2024 CPA Exam Changes

CPA Evolution

Free eBook:

2024 CPA Exam Evolution

Learn everything you need to know about the 2024 CPA Exam Core-Plus Discipline Model, evolution timeline, recommendations and more.

CPA Review » CPA Exam » CPA Exam Changes » 2024 CPA Exam Changes – CPA Evolution

Technology is rapidly changing the accounting profession, how accountants perform their jobs, and the skills and knowledge needed to be successful. In response to these changes, The American Institute of CPAs (AICPA) and the National Association of State Boards of Accountancy (NASBA) have restructured the CPA Exam into a new CPA core-plus-discipline licensure model. This initiative is known as the CPA Evolution.

How and Why the CPA Exam Changed

As the profession evolves, so must the CPA Exam. Today’s CPAs are required to perform more advanced tasks, adopt new technologies, and contribute to increasingly complex projects earlier in their accounting careers. The CPA Evolution is a response to these changes in the profession, ensuring that the exam remains relevant as a measure of the knowledge and skills newly-licensed CPAs need to protect the public interest in today’s marketplace.

2024 CPA Exam Evolution: Core-Plus-Discipline Model

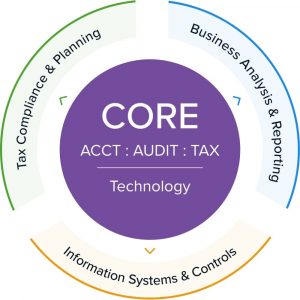

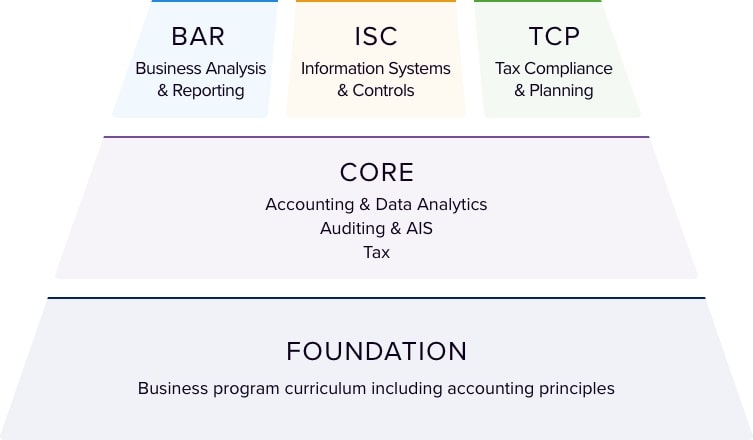

So, what does the new CPA Exam model look like? The exam will remain in a four-section, 16-hour format. The new CPA licensure model requires CPA candidates to be skilled in accounting, auditing, and tax. These topics will be tested in three core sections that are required for all candidates. They include:

- Financial Accounting and Reporting (FAR)

- Auditing and Attestation (AUD)

- Taxation and Regulation (REG)

In addition, candidates will need to have a deeper knowledge in one of the following three discipline sections:

- Business Analysis and Reporting (BAR) – a continuation of the FAR core

- Information Systems and Controls (ISC) – a continuation of the AUD core

- Tax Compliance and Planning (TCP) – a continuation of the REG core

Questions about technology will be infused throughout the entire CPA Exam.

Candidates are required to pass all three core sections and one discipline on the CPA Exam. It is important to note that the discipline passed will not change the type of license granted. The new licensure model results in one CPA license no matter which discipline is chosen.

How does the CPA Evolution Affect Accounting Curriculum?

Most master’s programs will prepare students for one of the three discipline areas. For schools without a master’s program, elective courses may be added to prepare students for the discipline areas. The CPA Evolution committee meets regularly to determine what recommendations they will have for the evolving accounting curriculum.

“I would not expect the undergraduate accounting curriculums to be much different than they are now. In my opinion, the undergraduate curriculum will continue to prepare the students for the foundational requirements that will still be tested on the future CPA Exam.” - Dr. Marcus Odom, Ph.D., CPA, CFE

2024 CPA Exam Section Overview

The new CPA Exam assumes that CPA candidates will sit for the CPA Exam after completing a foundational academic program focused on a strong business and accounting-based curriculum. This will provide candidates with the skills they need to practice in today’s business world and meet the needs of the public.

Technology continues to be increasingly vital to the accounting profession. Therefore, technology will be tested on the 2024 CPA Exam, not as a single discipline but throughout all exam sections.

Watch These Quick Overviews of the New Discipline Options

Business Analysis and Reporting (BAR)

CPA Candidates who are interested in assurance or advisory services, financial statement analysis and reporting, technical accounting, and financial and operations management should consider the BAR discipline. The content in the BAR discipline includes a data analytics focus and assesses topics like financial risk management and financial planning techniques. BAR could also include more advanced technical accounting and reporting topics, including assessment of revenue recognition and leases, business combinations, derivatives and hedge accounting, as well as employee benefit plan financial statements.

Information Systems and Controls (ISC)

Technology and business controls is a focus of the ISC discipline. CPA candidates who are interested in assurance or advisory services related to business processes, information systems, information security and governance, and IT audits are encouraged to choose this discipline. Content for this discipline is focused on IT and data governance, internal control testing, and information system security, including network security, software access, and endpoint security.

Tax Compliance and Planning (TCP)

The focus of the TCP discipline includes taxation topics involving more advanced individual and entity tax compliance. Content focused on personal financial planning and entity planning, inclusions and exclusions to gross income, and gift taxation compliance and planning could also be covered. Coverage of advanced entity tax compliance might include consolidated tax returns, multijurisdictional tax issues, and transactions between an entity and its owners. The tax treatments of the formation and liquidation of business entities could also be included in entity planning.

2024 CPA Exam Test Dates & Score Release Dates

The AICPA and NASBA announced the following, tentative testing schedule for the 2024 exam. Note that continuous testing will be paused in 2024 to account for standard-setting analyses and activities.

| Quarter | Core Test Dates |

Core Score Reports |

Discipline Test Dates |

Discipline Score Reports |

|---|---|---|---|---|

| Q1 | Jan 10 – Mar 26 | May 14 – June 4 | Jan 10 – Feb 6 | Mar 26 – Apr 16 |

| Q2 | Apr 1 – June 25 | Aug 1 | Apr 20 – May 19 | June 20 |

| Q3 | Jul 1 – Sep 25 | Nov 1 | July 1 – 31 | Sep 3 |

| Q4 | Oct 1 – Dec 26 | Early Feb 2025 | Oct 1 - 31 | Dec 3 |

|

*Dates are subject to change |

||||

CPA Exam Credit Extension

To accommodate the transition to the 2024 CPA Exam, NASBA announced a credit extension that has been adopted by most states. The following are proposals that some jurisdictions may or may not have already implemented. It’s best to check with your board regularly for updates. There are two proposed changes:

- Candidates who have passed at least one section of the CPA Exam before January 1, 2024, will have those credits extended to June 30, 2025 (see if your jurisdiction has adopted this here)

- Candidates in most states now have 30 or 36 months to pass the exam. The clock begins ticking on the date you pass your first exam section. In the past, it was 18 months but most states have extended this period to give you some breathing room in light of recent exam changes. Please be sure to check with your State Board of Accountancy to confirm what the current rule is in your state.

2024 CPA Evolution: Transition Policy

The AICPA and NASBA have developed a strategy to simplify candidates’ migration from the old exam to the new one. Those who had already earned credit in AUD, FAR, or REG on the old CPA Exam will not need to retake the corresponding new core section in AUD, FAR, or REG. Likewise, those who earned credit for BEC on the old CPA Exam do not have to take a discipline section.

Recommended 2024 CPA Exam Order

No matter which pathway you choose, it’s important to develop a strategy as you plan your exam schedule. While every candidate is different, our experts have determined a general recommended order for taking the exam once the 2024 changes go into effect. We suggest you take the section you find most difficult first. We also highly recommend taking your chosen discipline after its related core section, as the material does build upon it.

Considering currently released information, below are our proposed 2024 CPA Exam orders based on your chosen discipline: