row 2) Employee claims will not necessarily be paid in full after payment of secured creditors. After the payment of secured parties, administrative expenses will be paid, followed by post petition or involuntary gap creditors. Employee claims, up to $13,650 per employee, will be paid next. These and other priority claims will be paid before payment of any claims of general creditors.

(Row 3) The claim for 20X4 income taxes is a priority claim, but it is not considered a secured claim. After payment of secured parties, administrative expenses will be paid, followed by post petition or involuntary gap creditors. Employee claims, up to $13,650 per employee, will be paid next, followed by advances to customers. Claims for taxes will be paid next, prior to payment for claims of general creditors.

(Row 4) Directors are considered insiders. As a result, the payments to the directors on February 1 are considered preferential transfers since they were within one year of the petition.

(Row 5) The purchase on May 1 was made in the ordinary course of business and Rusk received new value for the payment. As a result, it is not a preferential transfer.

Lecture References :- REG 8.01 : Federal laws and regulations

Which of the following actions would most likely be an infringement of the exclusive rights of the owner of a copyrighted work?

| A. Preparing a foreign language translation of the copyrighted work. | ||

| B. Writing a book review of the copyrighted work that includes excerpts from the work. | ||

| C. Making multiple copies of extracts from the copyrighted work for classroom use. | ||

| D. Using the copyrighted work for research. |

Explanation:

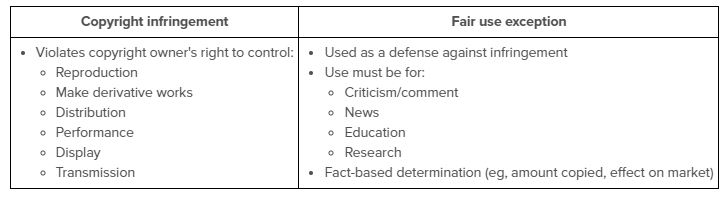

A copyright represents the owner’s legal right to control how a creative work will be used. Common uses include:

- Selling a copy of the work (eg, book)

- Selling access to the work (eg, theater ticket)

- Giving someone the right to make a derivative work (eg, a foreign translation of a book)

Copyright infringement occurs when someone uses copyrighted material (such as to perform, display, or make a derivative work) without permission from the copyright owner.

However, the fair use exception is one of the limitations on a copyright owner’s exclusive rights. The fair use exception allows copyrighted material to be used without permission for purposes that are fair under the facts and circumstances. Criticism (eg, book reviews), news, education, and research are examples of fair use (Choices B, C, and D).

Still, the use must be limited and reasonable. For example, a teacher copying an extract from a book and displaying it to the class is fair use. Making multiple copies of an entire book and distributing one to each student in the class is not.

Things to remember:

A copyright represents the owner’s legal right to control how a copyrighted work will be used. Copyright infringement involves using a copyrighted work without the owner’s permission (eg, an unauthorized derivative work). But under the fair use exception, permission is not needed if the material is used (reasonably) for criticism, news, education, or research.

- REG 8.01 : Federal laws and regulations

What is an example of property that can be considered either personal property or real property?

| A. Air rights. | ||

| B. Mineral rights. | ||

| C. Harvested crops. | ||

| D. Growing crops. |

Explanation:

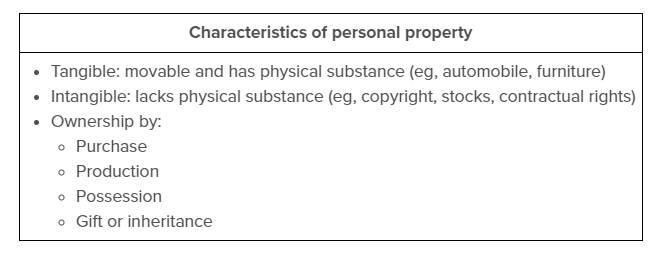

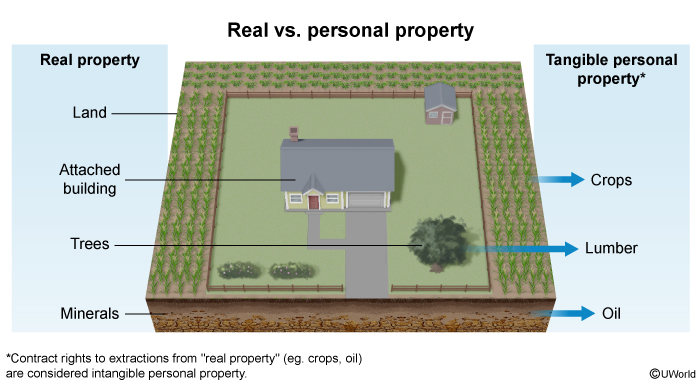

Personal property is any tangible or intangible object that is subject to being owned and not categorized as real property. Real property is land and anything permanently affixed to the land (eg, buildings). The focus of laws regulating personal property is to promote trade through the easy transfer of ownership. The focus of laws regulating real property is to establish and maintain proper title (ie, ownership).

Crops under cultivation are unique since they can be considered real or personal property depending on the context. If a farmer sells land (with the growing crops), the crops are real property. If the farmer sells just the crops, whether grown or harvested, they are considered personal property (Choice C).

(Choices A and B) Air rights and mineral rights cannot be separated from the use of the land and are therefore real property. For instance, mineral rights are different than the minerals themselves. A mineral rights owner has title to the minerals plus the right to enter (use) the land and extract the minerals. If the minerals are bundled with the extraction right, then they are real property. If the minerals are sold separately, either before or after extraction, they are personal property.

Things to remember:

The distinction between real and personal property is necessary because different laws affect the methods of transfer, rights of creditors, and negotiability of ownership documents. Certain things such as growing crops can be categorized as one or the other depending on the context.

- REG 10.01 : Basis of assets

Trees were cut down and made into lumber. The lumber was used to build a house. Which of the following statements best describes the property aspect of these events?

| A. The trees were and remained tangible personal property. | ||

| B. The trees were and remained real property. | ||

| C. The trees were real property, then became and remained personal property. | ||

| D. The trees were real property, became personal property, and then reverted to being real property. |

Explanation:

Real property is anything affixed to one specific location (ie, cannot be moved). It includes land and anything permanently attached to land. Personal property is anything that is not real property (eg, cars, contract rights). An item’s status as real or personal property is not permanent. Items can be converted from real property to personal property, and vice versa.

For example, trees are considered real property because they are attached to land (Choice A). Once they are cut down and made into lumber, they become personal property (Choice B). When the lumber becomes part of a house that is affixed to land, the lumber (as part of the house) becomes real property again (Choice C).

Even then, the lumber’s status as real property is not permanent. In the future, the house may be renovated and the lumber salvaged as reclaimed wood, which would convert it back to personal property.

Things to remember:

Real property is anything affixed to one specific location. It includes land and anything permanently attached to land. Personal property is anything that is not real property. An item’s status as real or personal property is not permanent; an item can be converted from real property to personal property, and vice versa.

- REG 10.01 : Basis of assets

A cloud service provider offering Infrastructure as a Service is most likely to be contractually responsible for maintaining which of the following?

| A. Networks. | ||

| B. Middleware. | ||

| C. Operating systems. | ||

| D. Applications. |

Explanation:

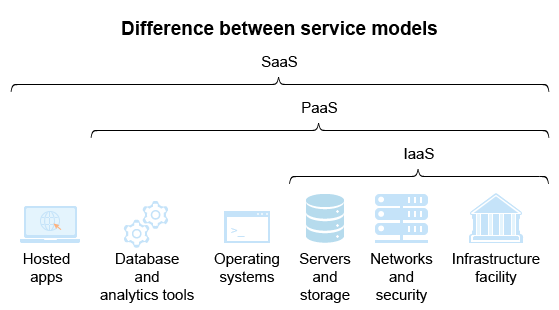

Cloud computing is the delivery of IT resources (eg, processing, storage) via a network (eg, the Internet). When outsourced to a third-party service provider, cloud computing allows an organization to pay for infrastructure, platforms, and applications as it needs, rather than making upfront investments in on-premises hardware and technical personnel. Cloud service providers (CSPs) offer three primary service delivery models: Infrastructure as a Service (IaaS), Platform as a Service (PaaS), or Software as a Service (SaaS).

Under the IaaS model, the CSP would be contractually responsible for maintaining servers, storage, and networking capabilities, creating virtual instances of those capabilities for each user entity. IaaS does not include platform components (eg, operating system, middleware) included in a PaaS model nor software components (eg, applications, data) included in a SaaS model.

(Choices B and C) PaaS and SaaS, not IaaS, provide platform components like middleware, operating systems, and analytic tools.

(Choice D) SaaS, not IaaS or PaaS, provides hosted software applications.

Things to remember:

Cloud service providers (CSPs) that offer an Infrastructure as a Service (IaaS) delivery model provide infrastructure (ie, network, servers, storage) to user entities.

- ISC 3.01 : Information systems: IT infrastructure

In a SOC 2® examination, management should consider the implementation guidance found in which of the following criteria when making judgments about the disclosures to include in its description of the service organization’s system?

| A. DC Section 100 Description Criteria. | ||

| B. DC Section 200 Description Criteria. | ||

| C. DC Section 300 Description Criteria. | ||

| D. DC Section 400 Description Criteria. |

Explanation:

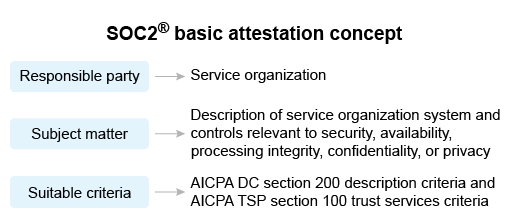

According to AT-C 105, the basic concept underlying all assertion-based examinations (eg, SOC 1®, SOC 2®) is that the responsible party measures or evaluates the subject matter against criteria and provides an assertion about the outcome. The subject matter of a SOC 2® examination includes management’s description of the service organization’s system and the related controls. The criteria that apply to the system description differ from the trust services criteria, which are used for controls.

In a SOC 2® examination, management’s system description is measured or evaluated against the AICPA’s DC Section 200, 2018 Description Criteria for a Description of a Service Organization’s System in a SOC 2® Report (with Revised Implementation Guidance—2022). This document outlines nine different criteria and contains corresponding implementation guidance, which management should consider when making judgments about the disclosures to include in its narrative description of the service organization’s system. CPAs also use these criteria to determine whether management’s system description is fairly stated.

(Choice A) DC Section 100 applies to SOC for Cybersecurity examinations.

(Choice C) DC Section 300 applies to SOC for Supply Chain examinations.

(Choice D) DC Section 400 does not exist.

Things to remember:

In a SOC 2® examination, management’s system description is measured or evaluated against the AICPA’s DC Section 200, 2018 Description Criteria for a Description of a Service Organization’s System in a SOC 2® Report (with Revised Implementation Guidance—2022).

During a suspected data breach, an incident response team has gathered raw data indicating anomalous server activity. Then they compared the current situation with a similar incident from the previous year. Which of the following stages of the OODA loop is the team primarily utilizing?

| A. Observe and act. | ||

| B. Orient and decide. | ||

| C. Observe and orient. | ||

| D. Decide and act. |

Explanation:

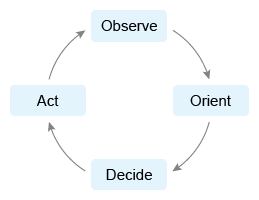

The OODA loop is a four-stage decision-making framework: observe, orient, decide, and act. It is a useful tool for incident response teams as it helps them to make timely and informed decisions under pressure.

- In the observe stage, the team gathers information about the incident. This information helps them to understand the scope and impact of the incident.

- In the orient stage, the team analyzes the information they have gathered and assesses the situation. They try to identify the attackers, their motivations, and their methods of attack.

- In the decide stage, the team makes a decision about how to respond to the incident. This may involve isolating affected systems, restoring data from backups, or changing passwords for affected accounts.

- In the act stage, the team takes action based on their decisions. They implement the security controls they have developed and take steps to mitigate the risks to the organization.

(Choices A, B, and D): This scenario illustrates the observe and orient stages of the OODA loop. The team is gathering information about the incident (observe) and comparing it to a similar incident from the previous year (orient). They have not yet made a decision on how to proceed (decide) or taken any definitive action in response to their findings (act)

Things to remember:The observe phase of the OODA loop involves gathering real-time data and information about an incident. The orient phase contextualizes this data by analyzing it against past experiences, knowledge, and other relevant information to derive meaning. Together, these steps provide a foundational understanding before making decisions. Lecture References :

- ISC 8.01 : Incident response

Which of the following IT controls would a company appropriately use to mitigate the risk of unauthorized access to its payroll data?

| A. Validity checks. | ||

| B. A neural network. | ||

| C. Biometric devices. | ||

| D. Employee purchase cards. |

Explanation:

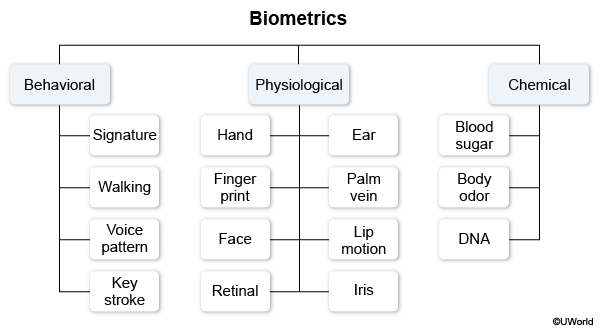

General controls over access to computers and files are particularly important for sensitive data, such as payroll information. Access to payroll programs and data should require the use of sophisticated passwords and/or biometrics to authenticate users.

Biometrics establish a person’s identity using their unique attributes (eg, physiological, behavioral, chemical), creating a strong control to prevent unauthorized access. Biometric identification methods include fingerprints, voice patterns, retina prints, facial patterns and features, body odor, and keystroke dynamics.

(Choice A) A validity check compares data entered in a field to acceptable values, indicating a potential error when there is not a match. For example, a payroll check with $1 million payment amount would exceed an acceptable value of $5,000 per paycheck.

(Choice B) A neural network is a type of machine learning that uses algorithms modeled after the human brain and nervous system to recognize patterns. One common use is to suggest potential future purchases based on a user’s previous buying experiences.

(Choice D) State and government agencies use employee purchase cards so that employees can pay for immaterial, routine goods and services without using a standard purchase requisition. Fields imbedded in the card allow the tracking of each purchase.

Things to remember:

Biometrics can be used to mitigate the risk of unauthorized access to data. Biometrics establish a person’s identity using his or her unique attributes (eg, physiological, behavioral, chemical), creating a strong control to prevent unauthorized access to sensitive data or physical sites.

- ISC 6.02 : Security: Mitigation

From an employee’s standpoint, the tax benefit of a qualified stock option is that:

| A. There is no AMT impact when stock is acquired through option exercise. | ||

| B. The gain recognized when stock acquired through option exercise is sold may be taxed at preferential rates. | ||

| C. The compensation income recognized is deferred until option exercise. | ||

| D. The compensation income recognized at grant date is taxed at preferential rates. |

Explanation:

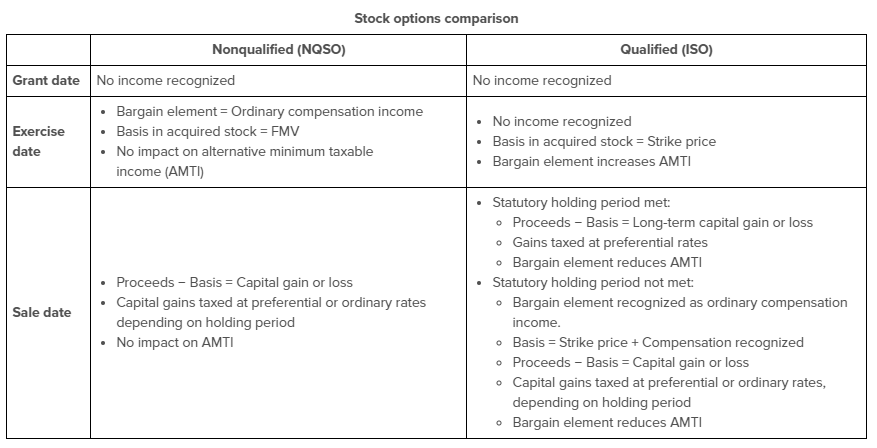

Employers issue stock options to compensate employees. The two types of employee stock options are qualified, known as incentive stock options (ISOs), and nonqualified (NQSOs). The types have differing tax consequences. On the grant date, neither type requires income to be recognized by an option recipient (Choice D).

On the exercise date:

- ISOs: There is no income recognition (Choice C). The employee’s acquired stock basis is the strike price paid. The bargain element increases AMTI (Choice A)

- NQSOs: The bargain element is recognized as ordinary compensation income. The employee’s acquired basis in the stock is its FMV

When the acquired stock is later sold:

-

ISOs: The bargain element decreases AMT impact

- If the statutory holding period is met, the employee recognizes long-term capital gain or loss (difference between proceeds and basis). Any gain is taxed at preferential rates

- If the statutory holding period is not met, the employee recognizes the bargain element as ordinary compensation income, increasing basis by this amount. Capital gain/loss recognized is the difference between proceeds and basis. Any gain is taxed at ordinary or preferential rates, depending on the holding period

- NQSOs: Capital gain/loss recognized is the difference between proceeds and basis. The gain is taxed at ordinary or preferential rates, depending on the holding period

Things to remember:

Employees often prefer ISOs to NQSOs because taxation is deferred until the stock acquired through option exercise is sold, rather than when the options are exercised. If statutory holding periods are met, gain recognized on the sale of stock is taxed at preferential rates.

- TCP 1.01 : Tax compliance and planning for individuals

The parents of a three-year-old taxpayer gifted him stock when he was born. This year, the taxpayer has $20,000 of qualified dividends, $0 earned income, and $4,000 of itemized deductions related to the dividends. Assuming the current dependent child standard deduction is $1,350, how much of the taxpayer’s dividends will be taxed at his parents’ rate?

| A. $1,350 | ||

| B. $14,650 | ||

| C. $18,650 | ||

| D. $20,000 |

Explanation:

The kiddie tax applies to children meeting certain conditions and affects a child’s net unearned income (NUI). Examples of unearned income are interest, dividends, and capital gains.

NUI is calculated as unearned income minus 1) the child’s standard deduction and 2) the greater of the child’s standard deduction or itemized deductions attributable to unearned income. The result is net unearned income that is:

- tax-free up to the child’s standard deduction, then

- taxed at the child’s rate up to the child’s standard deduction (or itemized deductions, if higher), and then

- taxed at the parents’ rate as income in excess (of the NUI).

In this case, the child taxpayer has $20,000 of unearned income and $4,000 of related itemized deductions. The first $1,350 is tax-free, and the next $4,000 (the greater of the $1,350 standard deduction or the $4,000 itemized deductions) is taxed at the child’s rate. The remaining $14,650 is taxed at the parents’ rate.

| Gross unearned income | $20,000 |

| Less: Standard deduction for unearned income (not taxed) | (1,350) |

| Less: Itemized deductions (ie, $4,000 is > $1,350) | (4,000) |

| Net unearned income (taxed at parents’ rate) | $14,650 |

(Choice A) The child’s standard deduction for determining NUI is $1,350; this is not the amount of the NUI.

(Choice C) Dividend income of $18,650 fails to subtract the child’s itemized deductions to determine the amount taxed at the parents’ rate.

(Choice D) Dividend income of $20,000 erroneously treats all the income as NUI.

Things to remember:

The kiddie tax applies to children meeting certain conditions and is based on net unearned income (NUI) that is taxed at the parents’ tax rate. NUI is calculated as unearned income less 1) the child’s standard deduction and 2) the greater of child’s standard deduction or itemized deductions attributable to unearned income.

- TCP 1.01 : Tax compliance and planning for individuals

Osha, a cash-basis calendar-year partnership, began business on April 1, Year 5. Osha incurred and paid the following during Year 5:

| Legal services associated with formation of the partnership: | $15,260 |

| Accounting fees associated with promoting and selling partnership interests: | 10,000 |

Osha elected to amortize costs. What is the maximum amount of organizational costs deductible on Osha’s Year 5 partnership return?

| A. $5,000 | ||

| B. $5,513 | ||

| C. $5,684 | ||

| D. $6,013 |

Explanation:

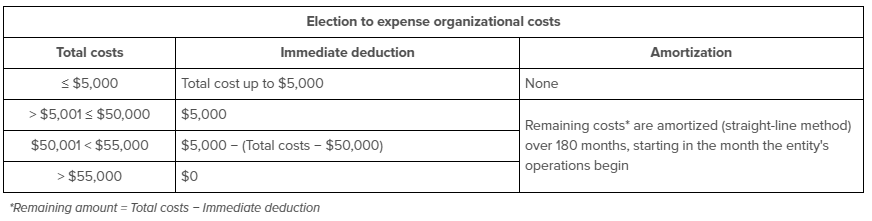

For tax purposes, no deduction is generally allowed for costs incurred to organize a partnership or promote the sale of an interest in the partnership. However, regulations provide that a business has deemed to make an election to deduct start-up and/or organizational expenses in the tax year in which the business began (ie, no longer required to attach election to tax return).

Accordingly, a partnership may elect to immediately deduct up to $5,000 of organization costs. The remaining costs are amortized, using the straight-line method, ratably over 180 months beginning in the month the entity’s business begins. The $5,000 immediate deduction must be reduced by the amount of organizational expenses exceeding $50,000.

Examples of organizational costs are legal and accounting services incidental to the creation of the partnership such (eg, preparation of the partnership agreement, state registration and filing fees). No immediate deduction or amortization is allowed for syndication costs; instead, these costs are capitalized. Therefore, costs for promoting and selling partnership interests are not deductible.

In this scenario, the partnership has elected to amortize (not capitalize) the organizational costs. The $15,260 for legal services qualify as organizational expenses. However, the $10,000 fees for promoting and selling partnership interests (ie, syndication costs) do not. Because the operations began on April 1, the maximum amount deductible in Year 5 is $5,513, as calculated below.

| Immediate deduction | $5,000 |

| Amortization [($15,260 − $5,000) × 9/180] | 513 |

| Total | $5,513 |

| *Operations began April 1, so 9 months of amortization allowed | |

Things to remember:

A partnership may immediately deduct up to $5,000 of organizational costs (ie, costs incidental to the creation of the partnership) and amortize the remainder ratably over 180 months beginning in the month the entity begins business. The $5,000 deduction must be reduced by the amount of organizational expenses exceeding $50,000. Syndication costs must be capitalized.

- TCP 7.02 : Partnerships: Partnership and partner elections

On January 1, Year 2, a individual lent $110,000 to a friend as a gift loan to help the friend buy a home. The loan terms require the friend to repay the loan in three equal annual installments of $30,000, with the first payment due on December 31, Year 2. The loan does not require payment of interest. For Year 2, what are the income tax consequences to the individual lender?

| A. The individual has no income tax consequences because no interest is due under the loan terms. | ||

| B. The individual must recognize interest income because the loan was issued at a premium. | ||

| C. The individual has no income tax consequences because the loan is de minimis. | ||

| D. The individual must recognize interest income because interest income must be imputed. |

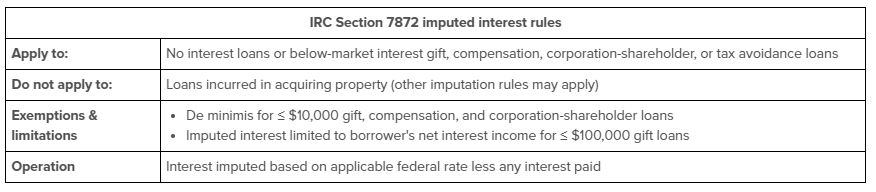

Explanation:

Imputed interest rules, which result in interest income reported by a lender, affect no interest and below-market interest loans such as demand, gift, corporation-shareholder, and compensation (ie, employer-employee) loans.

Affected loans are generally characterized as arm’s length transactions in which the lender is treated as making a loan at the applicable federal rate (AFR). Forgone interest (ie, the difference between calculated AFR interest and interest paid, if any) is characterized as 1) a gift to the borrower, followed by 2) a retransfer of this interest to the lender. The retransfer results in imputed interest income that must be reported by the lender over the life of the loan (Choice A).

A de minimis exception applies to gift loans exempted from the imputed interest rules (ie, ≤ $10,000) (Choice C). The ≤ $10,000 de minimis exception also applies to compensation loans and corporation-shareholder loans. This exception applies per loan, not per borrower.

In this scenario, the individual must recognize interest income because interest must be imputed on the $110,000 loan.

(Choice B) The loan at issue was not issued at a premium. In addition, issuing at a premium would not cause income recognition.

Things to remember:

Interest must be imputed when an lender makes a below-market interest or no interest loan, unless the loan is de minimis (≤ $10,000 gift, compensation, or corporation-shareholder loan). The taxpayer (lender) reports the imputed interest as interest income over the life of the loan.

- TCP 1.01 : Tax compliance and planning for individuals

In the current year, Poplar City paid $5,000 interest and $20,000 principal on its outstanding general obligation bonds. The payment was made from a debt service fund using cash transferred earlier the same year from the general fund. How should the city report the expenditures?

| General fund | Validity Debt service fund | Permanent fund | |||

| A. | $25,000 | $25,000 | $0 | ||

| B. | $0 | $25,000 | $20,000 | ||

| C. | $25,000 | $5,000 | $0 | ||

| D. | $0 | $25,000 | $0 |

Explanation:

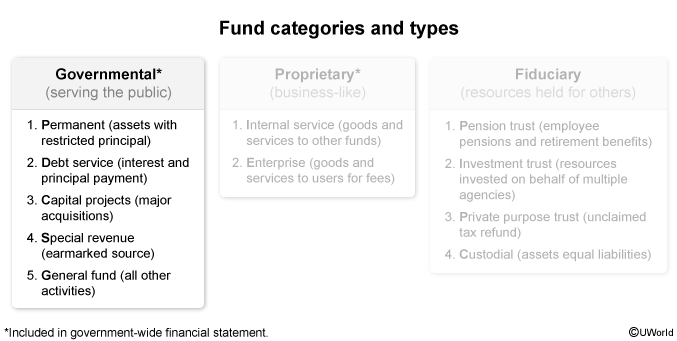

Government entities report their financial activities using fund accounting. The fund basis of accounting involves using separate general ledgers (ie, sets of books) and reports to track activities. There are 3 main categories of funds: governmental, proprietary, and fiduciary. The governmental fund category contains 5 fund types to account for different tax-supported activities.

The debt service fund is a governmental fund type used to account for resources designated for interest and principal expenditures on the entity’s debt obligations. Cash transfers between governmental funds are permitted; however, entities are required to report the transfers under other financing sources (transferee) and other financing uses (transferor) to distinguish them from ordinary revenues and expenditures. Subsequently, when the cash is used, the expenditure is recognized in the fund that makes the payment.

The city should report $0 as expenditure under the general fund since the payment for the expenditures was made from the debt service fund. Interest of $5,000 and principal of $20,000 should both be reported in the debt service fund for a total of $25,000. An amount of $0 should be reported under permanent fund (like an endowment) since there is no restriction on the principal.

Things to remember:

The debt service fund accounts for all interest and principal expenditures on a government entity’s debt obligations. Interfund cash transfers are reported as transfers in or out under the financing source (use) section of the financial statement. When transferred cash is used, the expenditure is recorded in the fund that expends the cash.

- BAR 14.09 : State and Local Governments: Interfund transactions

North Bank is analyzing Belle Corp.’s financial statements for a possible extension of credit. Belle’s quick ratio is significantly better than the industry average. Which of the following factors should North Bank consider as a possible limitation of using this ratio when evaluating Belle’s creditworthiness?

| A. Fluctuating market prices of marketable debt securities may adversely affect the ratio. | ||

| B. Increasing market prices for Belle’s inventory may adversely affect the ratio. | ||

| C. Belle prepaid its rent expense in full for the following year. | ||

| D. Belle may need to liquidate its inventory to meet its long-term obligations. |

Explanation:

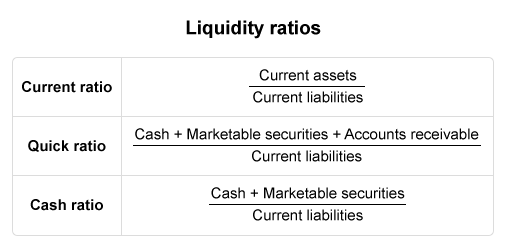

The quick ratio (acid test ratio) is used to assess an entity’s ability to pay its short-term obligations. This ratio compares the entity’s highly liquid current assets (eg, cash, marketable debt securities, net accounts receivable) to its current liabilities.

Marketable securities (eg, trading debt securities) are assets the investor has acquired in an attempt to profit by buying and selling within a short period of time. These assets are carried typically at fair value; fluctuating market prices limit the usefulness of this ratio because the changing prices could cause the quick ratio to rapidly increase or decrease.

(Choices B and C) Certain current assets (eg, inventory, prepaid expenses) are excluded from the quick ratio because they cannot be easily converted to cash. Changing market prices of these assets would not affect the quick ratio. The alternative formula (the ratio can be calculated with either approach) used for the quick ratio is:

(Choice D) The ratio would not change based on a potential sale of inventory. However, if the assets are actually sold or disposed of for cash, the cash received for them would then be included in the ratio.

Things to remember:

The quick ratio assesses an entity’s ability to meet its short-term obligations. It is calculated by the sum of cash and assets that can be easily converted to cash (eg, marketable debt securities, net accounts receivable) divided by current liabilities. Fluctuating market prices on marketable securities is one limitation of the quick ratio.

- BAR 1.01 : Current period/historical analysis, including the use of data: Financial statement analysis

On December 31, Year 1, Northpark Co. collected a receivable due from a major customer. Which of the following ratios would be increased by this transaction?

| A. Inventory turnover ratio. | ||

| B. Receivable turnover ratio. | ||

| C. Current ratio. | ||

| D. Quick ratio. |

Explanation:

| Accounts receivable turnover = Net credit sales / Average receivables* |

Average receivables = (Beginning receivables + Ending receivables) / 2

The accounts receivable (A/R) turnover rate measures the average number of times a company converts its A/R into cash during a period. It indicates management’s effectiveness in managing credit given to customers, with a higher A/R turnover implying greater ability to quickly convert receivables to cash. A/R turnover is calculated as Credit sales / Average receivables.

The entry to collect a receivable includes a debit (ie, increase) to cash and a credit (ie, decrease) to A/R. Any transaction reducing A/R will decrease average A/R for the period (ie, the denominator). Therefore, this collection will increase the A/R turnover ratio.

(Choices A) The inventory turnover ratio measures the number of times inventory is sold and replaced within a period and is calculated as COGS / Average inventory. This ratio is unaffected by the collection of a receivable.

(Choices C and D) The current ratio and quick ratio are liquidity metrics that assess a company’s ability to meet its short-term obligations. Collection of a receivable involves increasing one current/quick asset (cash) and decreasing another current/quick asset (A/R). Because the overall amount of current/quick assets does not change when receivables are collected, the current and quick ratios are unaffected.

Things to remember:

The accounts receivable (A/R) turnover rate measures the average number of times that a company converts its A/R into cash during a period. A/R turnover is calculated as Credit sales / Average receivables. The collection of a receivable will decrease average A/R for the period and will therefore increase the A/R turnover ratio.

- BAR 1.01 : Current period/historical analysis, including the use of data: Financial statement analysis

On May 1, Clothes Co. sells clothing to Link Corp. for $40,000. Clothes ships the clothing on May 1 and Link is obligated to pay Clothes within six months. Link is given 12 months to return any of the clothing for a refund if they experience low demand. Link is also given 18 months to exchange any clothing due to low demand. At the time of sale, Clothes cannot reasonably estimate returns, but estimates $5,000 in exchanged goods. Clothes should recognize revenue for the aforementioned transaction

| A. On the day of the sale. | ||

| B. 6 months after the date of sale. | ||

| C. 12 months after the date of sale. | ||

| D. 18 months after the date of sale. |

Explanation:

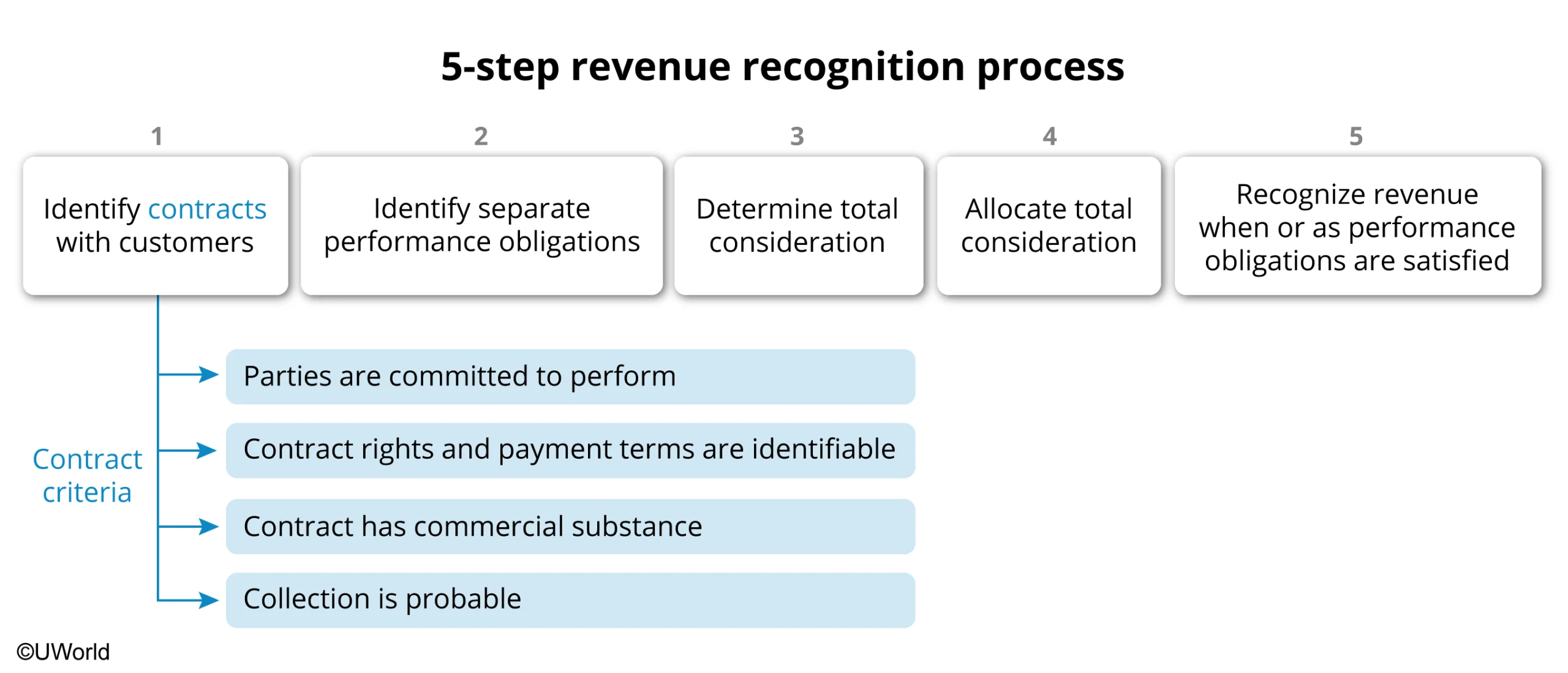

GAAP requires that revenue be recognized at the conclusion of a five-step recognition process. The first step in this process is to identify a contract with the customer. A key criterion for establishing a contract is that collection from the customer is probable (ie, substantially all the accounts receivable will be collected).

In this scenario, Link Corp.’s payment obligation is contingent on customer demand. Therefore, collection is not probable until this is determined, at the 12-month deadline. Revenue will be recognized at that time.

Note: Right of return is not necessarily an impediment to revenue recognition. If Clothes Co. could reasonably estimate the proportion of unreturned items (eg, using previous experience) it could recognize that proportion of revenue on the day of sale. Only the estimated returns revenue amount would be deferred for 12 months.

(Choice A) Day-of-sale recognition incorrectly implies no risk of return.

(Choice B) Cash accounting recognizes revenue when the customer pays (six months). Accrual accounting requires five-step revenue recognition, under which timing of cash receipts is not considered.

(Choice D) Although exchanges can be made for 18 months, they do not prevent revenue recognition. Exchanges are only a transfer to different goods, not a reversal of the sale.

Things to remember:

The first step of the five-step revenue recognition process is to identify a contract with the customer. This includes ensuring that collection is probable. Right of return requires revenue to be deferred until the amount returned can be reasonably estimated. Customer exchanges do not require deferring of revenue.

- BAR 5.01 : Revenue recognition

Mock Exams: True Exam Simulation

Simulate the official CPA Exam before test day with UWorld’s full-length mock exams. They mirror the actual CPA Exam interface, navigation, timing, difficulty, and weighting. Using entirely new questions, these mocks accurately assess your readiness and eliminate surprises. Includes 2 full mock exams per core section and 1 per discipline, preparing you for the real experience.

Study Planner

Stay on track with a customizable Study Planner that helps you manage your time effectively. Build a realistic study schedule, balance your workload, and move through your CPA prep with confidence and clarity.

SmartPath ™

Stop wasting time on topics you've already mastered. SmartPath shows you exactly when you're ready to advance, saving hours of unnecessary study.

Flashcards

Master concepts faster with our interactive flashcards. Use our prebuilt decks or create custom flashcards directly from textbook content and question explanations. Our advanced spaced repetition technology optimizes your review sessions to improve retention and recall.

My Notebook

Organize your learning with My Notebook, a personalized space to save key takeaways, tables, flow charts, and mnemonics for quick review in the final days before the exam.

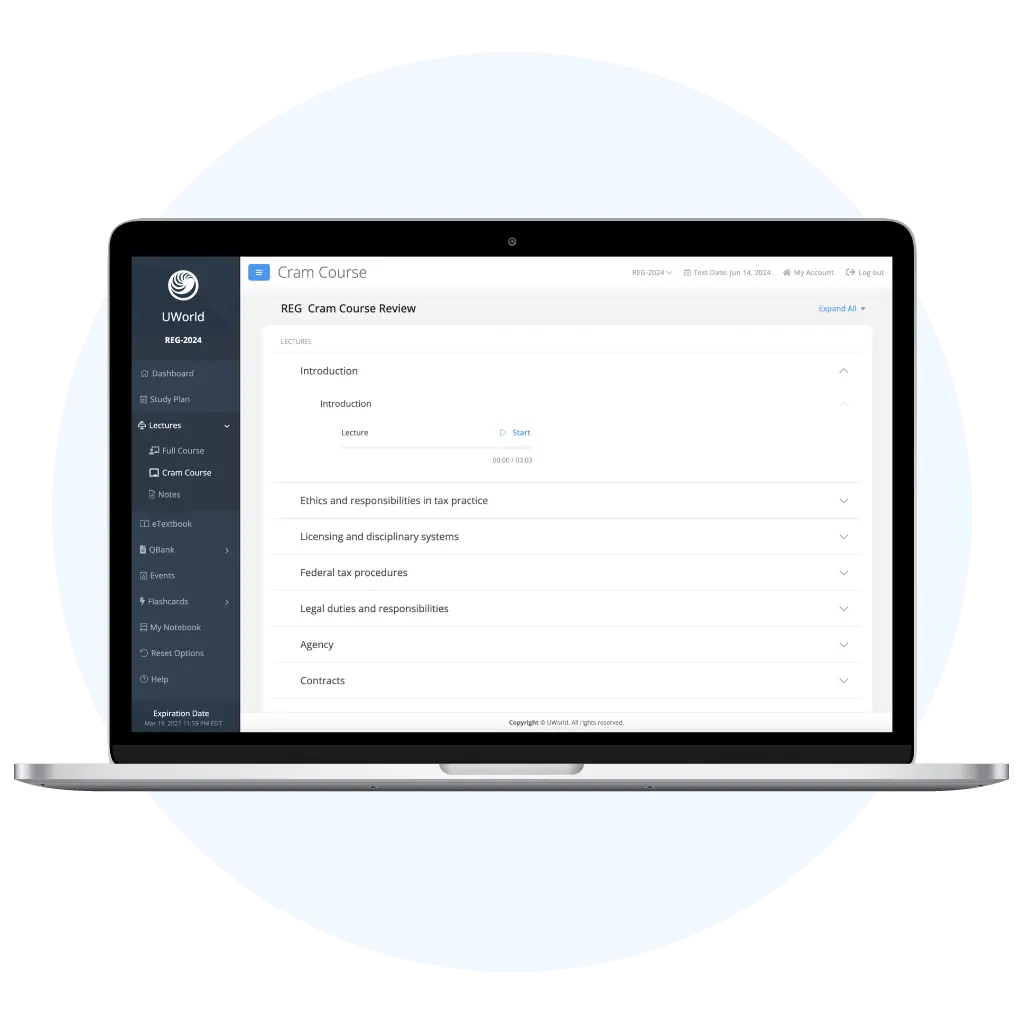

Cram Course

Get exam-ready fast with our focused Cram Course designed to reinforce key concepts and high-yield topics. Perfect for final review, this course helps you sharpen understanding and boost confidence before test day.

Bootcamps

Join our exclusive live bootcamps with interactive, online sessions for every exam section led by expert CPA instructors. Ask questions and clarify difficult concepts.

Mobile Apps

Study anytime, anywhere with our mobile app. Access your complete CPA course on the go—synced seamlessly with the desktop version. Stay productive during commutes, breaks, or between classes without missing a beat in your prep.

Study Planner

Stay on track with a customizable Study Planner that helps you manage your time effectively. Build a realistic study schedule, balance your workload, and move through your CPA prep with confidence and clarity.

SmartPath ™

Stop wasting time on topics you've already mastered. SmartPath shows you exactly when you're ready to advance, saving hours of unnecessary study.

Flashcards

Master concepts faster with our interactive flashcards. Use our prebuilt decks or create custom flashcards directly from textbook content and question explanations. Our advanced spaced repetition technology optimizes your review sessions to improve retention and recall.

My Notebook

Organize your learning with My Notebook, a personalized space to save key takeaways, tables, flow charts, and mnemonics for quick review in the final days before the exam.

Cram Course

Get exam-ready fast with our focused Cram Course designed to reinforce key concepts and high-yield topics. Perfect for final review, this course helps you sharpen understanding and boost confidence before test day.

Bootcamps

Join our exclusive live bootcamps with interactive, online sessions for every exam section led by expert CPA instructors. Ask questions and clarify difficult concepts.

Mobile Apps

Study anytime, anywhere with our mobile app. Access your complete CPA course on the go—synced seamlessly with the desktop version. Stay productive during commutes, breaks, or between classes without missing a beat in your prep.

Powerful Study Tools That Save Time and Boost Retention

The UWorld CPA Course brings together innovative study tools and expert guidance to help you prepare with confidence. SmartPath, personalized study plans, diagnostic reports, flashcards, My Notebook, and mobile apps help you save time and retain information longer—so you can pass on your first try.

What Our Students Think About UWorld CPA Review Courses

“UWorld...you guys are rockstars! Thank you for helping me achieve this dream! I passed all exams on my first attempt. Yes I did put in a lot of effort and hard work but UWorld prepared me to handle the exam with confidence. I have been telling people about the program and to trust the process. I really hope this program helps other people just like it helped me.”

Flexible CPA Review Courses Designed for Success

Whether you’re looking for just the basics or unlimited access until you pass the CPA Exam, we have a course that’s right for you.

Elite-Unlimited+

Elite-Unlimited

Premier

Not Satisfied With Your “Other” CPA Course?

We’re here to help! If you have purchased another CPA Review program and are dissatisfied with your results, you may qualify for a Fresh Start Discount.

Explore our free trial and best CPA course discounts.

Award-Winning Leader in Education Technology

Frequently Asked Questions (FAQs)

Are Roger CPA Review and Wiley CPA Review part of UWorld now?

Yes. Roger CPA Review and Wiley CPA Review are now fully integrated into UWorld CPA Review, forming a single, unified CPA preparation platform.

UWorld acquired Roger CPA Review, bringing in Roger Philipp’s highly engaging, energetic teaching style that has helped hundreds of thousands of CPA candidates understand complex accounting concepts more intuitively. Roger continues to serve as a lead instructor and remains a central part of the UWorld CPA experience.

UWorld also acquired Wiley Efficient Learning’s test-prep portfolio, including Wiley CPA Review. This added Wiley’s long-established, deeply

vetted question bank and task-based simulations that had been refined over decades.

Today, candidates benefit from a powerful combination of Roger’s motivational lectures, Wiley’s practice depth, Peter Olinto’s expert instruction, and UWorld’s modern learning technology—all on one platform.

How does UWorld CPA compare to Becker and other CPA review courses?

UWorld CPA differentiates itself through a unique combination of elite instructors, precision-focused content, adaptive technology, and visual learning design.

UWorld features Roger Philipp, known for his dynamic and motivational lectures, alongside Peter Olinto, one of the most respected instructors in the industry, now teaching exclusively at UWorld. This gives students access to multiple teaching styles rather than a single instructional voice.

Content is 100% aligned to current AICPA blueprints, with no extraneous material. A full-time content team updates materials continuously to reflect accounting standard changes, exam updates, and CPA Evolution requirements—ensuring candidates are always studying relevant content.

UWorld’s question explanations are widely regarded as best-in-class, using visual aids, diagrams, flowcharts, and step-by-step reasoning instead of dense text. SmartPath Predictive Technology™ further distinguishes UWorld by guiding students toward exam readiness using real performance data from past passers.

UWorld CPA vs. Becker: Key Differences

Feature | UWorld CPA | Becker CPA |

|---|---|---|

Price | Lower cost with flexible payment options | Premium pricing, typically higher investment |

AICPA Blueprint Alignment | 100% aligned with current AICPA blueprint—no more, no less than what you need | Content may include extra material beyond exam scope |

Instructor Lineup | Roger Philipp + Peter Olinto + multiple expert instructors for diverse teaching styles | Lost Peter Olinto to UWorld; conventional instruction |

Question Bank | Combined resources from Roger, Wiley, and UWorld—largest variety and depth in the industry | Becker’s proprietary questions only |

Answer Explanations | Unmatched clarity with integrated visuals, mnemonics, flowcharts, graphs, and memory aids | Text-heavy explanations with limited visual learning tools |

The Bottom Line:

While Becker built its reputation on solid fundamentals, UWorld has fundamentally changed the game by uniting the industry’s best instructors, most comprehensive content, and most advanced technology. You’re no longer choosing between Roger’s engaging style or Peter’s expertise or Wiley’s question depth—you get all of them working together for your success.

Experience the UWorld advantage with a free trial and see why candidates who compare courses consistently choose UWorld CPA.

Are CPA Review Courses worth it?

Yes. For most candidates, a structured CPA review course is absolutely worth the investment.

The CPA Exam historically has a pass rate around 50%, meaning many candidates fail without guided preparation. Self-study often results in inefficient studying, missed blueprint areas, and costly retakes—each retake adding exam fees, lost time, and additional stress.

A comprehensive course like UWorld CPA provides structured learning, expert instruction, thousands of exam-level questions, simulations, and analytics that dramatically improve pass probability. For candidates facing 300+ study hours, a review course helps reduce wasted effort, accelerate licensure, and deliver strong long-term career ROI.

What is UWorld CPA’s pass rate?

UWorld CPA reports a 90% average pass rate among students who meet their SmartPath Predictive Technology™ targets.

SmartPath benchmarks are built using performance data from thousands of past CPA exam passers. When candidates achieve these personalized targets, they statistically reach a 90% probability of passing their exam section. This applies to committed users who follow the program thoroughly—not casual users.

While pass rates are never guaranteed, UWorld’s data-driven approach significantly exceeds the national CPA exam average and provides candidates with measurable confidence before exam day.

How many practice questions and task-based simulations (TBS) does UWorld CPA have?

UWorld CPA offers 9,000+ multiple-choice questions (MCQs) and 500+ task-based simulations (TBS) across all CPA Exam sections, (AUD, FAR, REG, BAR, ISC, TCP).

The question bank combines content from Roger CPA Review, Wiley CPA Review, and UWorld, providing unmatched variety, depth, and realism. Every question includes a detailed explanation enhanced with visuals and structured reasoning. Candidates also receive unlimited custom quizzes and full-length practice exams to build both mastery and endurance.

Does UWorld CPA offer a pass guarantee or refund policy?

UWorld offers a pass guarantee on the Elite-Unlimited+ package that provides a $250 refund per section in the unlikely event you don’t pass. That’s up to $1,000 back.

Select packages include StudyPass™, which allows access until you pass, along with automatic content updates. UWorld also provides a 7-day free trial with no credit card required, allowing candidates to experience the full platform risk-free. Refund policies may vary by product and time window, so candidates should confirm current terms with UWorld support.

Does UWorld CPA create a personalized study plan?

Yes. UWorld’s platform features a dynamic study planner that generates a customized blueprint based on your schedule and study habits. Simply enter your start date, target exam date, and available study hours per day. Our algorithm creates a personalized study plan with a detailed syllabus and lesson deadlines aligned with your goals.

Does UWorld CPA offer payment plans, discounts, or a free trial?

Yes. UWorld CPA offers:

- Flexible payment plans that allow candidates to spread costs over time

- Discounts and promotions, including FreshStart offers for switchers, seasonal sales, and group pricing for firms or universities

- A 7-day free trial with full access and no credit card required

Check our current discounts or see if your employer or organization has preferred pricing. These options make UWorld CPA accessible to a wide range of candidates without compromising content quality.

Is UWorld CPA aligned with CPA Evolution?

Yes. UWorld CPA is fully aligned with the CPA Evolution model and was redesigned specifically to support its structure and blueprint requirements.

Under CPA Evolution, candidates complete three Core sections (AUD, FAR, REG) plus one Discipline section (BAR, ISC, or TCP). UWorld provides complete, discipline-specific coverage for all six sections, including tailored video lectures, practice questions, and task-based simulations that reflect the distinct skills tested in each exam.

Content weighting strictly mirrors the official AICPA blueprints, ensuring candidates focus their time on what is most heavily tested. There is no unnecessary material and no gaps in coverage. As the AICPA updates representative tasks or blueprint emphasis, UWorld updates corresponding lectures, questions, and simulations immediately—so candidates are always preparing for the current version of the exam, not last year’s.

Is UWorld CPA good for visual learners?

Absolutely. Visual learning is one of UWorld CPA’s strongest differentiators.

Instead of relying on long, text-heavy explanations, UWorld emphasizes diagrams, flowcharts, tables, graphs, mnemonics, and structured breakdowns that make complex accounting concepts easier to understand and remember. This approach is especially effective for subjects like FAR and REG, where relationships between rules matter more than memorization.

Every practice question includes a visual explanation designed to show why an answer is correct, not just state it. This helps candidates retain information longer, recognize patterns on exam day, and apply concepts under pressure—especially when facing unfamiliar or integrated questions.

Can I customize quizzes and practice exams?

Yes. UWorld CPA allows complete customization of quizzes and practice exams to match your exact study needs.

You can build unlimited quizzes and exams based on:

- Specific topics or subtopics

- AICPA blueprint areas

- Difficulty level

- Previously missed questions

- Performance history and weak areas

This flexibility allows you to focus intensely on problem areas while also simulating full-length exams to build endurance and time management skills. Custom exams can be used for targeted remediation or as realistic exam-day rehearsals, helping you transition smoothly from learning to testing.

Is UWorld CPA used by firms and universities?

Yes. UWorld CPA is widely used by accounting firms, universities, and employers to support CPA candidates at scale.

Institutions partner with UWorld to provide structured CPA preparation for students and employees, often integrating UWorld CPA into academic programs or firm-sponsored licensure initiatives. These partnerships reflect confidence in UWorld’s instructional quality, exam alignment, and proven results.

Learn more about institutional partnerships and how UWorld CPA can support your organization’s candidates.

How long should I study for each CPA section?

Study time varies by section and individual background, but most candidates should plan for 300–400 total study hours across all CPA exams.

Approximate averages per section:

- FAR: 120–150 hours (most content-heavy)

- REG: 80–100 hours

- AUD: 70–90 hours

- Discipline (BAR, ISC, TCP): 60–80 hours

UWorld’s SmartPath Predictive Technology™ helps reduce wasted study time by identifying exactly how much mastery you need in each topic to be exam-ready. Instead of studying blindly or over-reviewing areas you already understand, SmartPath directs your effort where it matters most—often saving dozens of hours compared to traditional study plans.

Is UWorld CPA good for CPA retakers?

Yes. UWorld CPA is particularly effective for CPA retakers, who often need a different approach than first-time candidates.

SmartPath diagnostics quickly identify why you failed—whether it was content gaps, weak application, poor time management, or misunderstanding question logic. Instead of repeating the same study process, retakers get a data-driven reset.

UWorld’s explanations emphasize conceptual understanding and exam logic, helping retakers move beyond memorizing answers they’ve seen before. A FreshStart discount is also available for candidates switching from another provider, making UWorld a strong option for those ready to pass on their next attempt.

Does UWorld CPA help with exam-day strategy?

Yes. UWorld CPA helps candidates prepare not only for the content, but also for how to take the CPA exam effectively.

Through realistic practice exams and simulations, candidates learn:

- How to manage time across MCQs and TBS

- When to move on from difficult questions

- How to approach multi-step simulations logically

- How to stay composed under exam pressure

Full-length mock exams are essential for building the endurance and focus required on exam day. Practicing with a complete 4-hour exam helps candidates experience the mental stamina needed to perform well, when fatigue can impact decision-making and accuracy.

UWorld’s 4-hour mock exams replicate the actual CPA Exam experience with the identical interface, format, difficulty, timing, and topic weighting—all using brand-new questions not seen elsewhere in the course. The Elite-Unlimited and Elite-Unlimited+ packages include 2 full mock exams per core section, plus 1 per discipline (9 unique mock exams in total).