UWorld AUD CPA Review Course

Focus on passing the AUD CPA Exam with engaging instructors, expertly crafted content, and the most thorough AUD practice questions and answer explanations available. Roger CPA Review and Wiley CPA Review have joined UWorld to deliver a proven path to success on the AUD section of the CPA Exam.

No Credit Card Required

Pass Rate

AUD CPA Review Courses, Created for You

Our AUD CPA Review course packages are designed to meet your unique needs. Whether you're looking to supplement another review course with high-quality material or a more comprehensive package with unlimited access, we have you covered.

Unlimited Access

AUD+

$

$

6-Month Access

AUD

$

$

Print + eBook

eBook Only

6-Month Access

AUD CPA Review Courses, Created for You

Our AUD CPA Review course packages are designed to meet your unique needs. Whether you're looking to supplement another review course with high-quality material or a more comprehensive package with unlimited access, we have you covered.

Unlimited Access

$

Study only the material that counts with an AUD course perfectly mapped to the latest CPA Exam Blueprints. You’ll have everything you need to know for exam day success.

Our comprehensive QBank includes all the MCQs and TBSs you need to pass the AUD section of the CPA Exam with clear, concise answer explanations.

|

Print + eBook |

Get the motivation you need to pass your AUD Exam with video lectures from the industry’s most dynamic instructors.

Sharpen your skills, stamina, and time management with unlimited full-length practice exams and fully customizable quizzes. Target your weakest areas by creating quizzes down to the sub-topic level, so you focus where it matters most.

Create a personalized study plan by entering your exam date and available study hours. Choose from three options — a set plan with full AUD coverage, a flexible plan that lets you customize key elements, or an entirely customized schedule built from scratch.

Identify your strengths and areas needing improvement with detailed performance tracking by topic.

Study on the go with mobile app access to all your CPA course materials. Available on Android and Apple.

Create unlimited digital flashcards or use pre-curated ReadyDecks to review concepts. Spaced-repetition technology adjusts frequency based on your mastery.flashcards by difficulty and spaced-repetition technology to adjust how often you see cards based on your proficiency.

Use strategic, guided videos to tackle any TBS variation on the CPA Exam.

Copy text and graphics from CPA study material, personalize the content, and review it on the go across devices with My Notebook.

Optimize your study time in the crucial lead-up to exam day with final review videos that cover the most testable topics in the core sections.

Experience the exam before exam day — identical interface, format, difficulty, timing, and topic weighting, all with brand-new questions not seen before in the course. Includes 2 full AUD section mock exams.

Get unlimited course access until you pass — including free online updates through our StudyPass™ Program.

6-Month Access

$

Study only the material that counts with an AUD course perfectly mapped to the latest CPA Exam Blueprints. You’ll have everything you need to know for exam day success.

Our comprehensive QBank includes all the MCQs and TBSs you need to pass the AUD section of the CPA Exam with clear, concise answer explanations.

|

eBook Only |

Get the motivation you need to pass your AUD Exam with video lectures from the industry’s most dynamic instructors.

Sharpen your skills, stamina, and time management with unlimited full-length practice exams and fully customizable quizzes. Target your weakest areas by creating quizzes down to the sub-topic level, so you focus where it matters most.

Create a personalized study plan by entering your exam date and available study hours. Choose from three options — a set plan with full AUD coverage, a flexible plan that lets you customize key elements, or an entirely customized schedule built from scratch.

Identify your strengths and areas needing improvement with detailed performance tracking by topic.

Study on the go with mobile app access to all your CPA course materials. Available on Android and Apple.

Create unlimited digital flashcards or use pre-curated ReadyDecks to review concepts. Spaced-repetition technology adjusts frequency based on your mastery.flashcards by difficulty and spaced-repetition technology to adjust how often you see cards based on your proficiency.

Use strategic, guided videos to tackle any TBS variation on the CPA Exam.

Copy text and graphics from CPA study material, personalize the content, and review it on the go across devices with My Notebook.

Optimize your study time in the crucial lead-up to exam day with final review videos that cover the most testable topics in the core sections.

|

6-Month Access |

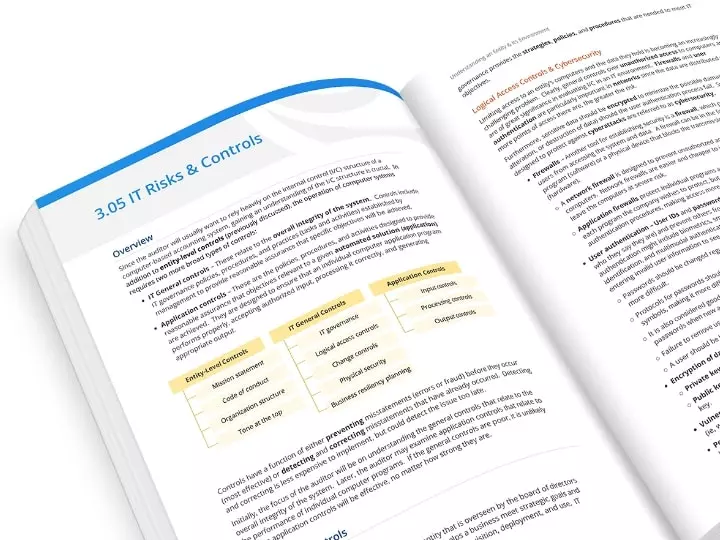

AUD CPA Review Practice Questions with Visual Learning

Developed by professional CPAs and accounting educators, our high-quality AUD CPA Exam Review questions and thorough answer explanations include vibrant images, flowcharts, and tables, so you can understand the what, why, and how behind each concept.

Not Satisfied With Your “Other” CPA Course?

We’re here to help! If you have purchased another CPA Review program and are dissatisfied with your results, you may qualify for a FreshStart Discount on our most comprehensive course package.

See If You QualifyWhat our students think about UWorld CPA Review

Frequently Asked Questions

What is included in UWorld’s CPA AUD Exam Course content?

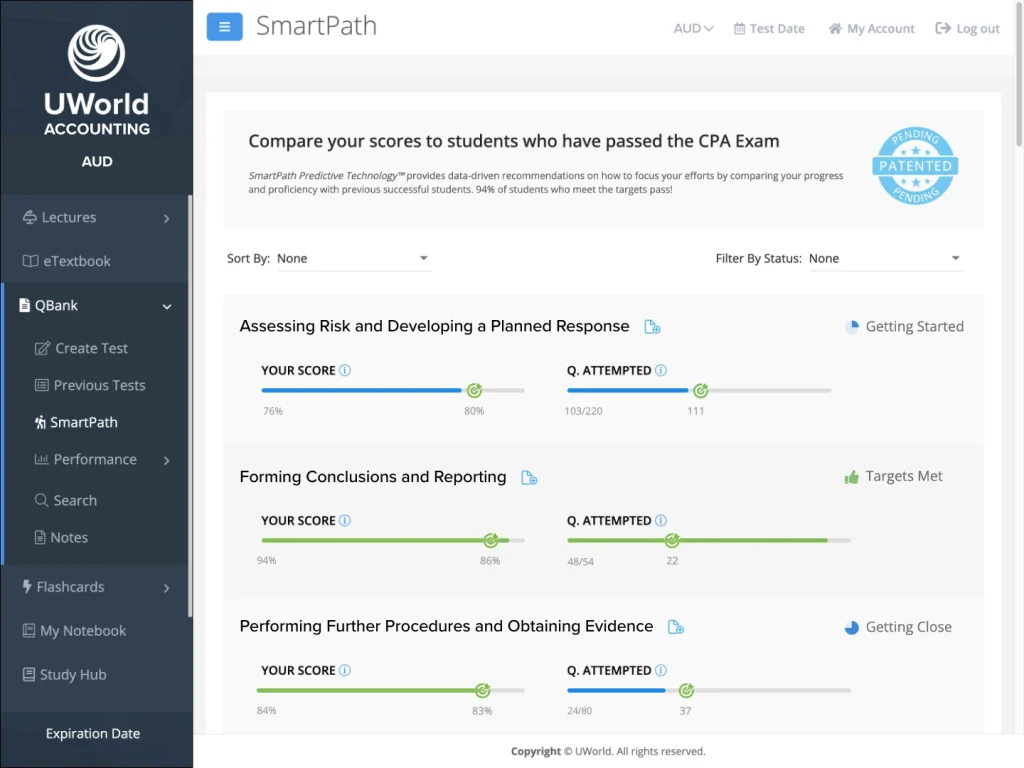

The UWorld AUD CPA Review Course comes with exactly what you need to pass the AUD CPA Exam, including high-quality MCQs and TBSs, mapped to the AICPA blueprints, engaging and effective lectures, SmartPath Predictive Technology™; customizable study planners; and innovative learning materials.

Does UWorld CPA Review offer unlimited access?

Yes! Our AUD+ package includes StudyPassTM with unlimited access until you pass your exam. This means that your online course will be active, up-to-date, and uninterrupted for a period of three years from your purchase date to allow you to pass all sections of the CPA Exam. If you continue to need access beyond three years, you may request a course extension and provide proof of your upcoming CPA Exam registration date. Your access will be extended through your exam date.

Does UWorld CPA Review expire?

Is UWorld’s CPA AUD Review Course updated for the latest exam content?

The UWorld CPA AUD Review is updated regularly to align with the latest AICPA blueprints. You can trust that the content and practice materials are relevant and up-to-date for the current exam cycle.

Are there practice exams available in UWorld’s AUD CPA Review Course?

Yes, the UWorld AUD CPA Review course offers full-length practice exams that closely replicate the actual AUD CPA exam. These exams help you gauge your readiness and improve your time management skills.

Can I access UWorld’s AUD CPA Review Course on multiple devices?

Absolutely. UWorld CPA Review comes with a fully-featured mobile app that syncs across devices, allowing you to study seamlessly on your preferred platforms.

How can UWorld help me succeed on the AUD CPA Exam?

The UWorld AUD CPA Review equips you with the knowledge, practice, and tools needed to master accounting concepts and effectively communicate about business operations. With expert guidance and comprehensive resources, you’ll increase your chances of success on the AUD section of the CPA exam.

What topics are covered in the AUD CPA Exam course?

The UWorld AUD CPA Review course covers all major topic areas outlined in the AICPA blueprint, including ethics, professional responsibilities, audit procedures, internal controls, risk assessment, and reporting. Each topic is reinforced with detailed explanations and guided learning strategies.

How many practice questions are included in the AUD CPA course?

The course includes hundreds of MCQs and task-based simulations tailored to the AUD section. These questions are regularly updated and aligned with the most current exam content.

Are there video lectures specific to the AUD section?

Yes. UWorld’s video lectures for AUD are led by expert instructors like Roger Philipp and others. Each video is focused on core AUD topics and designed to make complex concepts easier to understand.

Can I purchase the AUD CPA Review Course as a standalone product?

Yes. UWorld offers the option to purchase the AUD course individually, ideal for students retaking the section or focusing on one part of the CPA Exam at a time.

Who is the AUD CPA Review course best suited for?

This course is ideal for students who prefer a structured and visual learning experience, and for those who need to strengthen their audit knowledge. It’s especially useful for candidates who benefit from clear explanations, guided study plans, and a performance-tracking system.

Does the course include exam-day strategies for the AUD section?

Yes. UWorld CPA Review integrates tips, time management guidance, and test-taking strategies to help students navigate the format and pressure of the actual AUD exam.

*UWorld candidates who meet SmartPathTM performance benchmarks achieve an impressive 90% average pass rate across all sections of the CPA Exam — a figure that substantially exceeds the national average. Learn more.