Which of the following would be required to register for a Preparer Tax Identification Number (PTIN)?

Below is the code for an example image modal link

Flashcards

/* -- Un-comment the code below to show all parts of question -- */

| A. A CPA preparing returns in exchange for services but receiving no monetary compensation. | ||

| B. A CPA preparing returns for family and friends for no charge. | ||

| C. A CPA preparing a return for an entity as an employee of that entity. | ||

| D. A CPA's assistant who enters taxpayer data into an electronic tax return preparation system. |

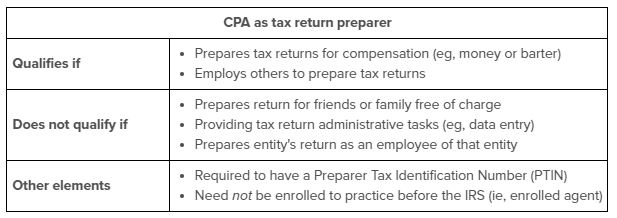

A tax return preparer includes anyone (eg, a CPA) who prepares for compensation, or who employs one or more persons to prepare, all or a substantial portion of any tax return or claim for refund. The compensation can be either explicit (ie, for money) or implicit (ie, barter). A CPA is not classified as a tax return preparer if the CPA prepares a tax return for a family member or friend free of charge (Choice B).

Anyone who qualifies as a tax return preparer must obtain a Preparer Tax Identification Number (PTIN). The PTIN is a nine-digit number that must be used on all the tax returns and claims for refund prepared by the CPA. The PTIN must be renewed annually.

(Choice C) IRS rules specifically exempt from the definition of tax return preparer those employees who, as part of their job, prepare their employer's tax return.

(Choice D) Merely entering a taxpayer's data into an electronic tax return preparation system does not qualify a person as a tax return preparer.

Things to remember:

A tax return preparer includes anyone (eg, a CPA) who prepares for compensation, or who employs one or more persons to prepare, all or a substantial portion of any tax return or claim for refund. Tax return preparers must obtain a Preparer Tax Identification Number (PTIN) and include it on all tax returns and claims for refunds they prepare.

Lecture References :

- REG 1.01 : Ethics and responsibilities in tax practice: Regulations governing practice before the Internal Revenue Service