2025 CPA Exam Changes

In 2025, the Certified Public Accountant (CPA) Exam continues to follow the core-plus-discipline licensure model that was introduced in January 2024. This model requires candidates to pass three core sections—Auditing and Attestation (AUD), Financial Accounting and Reporting (FAR), and Taxation and Regulation (REG)—along with one chosen discipline section: Business Analysis and Reporting (BAR), Information Systems and Controls (ISC), or Tax Compliance and Planning (TCP).

A significant update for 2025 is the expansion of testing windows for the core sections. Unlike the quarterly testing periods in 2024, the core sections are now offered throughout the year, providing candidates with increased flexibility in scheduling their exams. The discipline sections will maintain a quarterly testing schedule but will include an additional testing window in June, resulting in five opportunities to sit for these sections in 2025.

Effective January 1, 2025, the American Institute of CPAs (AICPA) implemented several revisions to the CPA Exam Blueprints. These revisions are intended to fine-tune the exam's content without significantly altering the nature or scope of the material tested. Candidates are encouraged to review the updated Blueprints to ensure their preparation aligns with the current exam structure.

2025 General Changes Include:

- Clarification has been provided in the References section of each Section Introduction, specifying that the subject matter eligible for assessment is limited to the detailed References and does not extend to external links or references within these sources.

2025 Section Changes Include:

- Examples have been added to representative tasks in specific topics to enhance clarity.

- The term “referred-to auditor” has been incorporated into certain tasks, reflecting recent standard-setting

activities. - A technical correction has been made to a representative task concerning sufficient appropriate evidence.

- References to the direct method for nongovernmental, not-for-profit entities in the statement of cash flows have been removed.

- Clarifications have been made regarding methods used when preparing income tax basis financial statements.

- A technical correction has been applied to a representative task related to adjustments and deductions to arrive at adjusted gross income and taxable income.

- Revisions include updates to tasks concerning indefinite-lived intangible assets and the addition of examples related to capital and infrastructure assets.

- Updates to references reflect the issuance of new versions of documents by the Center for Internet

Security and the removal of outdated references. - Technical corrections have been made to skill allocations and representative tasks in various

topics. - An analysis representative task has been added to the topic of change management.

- Terminology has been clarified in tasks related to data management.

- References have been updated based on the issuance of a revised framework by the National Institute of

Standards and Technology. - Clarifications have been made regarding the scope related to SOC for Cybersecurity reports.

- Technical corrections have been made to tasks concerning individual compliance and tax planning considerations, as well as tax planning for S corporations.

- References to carrybacks related to net operating losses have been removed.

2024 CPA Exam Changes

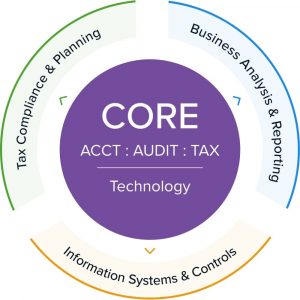

Effective January 10, 2024, AICPA and NASBA restructured the CPA Exam into a new CPA core-plus-discipline licensure model with three core sections and three discipline sections. Candidates must pass all three core sections and one discipline section of their choice to pass the CPA Exam. The exam remains in the four-section, 16-hour format.

In this section, we've reduced the multitude of exam changes to the most essential takeaways by the exam section, incorporating new content, content removal, and topics deemphasized with a reduction in the skill level required to be demonstrated. While BEC is no longer available, its content is distributed among several core and discipline sections.

It is important to note that the change is due to how technology has changed the accounting profession, how accountants perform their jobs, and the skills required to function.

The new licensure model results in one CPA license, irrespective of the discipline chosen. Let's examine the core-plus-discipline model.

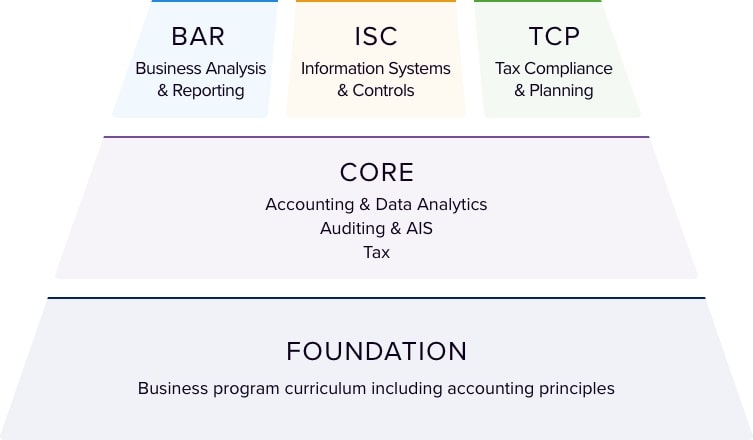

So, what does the CPA Exam model look like now? The new CPA licensure model requires CPA candidates to be skilled in accounting, auditing, and tax. These topics will be tested in three core sections that are required for all candidates. They include:

- Financial Accounting and Reporting (FAR)

- Auditing and Attestation (AUD)

- Taxation and Regulation (REG)

In addition, candidates will need to have a deeper knowledge in one of the following three discipline sections:

- Business Analysis and Reporting (BAR) – a continuation of the FAR core

- Information Systems and Controls (ISC) – a continuation of the AUD core

- Tax Compliance and Planning (TCP) – a continuation of the REG core

Questions about technology will be infused throughout the entire CPA Exam.

Candidates are required to pass all three core sections and one discipline on the CPA Exam. It is important to note that the discipline passed will not change the type of license granted. The new licensure model results in one CPA license no matter which discipline is chosen.

CPA Exam Section Overview

AICPA and NASBA assume that CPA candidates will sit for the CPA Exam after completing a foundational academic program focused on a strong business and accounting-based curriculum. This will provide candidates with the skills they need to practice in today’s business world and meet the needs of the public.

Technology continues to be increasingly vital to the accounting profession. Therefore, technology is tested on the 2024 CPA Exam, not as a single discipline but throughout all exam sections.

Let's look at the three new disciplines and understand what content they entail.

- The Business Analysis and Reporting (BAR)

CPA Exam – a continuation of FAR tests financial statement and financial information analysis skills by

comparing historical data to budgets and forecasts. - It also tests candidates’ knowledge of the Financial Accounting Standards Board (FASB), Accounting Standards

Codification, and the U.S. Securities and Exchange Commission (SEC) applicable to for-profit businesses and

employee benefit plans. - The discipline includes advanced technical accounting and reporting topics, such as assessing revenue

recognition and leases, business combinations, derivatives, and hedge accounting.

- The Information System and

Controls (ISC) CPA Exam integrates technology in accounting. It tests skills in

information systems, processing integrity, availability, security, confidentiality, and

privacy. - Successful candidates must demonstrate skills in data management, including data collection, storage, and

usage throughout the data life cycle. - It is a continuation of the AUD CPA Exam and is for candidates interested in assurance or advisory

services related to business processes, and IT audits.

- The Tax Compliance and

Planning (TCP) CPA Exam is a comprehensive discipline that covers U.S. federal tax

compliance for individuals and entities, with a focus on higher-complexity transactions, U.S. federal tax

planning for individuals and entities, and personal financial planning. - The discipline is a continuation of the FAR CPA Exam and tests a candidate’s knowledge of tax return

preparation and review and of determining the tax implications of transactions, available alternatives, or

business structures.

CPA Exam Testing and Score Release Dates

| Quarter | Core Test Dates | Core Score Reports | Discipline Test Dates | Discipline Score Reports |

|---|---|---|---|---|

| Q1 | Jan 10 – Mar 26 | June 4 | Jan 10 – Feb 6 | Apr 24 |

| Q2 | Apr 1 – June 25 | Jul 31 | Apr 20 – May 19 | Jun 28 |

| Q3 | Jul 1 – Sep 25 | October 31 | July 1 – 31 | Sep 10 |

| Q4 | Oct 1 – Dec 26 | January 29 | Oct 1 – 31 | Dec 10 |

| If the AICPA receives your exam data file by*: | Your target score release date is: |

|---|---|

| January 23 | February 7 |

| February 14 | February 25 |

| March 9 | March 18 |

| March 31 | April 9 |

| April 23 | May 8 |

| May 16 | May 28 |

| June 8 | June 17 |

| June 30 | July 10 |

| July 23 | August 7 |

| August 15 | August 26 |

| September 7 | September 16 |

| September 30 | October 9 |

| October 23 | November 7 |

| November 15 | November 25 |

| December 8 | December 16 |

| December 31 | January 13 |

| Testing Dates | Your target score release date is: |

|---|---|

| January 1 – 31 | March 14 |

| April 1 – 30 | May 16 |

| June 1 – 30 | July 17 |

| July 1 – 31 | September 11 |

| October 1 – 31 | December 16 |

2025 Dates

Core sections are available with continuous testing in 2025:| If the AICPA receives your exam data file by*: | Your target score release date is: |

|---|---|

| January 23 | February 7 |

| February 14 | February 25 |

| March 9 | March 18 |

| March 31 | April 9 |

| April 23 | May 8 |

| May 16 | May 28 |

| June 8 | June 17 |

| June 30 | July 10 |

| July 23 | August 7 |

| August 15 | August 26 |

| September 7 | September 16 |

| September 30 | October 9 |

| October 23 | November 7 |

| November 15 | November 25 |

| December 8 | December 16 |

| December 31 | January 13 |

| Testing Dates | Your target score release date is: |

|---|---|

| January 1 - 31 | March 14 |

| April 1 - 30 | May 16 |

| June 1 - 30 | July 17 |

| July 1 - 31 | September 11 |

| October 1 - 31 | December 16 |

CPA Evolution: Transition Policy

The AICPA and NASBA have simplified the candidate’s migration from the old exam to the new. Candidates with credits in AUD, FAR, or REG need not retake the corresponding new core sections. Likewise, candidates with credits in BEC are exempt from sitting for the discipline section.

CPA Exam Credit Extension

To accommodate the CPA Exam transition, NASBA announced a credit extension that most states have adopted. The following are proposals that some jurisdictions may or may not have already implemented. It’s best to check with your board regularly for updates. There are two proposed changes:

- Candidates who have passed at least one section of the CPA Exam before January 1, 2024, will have those credits extended to June 30, 2025 (see if your jurisdiction has adopted this here)

- Candidates in most states now have 30 or 36 months to pass the exam. The clock begins ticking on the date you pass your first exam section. In the past, it was 18 months but most states have extended this period to give you some breathing room in light of recent exam changes. Please be sure to check with your State Board of Accountancy to confirm what the current rule is in your state.

FAQs

If I purchase a CPA Exam review course now, will the materials still be relevant for next year?

Does the CPA Exam change every year?

What order should I take the CPA Exam parts?

We suggest taking the section you find most difficult first. We also highly recommend taking your chosen discipline after its related core section, as the material does build upon it.

How does the CPA Evolution Affect Accounting Curriculum?

Learn more about the CPA Exam

The CPA Exam is a comprehensive test composed of 4 parts, given individually over a total of 16 hours. These exams cover various topics taught in most university accounting programs.

CPA Exam Blueprints help candidates understand what skills and content topics will be tested on the CPA Exam. It also provides information on upcoming changes.

A score of 75 or greater is required to pass each section of the CPA Exam. Here are the variety of factors that go into compiling the score.