About the AUD Section of the CPA Exam

CPA Exam Basics

Your 1-stop-shop to CPA requirements, exam content & structure, plus tips to pass!

CPA Review » CPA Exam » About the AUD Section of the CPA Exam

The Auditing and Attestation (AUD) section of the CPA Exam covers the entire auditing process, including auditing procedures, generally accepted auditing standards, standards related to attest engagements, and the AICPA Code of Professional Conduct. The AUD CPA Exam is significantly different from other sections. It allows the candidate to assess a problem on their merit and suggest a solution based on their judgment.

What Is the Format of the AUD Exam?

The AUD exam consists of five testlets: two multiple-choice questions (MCQs) testlets, and three task-based simulations (TBSs) testlets. The MCQ component of the AUD exam accounts for 50% of your CPA Exam score, while the TBS portion accounts for the remaining 50%.

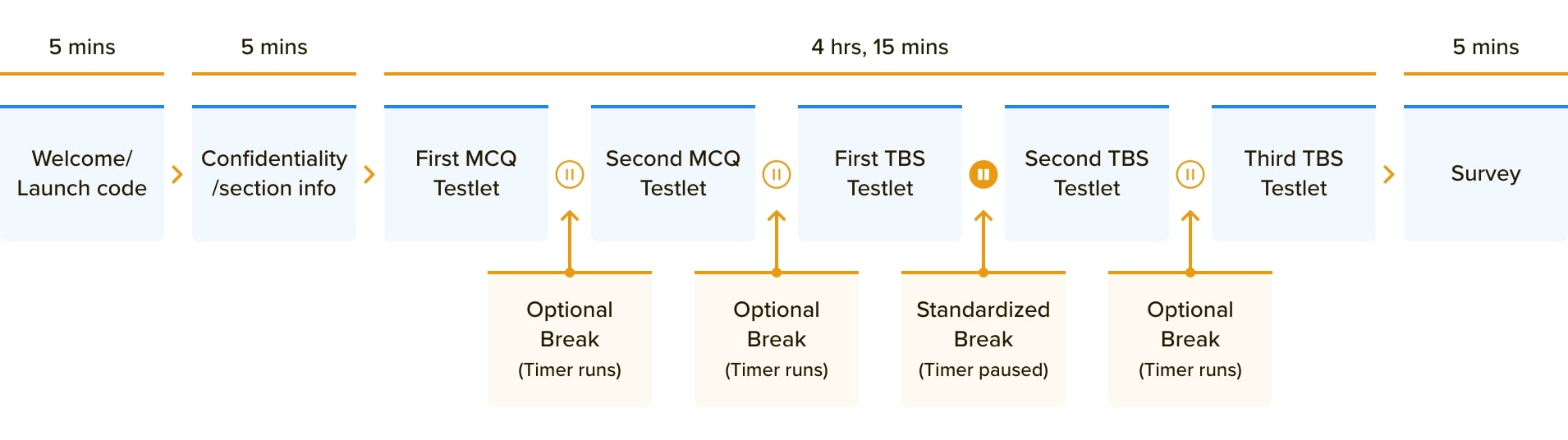

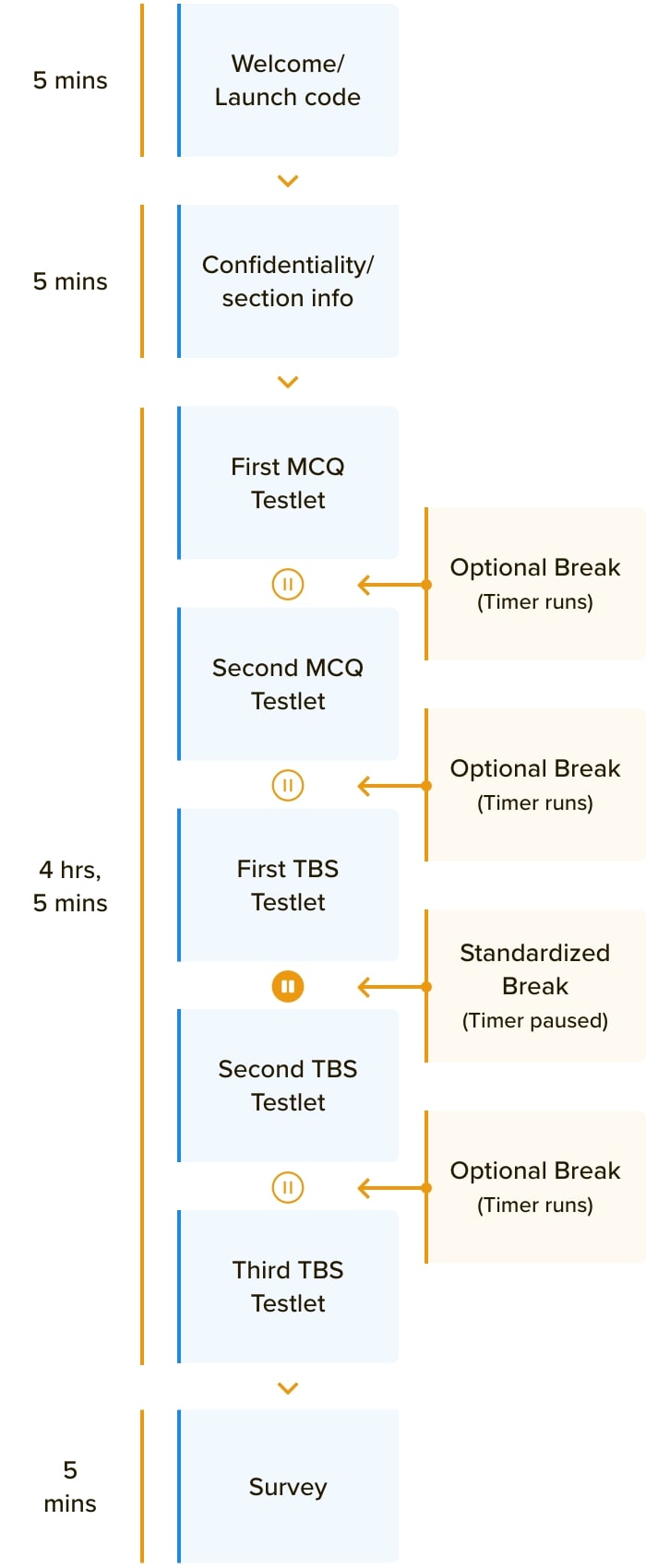

Pre-Exam

Before you start your exam, there is a welcome or launch screen that appears for 5 minutes. Next, a confidentiality screen follows, which flashes for another 5 minutes. Your pre-exam screen will last for a total of 10 minutes.

Exam

The exam is organized into 5 testlets. There are two question types on the AUD exam, and each testlet contains questions from only one of these question types:

- Multiple-Choice Questions (MCQ) - One question with four potential answers.

- Task-Based Simulations - Questions that require you to apply practical knowledge. This could include filling out a document or finishing a research question.

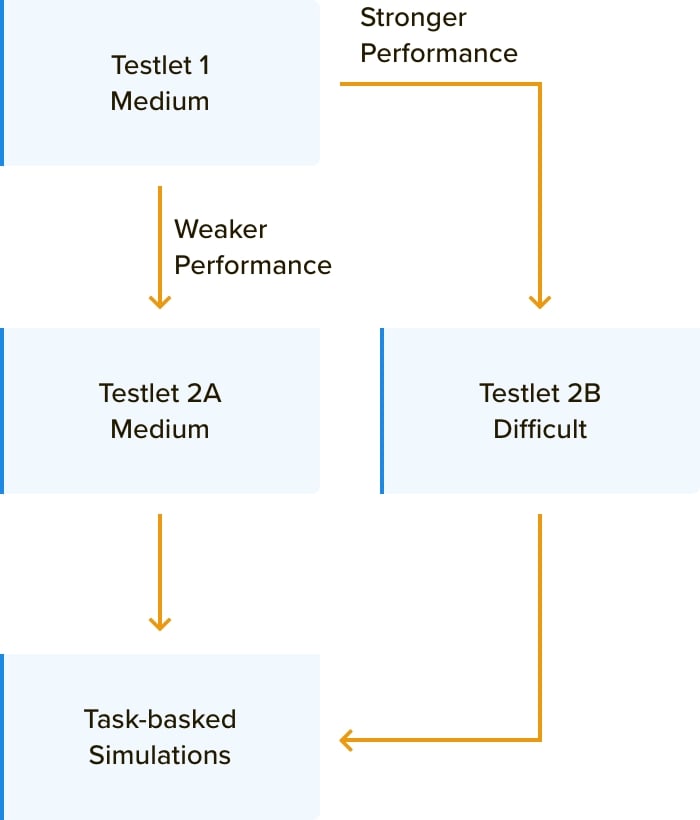

The AUD exam starts with 2 MCQ testlets that contain 36 questions in each testlet. For the multi-stage testing purpose, the first testlet is usually of moderate difficulty to analyze your content knowledge in the exam. If you do well on the first testlet, the next testlet is a little more difficult. On the contrary, if your performance is poor on the first testlet, you will get an easier testlet next.

Once the MCQ testlets are finished, the third testlet you will receive contains task-based simulations. Here the multi-stage testing process is not applied. When you are done with the third testlet, you are allowed to take a 15-minute break that does not count towards the 4-hour test period.

Afterwards, you will have to finish two more task-based simulation testlets for the AUD exam. There are no Written Communication (WC) questions on the AUD Exam.

Post Exam

Once you are done with the exam, a post-exam survey screen will appear for five minutes regarding the experience you had during the exam. It is done to understand the candidate’s perspective about the exam.

Allocated Time

The exam begins with a launch code or welcome screen, which appears for 5 minutes.. It takes a total of 10 minutes before the actual exam starts. The AUD exam is a four-hour long exam. You are allowed to take a 15-minute break between the first and second TBS testlet.

In addition, there are two optional breaks available for candidates. One is right after the first MCQ testlet and the second one is after the next MCQ testlet. However, these two breaks are not excluded from the total time duration of the exam. The exam timer continues to run during these two optional breaks.

Also, candidates have the liberty to finish the exam early and not be penalized for it.

Optimal Time Management for the AUD Exam

| Testlet | Question Type | Suggested Time |

|---|---|---|

| Testlet 1 | 36 MCQ | 45 Minutes |

| Testlet 2 | 36 MCQ | 45 Minutes |

| Testlet 3 | 2 TBS | 36 Minutes |

| 15 minute break (does not count toward total exam time) | ||

| Testlet 4 | 3 TBS | 54 Minutes |

| Testlet 5 | 3 TBS | 54 Minutes |

| Extra Time | 6 minutes | |

| Total Time | 240 minutes | |

Content Areas in the AUD Exam

The AUD Exam has a total of five content areas. It has the most unique content and vastly covers the auditing and attestation portion. Auditing requires a high amount of evaluation skills unlike the other sections of the CPA Exam. Let’s have a look at the topics covered in each content area.

- Nature and Scope of Audit and Non-Audit Engagements

- Ethics, Independence, and Professional Conduct

- Terms of Engagement for Audit and Non-Audit Engagements

- Requirements for Engagements Documentation

- Communication with Management and Those Charged with Governance

- Communication with Component Auditors and Parties Other Than Management and Those Charged with Governance

- A Firm’s System of Quality Control, Including Quality Control at the Engagement Level

- Planning an Engagement

- Understanding an Entity and Its Environment

- Understanding an Entity’s Internal Control

- Assessing Risks Due to Fraud

- Identifying and Assessing the Risk of Material Misstatement and Planning Further Procedures Responsive to Identified Risks

- Materiality

- Planning for and using the Work of Others, Including Group Audits, the Internal Audit Function and the Work of a Specialist

- Specific Areas of Audit Risk

- Understanding Sufficient Appropriate Audit Evidence

- Sampling Techniques

- Performing Specific Procedures to Obtain Evidence

- Specific Matters that Require Individual Attention

- Misstatements and Internal Control Deficiencies

- Written Representations

- Subsequent Events and Subsequently Discovered Facts

- Reports On Auditing Engagements

- Reports On Attestation Engagements

- Accounting and Review Service Engagements

- Reporting On Compliance

- Other Reporting Considerations

What Skills Are Tested On the AUD Exam?

The skills required for the AUD exam are remembering & understanding, application, analysis, and evaluation.

It's important to remember that the AUD exam tests how well a CPA candidate applies their audit and attestation knowledge when solving problems and performing specific tasks laid out in the AICPA Blueprints; not how well they are able to memorize auditing concepts. These are considered the primary skills required for auditing professionals. While judging a situation and performing the auditing and attestation, the candidate needs to be ethical and accurate.

is the observation and understanding of the significance of an area utilizing knowledge gained.

is the use or exhibition of knowledge, concepts,

or techniques.

is the investigation of the interrelationships of separate areas to identify causes and find confirmation to support implications

is the assessment of problems and the use of personal judgment to derive conclusions.

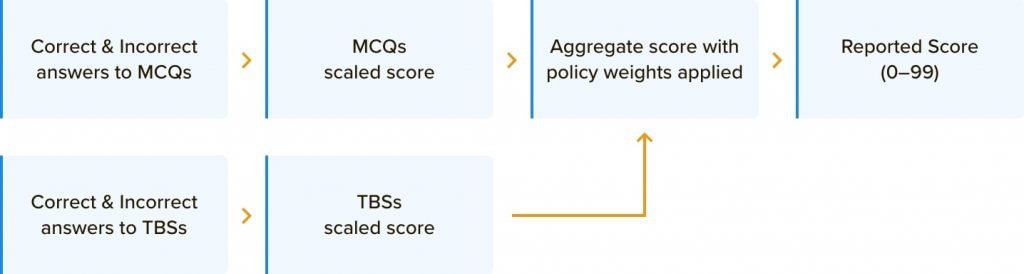

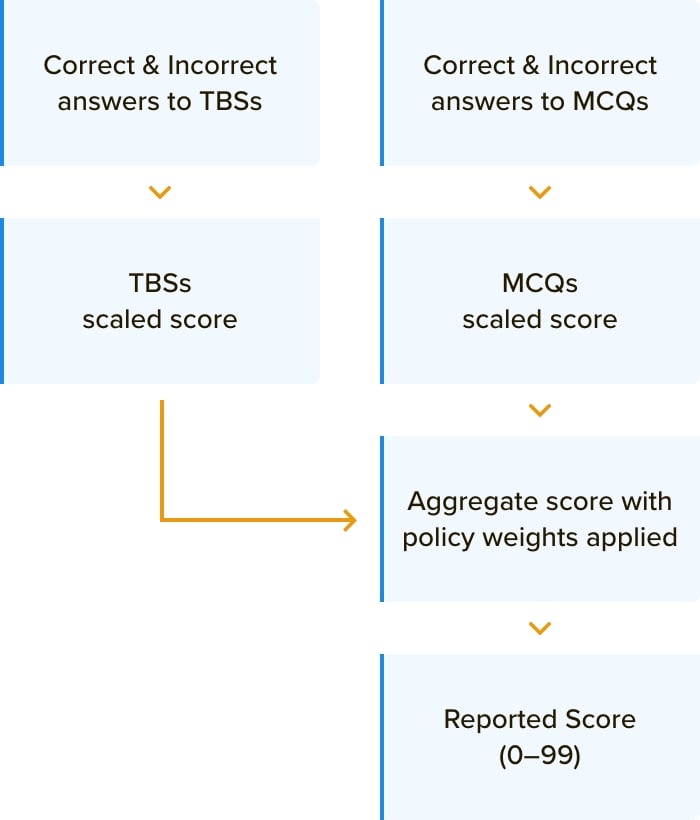

How is the AUD Exam Scored and Graded?

Scores for the AUD exam are given on a scale of 0 to 99 and a score of 75 to pass. In the AUD exam, 60 out of the 72 MCQ questions from the first two testlets are operational. The rest of the 12 questions are pretested, which means they are not graded. The presented questions are only given for data collecting purposes.

The AUD Exam has a total of 8 TBS, among which 1 TBS is pretested. The TBS questions typically have two tabs that are information and work. The information TBS revolves around resources, directions, and authoritative literature that helps in solving the simulation, and the work tab is the gradable response.

The scoring is done based on the difficulty level of the question. Not every question has the same numeric value. The harder the question, the higher the numeric value. Thus, if you answer 5 easy questions and 3 difficult questions correctly, the score of the difficult question would be higher than the easy one.

By default, the first AUD CPA Exam MCQ testlet is set to medium difficulty. The difficulty level of the subsequent MCQ testlet is decided by the candidate's performance on the first AUD testlet. As a result, the applicant will be presented with one of the MCQ testlet difficulty sequences below:

- The level of difficulty varies from medium to difficult (candidate performed well on first testlet)

- Moderate - Moderate (candidate did not perform well on first testlet)

The TBS testlets in the AUD Exam are pre-selected and have no influence on the candidate's performance on prior MCQ testlets, nor do the TBSs within the TBS testlets follow the previous TBS.

Non-research based TBSs receive partial credit while MCQs can be answered correctly or wrongly. Research based TBSs are graded as correct to incorrect, with no partial credit.

AUD Exam Pass Rates

The AUD section of the CPA Exam is mostly theory-based. Candidates often express that the questions are confusing. The reason for this could be the fact that many questions can seemingly appear to have more than one correct answer. In 2021, AUD had the second-lowest pass rate among the four sections of the CPA exam. Here’s a look at the AUD Exam pass rates over the years:

How to Study for the AUD Exam Section

Develop a Study Plan

Having a study plan for the AUD Exam is a great way to start. Since the AUD section has five content areas, make a study plan that covers all the areas. Allocate a timetable to complete each area and maintain a routine.

Know the Audit Opinion Letters by Heart

The audit opinion letters are an essential part of the AUD Exam. A load of questions come from the opinion letter and the concepts covered in it. It is advisable to memorize the letter word by word.

Practice MCQ

As you already know, there are two MCQ testlets on the AUD Exam. Make sure that you have a CPA review course that offers several MCQ practice sessions. Consistently practicing MCQ will enhance your knowledge base and boost your confidence.

Learn Internal Control

The AUD Exam is filled with internal control questions. There are five primary components of the internal control framework: control environment, control activities, risk assessment, information and communication, and monitoring. Expand your knowledge and understanding of them thoroughly.

Audit Sampling

In Audit Sampling, there are two main subsections. One subsection is Attribute Sampling and the other subsection is Variable Sampling. Both sampling techniques are frequently tested, and knowing the basics of each sampling technique is one way to collect easy points on the CPA Exam.

AUD CPA Exam Study Tips

- Memorize the study materials with proper context.

- Take practice exams and analyze your weaknesses.

- Follow up on weak areas until you understand them.

- Practice time management for each testlet so that you can finish the exam on time.

- Try creating a CPA audit exam review sheet.

- Go through a past years’ AUD questionnaire.

- Make a study plan and stick to it. Consistently following the plan will help you complete your study material quickly.

FAQs

How Hard is the AUD Exam?

When Should I Take the AUD Exam?

Can I Study for the AUD Exam in a Month?

What Should I Focus on for the AUD Exam?

What is Tested on the AUD Exam?

I Don’t Have Any Auditing Experience. Am I at a disadvantage?

Do I have to Choose a Career in Audit or Tax?

Other CPA Exam Section Pages

BEC CPA ExamFind out the format and structure of the BEC Exam and how to prepare for it.

FAR CPA Exam

FAR is considered to be the toughest CPA Exam section. Learn how you can pass FAR quickly and easily the first time.

REG CPA Exam

Wondering what to expect on the REG Exam? Get to know the REG section in detail here.

CPA Exam Resources

UWorld Roger CPA Review provides CPA candidates with all the study materials and resources needed to prepare and successfully pass the US Uniform CPA Exam online.