About the FAR CPA Exam

Updated for 2024-2025

Free eBook:

CPA Exam Basics

CPA Review » CPA Exam » FAR CPA Exam

What will it take to pass the FAR CPA Exam in 2024-2025? The Financial Accounting and Reporting (FAR) section intimidates almost every CPA candidate. It's the longest, most challenging, and highly comprehensive section of the CPA Exam. FAR requires CPA candidates to understand US GAAP, including financial statement concepts and standards, typical financial statement items, specific types of transactions and events, governmental accounting and reporting, and nongovernmental and not-for-profit accounting and reporting.

Commencing in 2024, the format and structure of the FAR CPA Exam have undergone some changes due to the 2024 CPA Evolution. Nonetheless, the fundamental essence of the exam remains the same. In this article, we'll comprehensively understand the changes introduced in the 2024 FAR CPA Exam and offer valuable study tips to navigate them successfully for exam triumph.

What is The 2024 FAR CPA Exam Format and Structure?

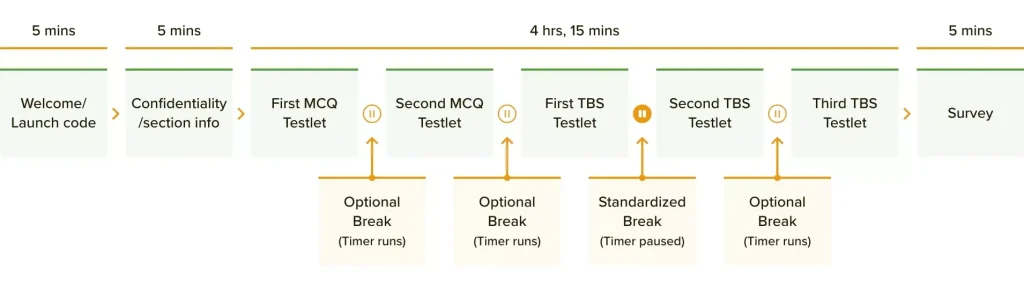

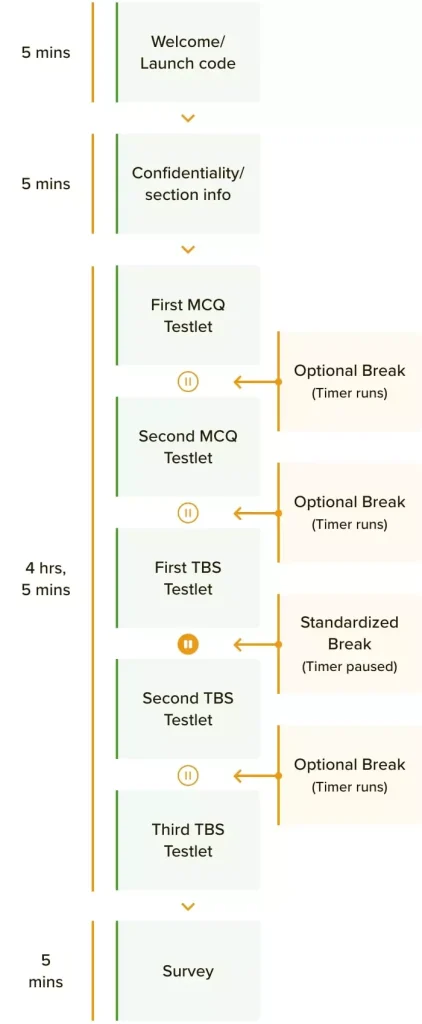

Despite the 2024 FAR CPA Exam changes, the format and structure are similar to those of previous years. For example, the exam duration is four hours with five testlets and two types of questions: multiple choice and task-based simulations.

The MCQ section has two testlets, each containing 25 questions, for a total of 50 questions. The TBS section consists of three testlets: the third testlet containing two TBS, the fourth testlet containing three TBS, and the fifth testlet containing two TBS. MCQs cover 50% of the score weight; the other 50% comes from the TBS section.

| FAR CPA Exam Structure | |

|---|---|

| Total Time | 4 Hours |

| Multiple Choice Questions | 50 |

| Task Based Simulations | 7 |

Pre Exam

A welcome or launch code flashes on your screen for 5 minutes before you begin the exam. After that, another screen presenting the confidentiality code remains for 5 minutes. Hence, there is a total of 10 minutes for your pre-exam screen.

Exam

The five testlets of the FAR CPA exam consist of two types of questions: Multiple Choice Questions and Task-Based Simulations.

- Multiple-Choice Questions (MCQ) – One question with four potential answers. MCQs make up 50% of the FAR exam.

- Task-Based Simulations (TBS) – Questions that require you to apply practical knowledge. This could include filling out a document or finishing a research question. The TBSs make up 50% of the FAR Exam.

Multiple Choice Questions: There are 50 MCQs divided equally into two testlets. Each testlet has a few pretest questions that aren’t graded. They are typically one sentence or a paragraph long and have four possible answer options.

Task-Based Simulations: TBSs are practical questions requiring candidates to type out answers. These may include research-based questions, completing a financial statement, filling out a form, or making journal entries. The TBSs are tested in 3 testlets containing 2 to 3 task-based simulation questions per testlet. There are 7 task-based simulations, among 1 of which is pretested.

An optional 15-minute break that does not count toward the 4-hour test period is provided after the 3rd testlet.

Post Exam

Post Exam, you will be prompted to complete a five-minute survey regarding your exam experience and acquire candidate feedback.

What Topics are Tested in the 2024 FAR CPA Exam?

- General-Purpose Financial Reporting: For-Profit Business Entities

- General-Purpose Financial Reporting: Nongovernmental Not-for-Profit Entities

- State and Local Government Concepts

- Public Company Reporting Topics

- Special Purpose Frameworks

- Financial Statement Ratios and Performance Metrics

- Cash and cash equivalents

- Trade receivables

- Inventory

- Property, plant and equipment

- Investments

- Intangible assets

- Payables and accrued liabilities

- Debt (financial liabilities)

- Equity

- Accounting changes and error corrections

- Contingencies and commitments

- Revenue recognition

- Accounting for income taxes

- Fair value measurements

- Lessee accounting

- Subsequent events

What Skills are Tested On the 2024 FAR Exam?

The FAR CPA Exam will continue to follow the upgraded Bloom’s Taxonomy of Educational Objectives regarding skills. Based on this, the skills tested on the CPA Exam are shown in the table below.

| Skill Allocation | Weight |

|---|---|

| Evaluation | – |

| Analysis | 35-45% |

| Application | 45-55% |

| Remembering & Understanding | 5-15% |

| Skill allocation | Weight |

|---|---|

| Evaluation | – |

| Analysis | 35-45% |

| Application | 45-55% |

| Remembering & Understanding | 5-15% |

How to Manage Your Time on the 2024 FAR CPA Exam?

Time management is essential for passing the CPA Exam. Here, we will discuss a few strategies that will help you maximize your time and improve your chances of passing the FAR Exam. We recommend that you adhere to the time management chart below to complete all your testlets on schedule.

| Testlet | Question Type | Suggested Time |

|---|---|---|

| Testlet 1 | 25 MCQ | 52 Minutes |

| Testlet 2 | 25 MCQ | 52 Minutes |

| Testlet 3 | 2 TBS | 36 Minutes |

| 15-minute break (does not count toward total exam time) | ||

| Testlet 4 | 3 TBS | 54 Minutes |

| Testlet 5 | 2 TBS | 36 Minutes |

| Extra Time | 10 Minutes | |

| Total Time | 240 Minutes | |

- There are 50 MCQs, combining the first two testlets. We suggest you allocate 2.08 minutes for each MCQ. Hence, it will take 52 minutes each to complete the MCQ testlets.

- The remaining three testlets contain 7 TBSs in total. Our experts recommend allocating 18 minutes for each TBS. With this strategy, you can finish the 3rd testlet within 36 minutes as it has only two TBSs, the next testlet in 54 minutes, and 36 minutes for the last testlet.

- A standard 15-minute break is allowed only after the third testlet, during which the timer is paused.

- In addition, there are two more optional breaks as well. These optional breaks are not excluded from the total duration of your exam, so the timer continues to run during these optional breaks.

What is The 2023 FAR CPA Exam Format and Structure?

There are five testlets in the FAR CPA Exam Format: two testlets consisting of multiple-choice questions (MCQs) and three testlets consisting of task-based simulations (TBSs). The MCQ component of FAR accounts for 50% of the exam score, while the TBS segment accounts for the remaining 50%.

What Topics are Tested in the 2023 FAR CPA Exam?

Like the other three parts of the CPA Exam, the FAR section’s substance is unique. It covers the financial accounting aspect of the profession. FAR questions are based on four content areas, which are mentioned below with percentages detailing how much each concept is tested on the exam:

- Conceptual framework and standard-setting

- General-purpose financial statements: for-profit business entities

- General-purpose financial statements: nongovernmental, not-for-profit entities

- Public company reporting topics

- Financial statements of employee benefit plans

- Special purpose frameworks

- Cash and cash equivalents

- Trade receivables

- Inventory

- Property, plant and equipment

- Investments

- Intangible assets

- Payables and accrued liabilities

- Long-term debt

- Equity

- Revenue recognition

- Compensation and benefits

- Income Taxes

- Accounting changes and error corrections

- Business combinations

- Contingencies and commitments

- Derivatives and hedge accounting

- Foreign currency transactions and translation

- Leases

- Nonreciprocal transfers

- Research and development costs

- Software costs

- Subsequent events

- Fair value measurements

- Differences between IFRS and U.S. GAAP

- State and local government concepts

- Format and content of the Comprehensive Annual Financial Report (CAFR)

- Deriving government-wide financial statements and reconciliation requirements

- Typical items and specific types of transactions and events in governmental entity financial statements

What Skills are Tested On the 2023 FAR Exam?

The skills required for the FAR CPA Exam are divided between remembering & understanding, application, and analysis.

Remembering and understanding is the process of observing and comprehending the significance of an area utilizing the acquired knowledge.

Application means the usage or display of the acquired knowledge, concepts, and techniques.

Analysis is the investigation of the interrelationships between different areas to uncover causes and find confirmation to support conclusions.

Evaluation is the assessment of a situation using judgments to reach a conclusion.

| Skill allocation | Weight |

|---|---|

| Evaluation | – |

| Analysis | 25-35% |

| Application | 50-60% |

| Remembering and Understanding | 10-20% |

How is the FAR CPA Exam Scored?

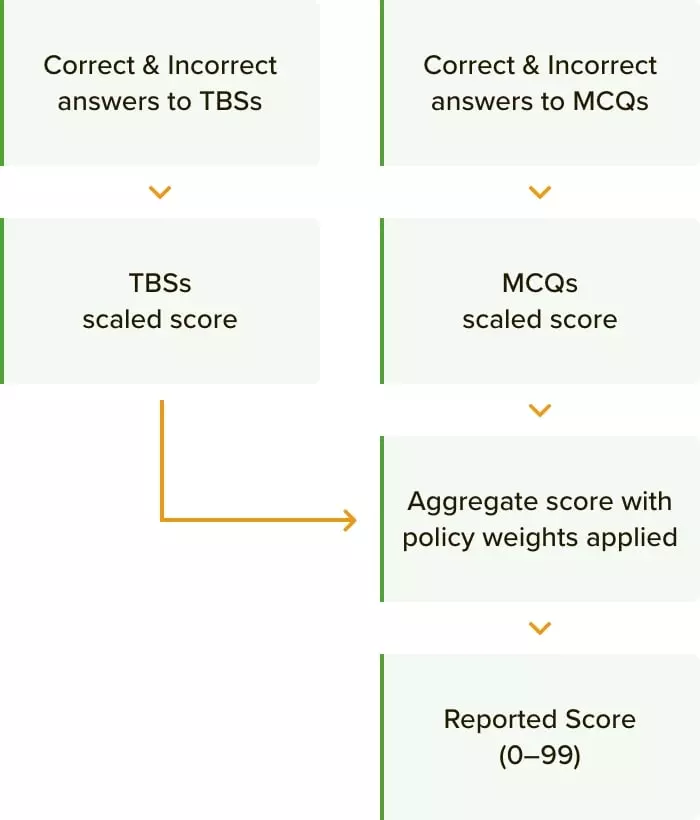

Scores for the FAR Exam are given on a scale of 0 to 99. All CPA Exam parts must be passed with a score of 75 or higher. It does not necessarily imply that you must answer 75% of the questions correctly. The difficulty level determines the numeric value of a question. It means difficult questions have more worth than easy or moderate questions. If you answer five difficult questions and five moderate or easy questions correctly, you will score more for the difficult questions.

The CPA Exam is not curved. The AICPA employs question weights instead of altering your score based on your cohort's performance. These weights are determined based on how candidates performed during the pre-testing of the questions.

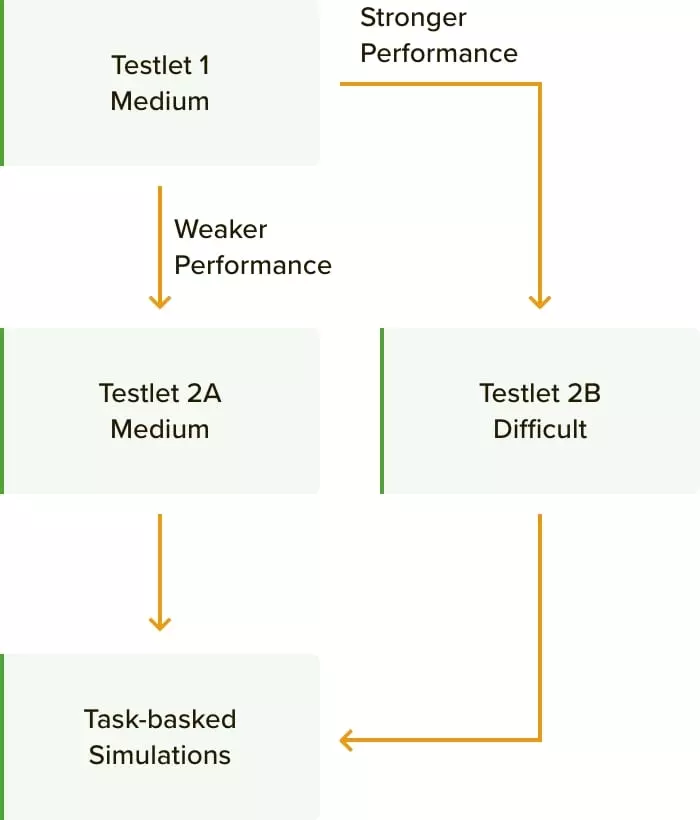

The FAR CPA Exam's MCQ testlets account for half the overall score. The remaining 50% comes from the TBS testlets. Multistage adaptive testing (MST) is eliminated and replaced with a linear test design to simplify the assembly of the CPA Exam and provide greater flexibility in the exam alignment.

The TBS scores are pre-programmed and are not modified based on the candidate's performance. Partial scoring is also applied for TBSs as they include multiple responses. You are eligible to earn credit for each accurate solution. The multistage testing method is only applicable for MCQ testlets.

FAR CPA Exam Pass Rates

Financial Accounting and Reporting is a broad section covering financial management, government accounting, fund accounting, and other topics. According to the candidates we surveyed, it is the most challenging section of the CPA Exam. It has had the lowest passing rate among the four sections for a long time. The year 2023 was no different, with a cumulative pass rate of 42.94%. It is most likely due to the vast amount of material that FAR covers and the necessity to comprehend the concepts rather than simply memorize them.

*Pass rates available till 2023 Q3.

How to Study for the FAR CPA Exam Section

Many candidates are intimidated by the FAR Exam content before they even begin studying. When studying for FAR, you must realize the importance of segmenting easy topics from the more difficult ones, and allocating study time accordingly. For example, dedicate plenty of study time to topics that are more difficult to understand, such as pensions, and dedicate less study time to topics that you already have a firm grasp on.

Analyze the Study Material

Watch Lectures

Work on Multiple-Choice Questions

Manage Time

Focus on Governmental, NGO, and Non-Profit Accounting

Analyze the Study Material

Watch Lectures

Work on Multiple-Choice Questions

Manage Time

Use a timer to practice FAR quizzes because of the amount of calculations—more so than AUD, REG, and the other disciplines. Getting caught up in numbers and formulas under pressure is easy, so having the timer on ensures that you are managing time wisely. If you find that time is running out and you still haven’t decided on an answer, you can use the bookmark feature to go back and review the question(s) later.

Focus on Governmental, NGO, and Non-Profit Accounting

The multiple-choice questions for FAR can be daunting because most of them require calculations. So remember that lots of practice and patience are required for FAR. If you can figure out what’s easy and what’s hard for you and use your time wisely, you’ll get through it soon enough!

How Many Hours Should I Study for the FAR CPA Exam?

CPA Candidates frequently ask about the number of hours they should study in order to pass the FAR section of the CPA exam. The AICPA recommends spending a minimum of 300 to 400 hours studying for the CPA Exam. That equates to 80 to 100 hours of study time for each section.

However, no two CPA candidates are alike. Each person learns at a different pace and has different learning styles. Also, certain portions of the study material may take longer to get through than others. Take your study style into account and set a realistic expectation for how long it will take to study for the FAR CPA Exam. Understanding your own learning style and limitations is vital to passing.

Frequently Asked Questions (FAQs)

How to pass the FAR CPA Exam?

Is FAR the hardest CPA Exam?

What is most heavily tested on the FAR CPA Exam?

Is the FAR section changing in the 2024 CPA Exam?

Will the 18-month credit rule still apply to the FAR CPA Exam in 2024?

Do I have 18 months to pass the entire CPA Exam or has that been extended?

CPA Exam candidates in most states (but not all) now allow 30 or 36 months to pass. The clock begins ticking on the date you pass your first exam section. In the past, it was 18 months but most states have extended this period to give you extra breathing room in light of recent exam changes.

You can read more about this historical rule amendment here. Please be sure to check with your State Board of Accountancy to confirm what the current rule is in your state.

Other CPA Exam Sections

AUD CPA ExamLearn the format, structure, and pass rates of the AUD CPA Exam. And prepare yourself with study tips to pass the exam.

REG CPA ExamDiscover REG CPA Exam's format, structure, and pass rates. Also, equip yourself with techniques to pass the exam.

BAR CPA ExamLearn what to expect when you take the BAR discipline of the CPA Exam, including the exam’s topics, structure, question format, and more. Plus, see how this discipline section relates to the FAR core section.

TCP CPA ExamLearn what to expect when you take the TCP discipline of the CPA Exam, including the exam’s topics, structure, question format, and more. Plus, see how this discipline section relates to the REG core section.

ISC CPA ExamLearn what to expect when you take the ISC discipline of the CPA Exam, including the exam’s topics, structure, question format, and more. Plus, see how this discipline section relates to the AUD core section.

CPA Exam Sections, Format & ContentGet all the information you need about the CPA Exam’s format, structure, and content for each exam section.