Home » Partner With Us » Firms & Corporations

Firm and Corporate Partnership Programs

Why Partner with UWorld?

Accelerated Exam Success

Data-Driven Confidence

Career-Relevant Learning

Industry Connections

Dedicated Support

Partner Pricing

Invest in Your Team for Long-Term Success

Structured learning and development improves retention, boosts engagement, and maximizes ROI — ensuring long-term firm growth. Employee success starts before exam day.

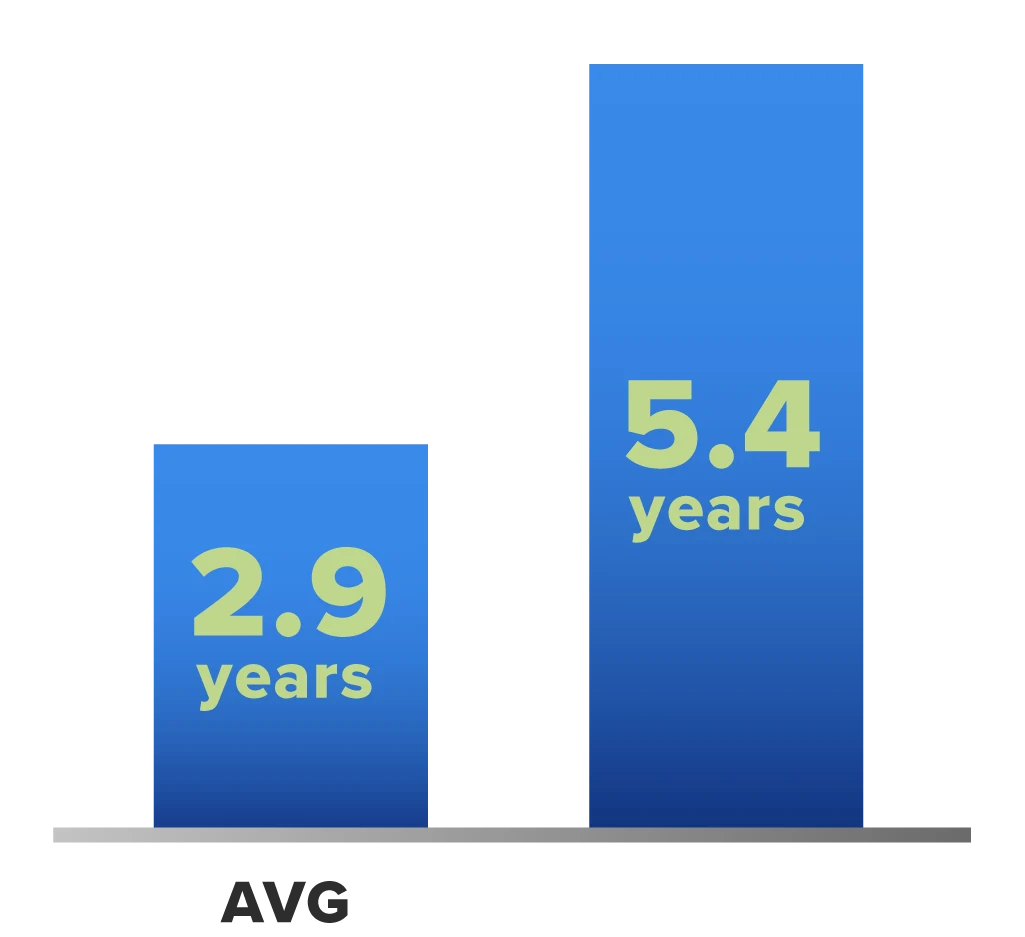

Increase Retention

Companies with robust internal mobility retain employees nearly

2x longer (5.4 yrs).

Keep your best employees longer and fill skills gaps from within while attracting top talent.

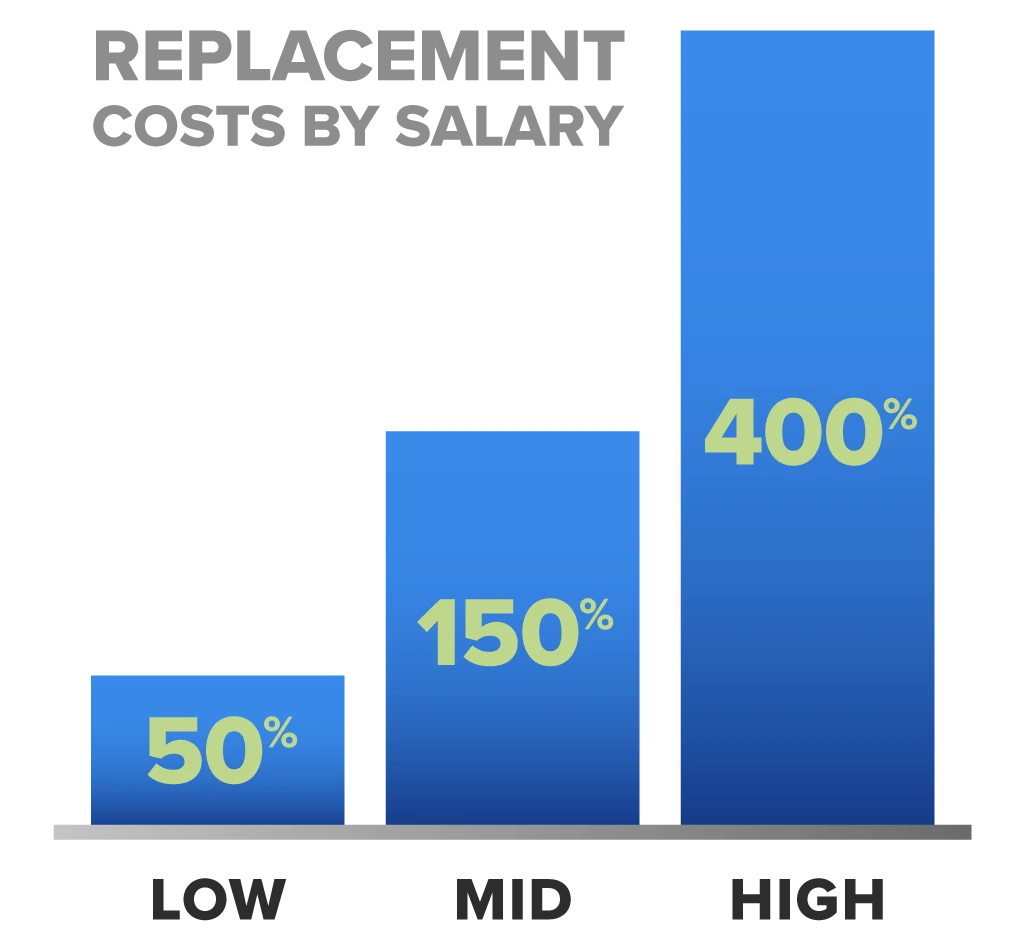

Increase ROI

The cost of replacing a candidate is 0.5-4x their annual salary.

Increase productivity, earn client trust, and get your employees to licensure and certification faster.

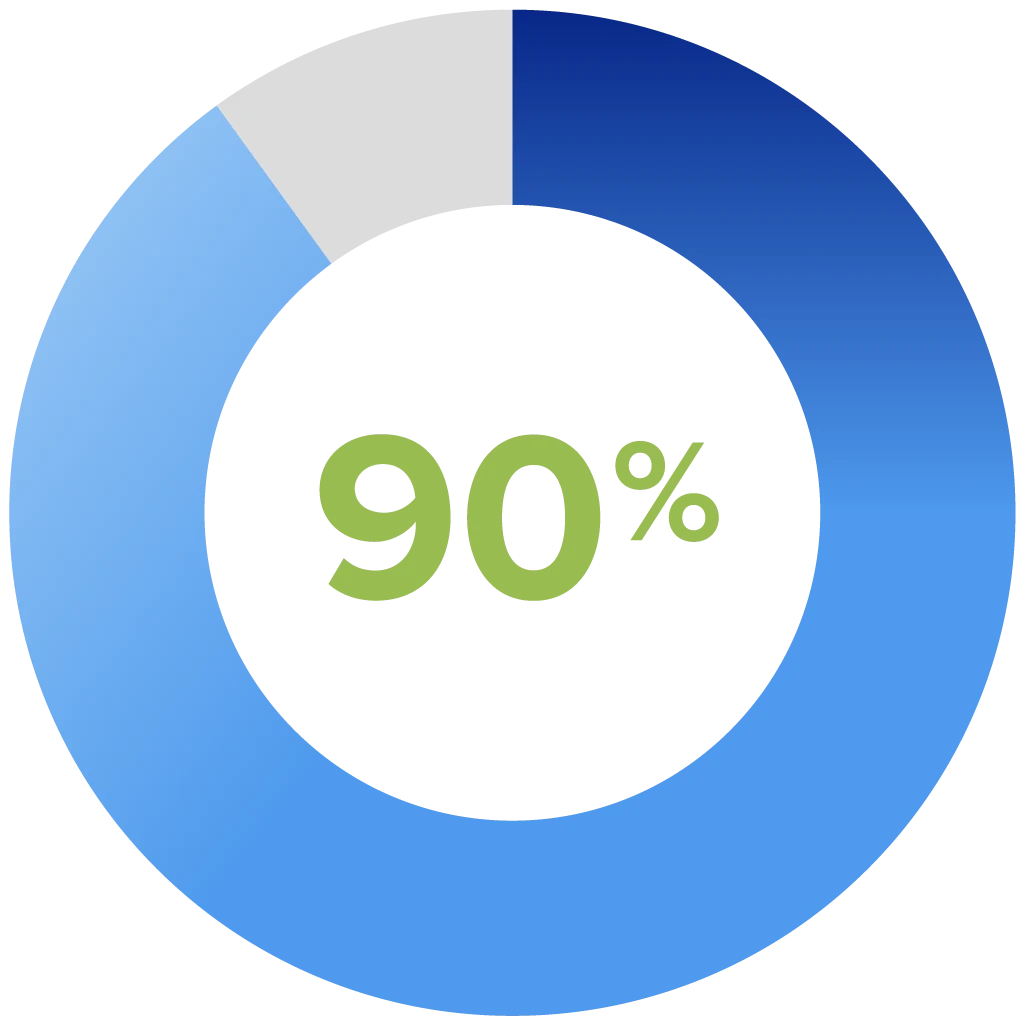

Increase Engagement

Objectives will be met

90% more often by

increasing team skills.

Build a culture of continuous learning that fosters intellectual curiosity and adaptive thinking.

Exam Preparation Courses That Make an Impact

Each Course Includes…

- An extensive collection of unique test bank questions covering foundational concepts

- Engaging video lessons presented by leading accounting and finance instructors

- Detailed performance reporting accessible on individual candidate and cohort levels

- Customizable digital learning tools like My Notebook and our flashcard builder with spaced-repetition technology

- Dynamic study planner that builds custom prep schedules based on individual candidate needs

Future-Proof Your Firm by Upskilling your Workforce

Build a Sustainable Organization with Advanced Certification

Encouraging growth and providing clear pathways to advanced finance and accounting credentials helps address pipeline challenges, reduce expenses, and build loyalty among your workforce in an ever-changing labor market.

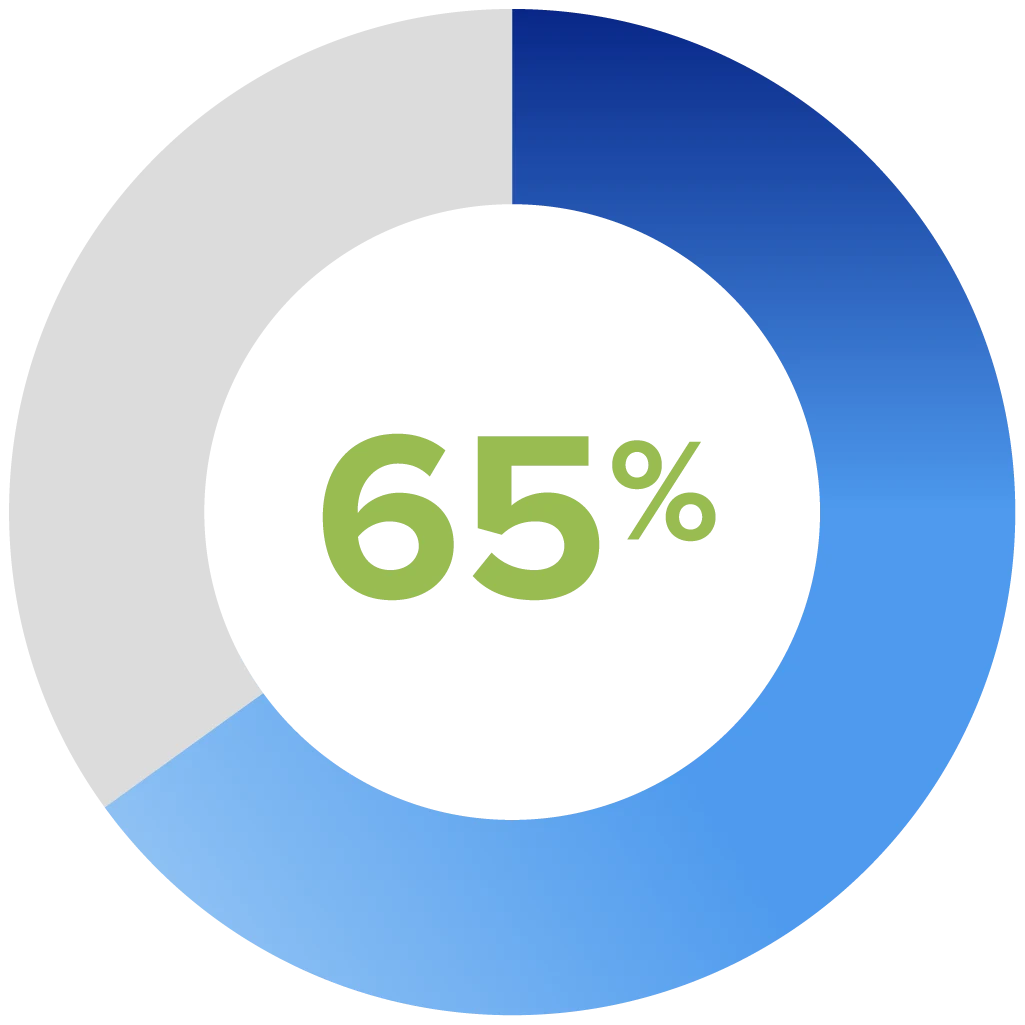

65% of global leaders cite “talent and leadership shortages” as their #1 business challenge.

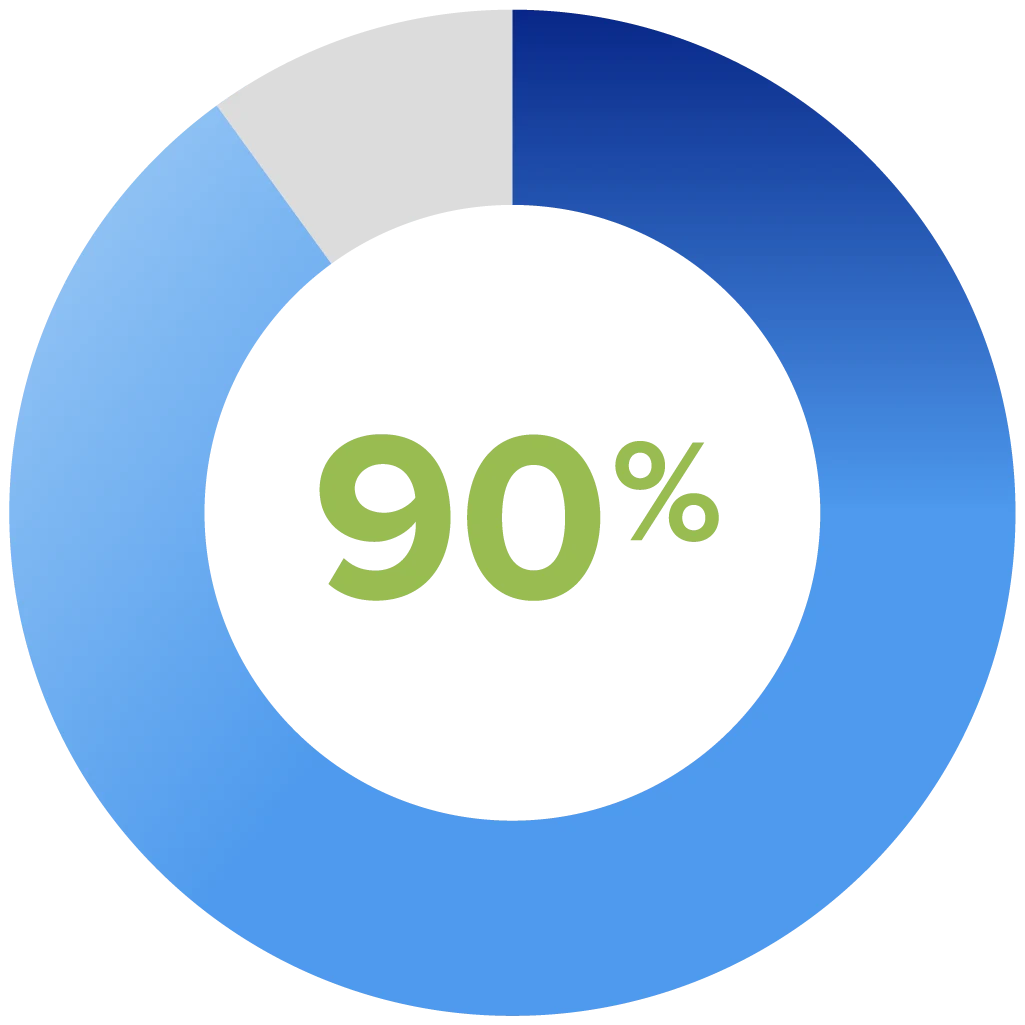

A full 90% of organizations do not have all the skills they need to be successful.

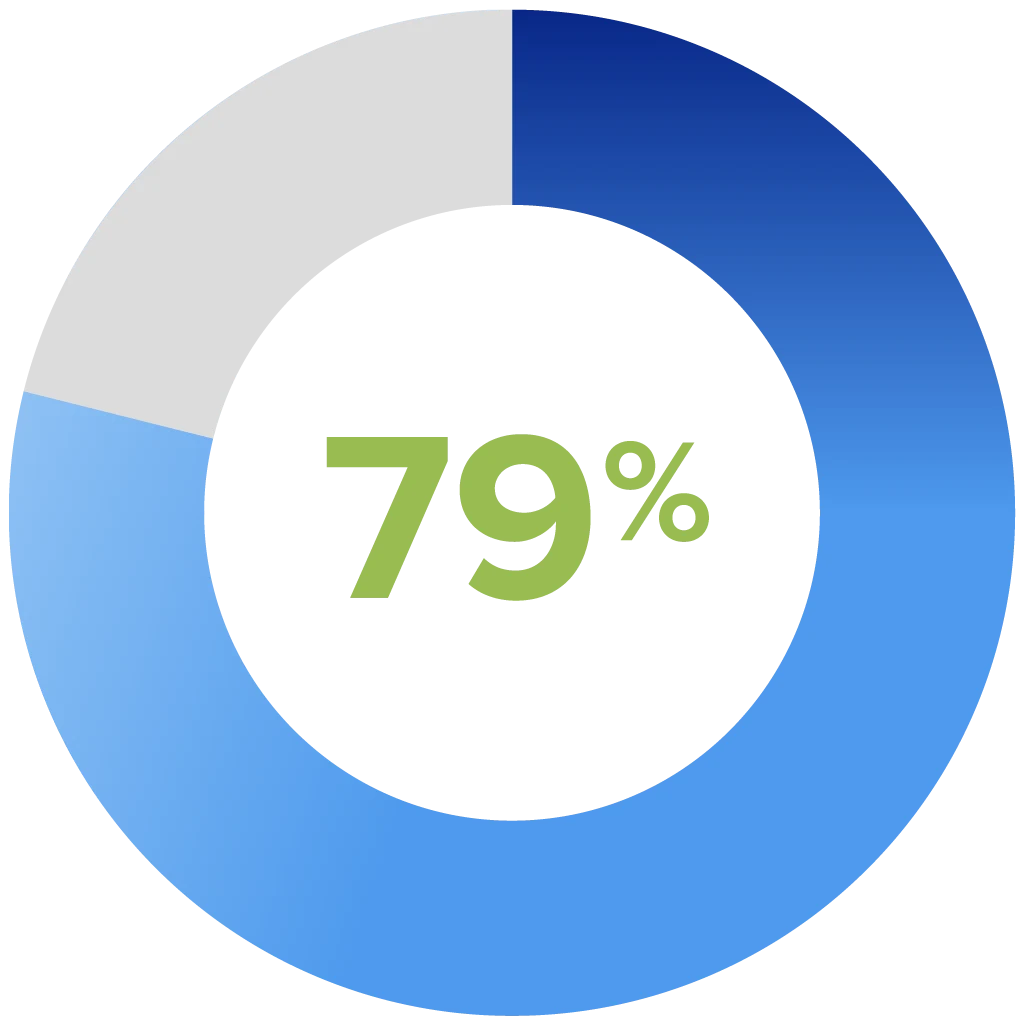

79% of L&D pros agree: it’s less expensive to reskill a current employee than to hire a new one.

Connect with a UWorld Representative Today

Explore Free Partnership Resources

Read about UWorld’s growth into a leading education technology company and our commitment to supporting learners throughout their careers. Discover how we partner with organizations like yours to deliver high-yield accounting and finance course content, certify candidates faster, and help address mounting pipeline challenges.

Download Now

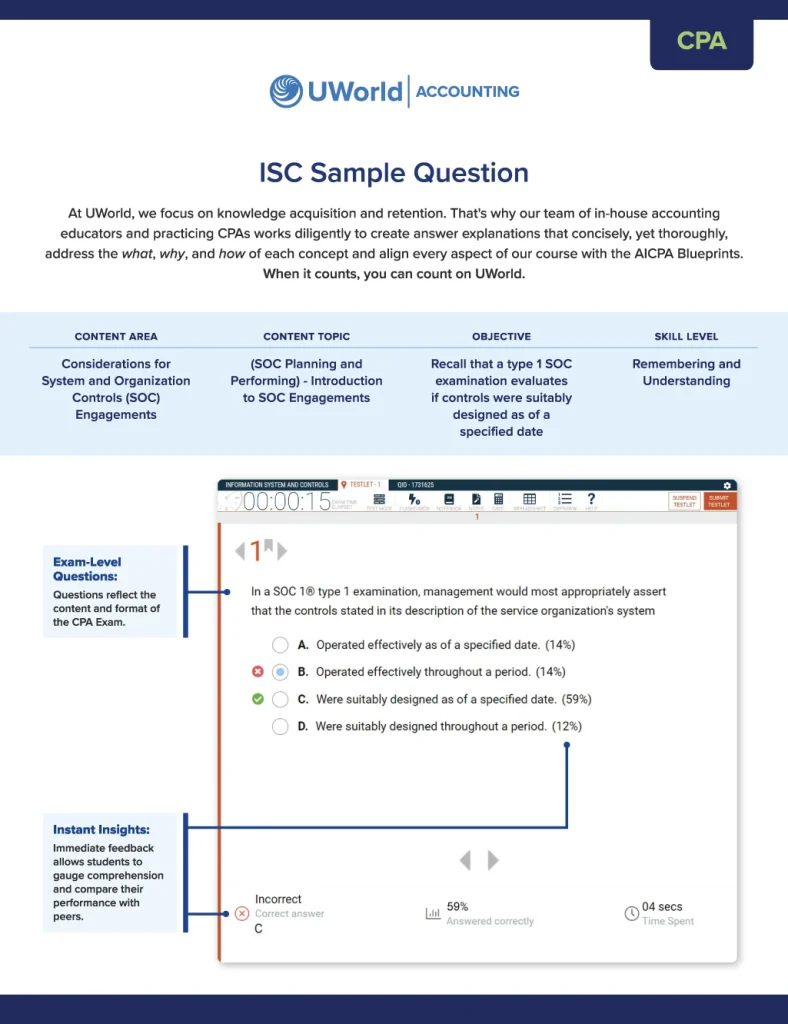

See why UWorld’s accounting licensure and certification exam practice questions boost candidates’ chances of passing. View sample questions from our CPA materials to discover how our questions offer industry-leading answer explanations and visuals to enhance understanding.

Download NowHere’s What Our Customers Are Saying…