TCP is one of the three discipline sections that candidates can select under the CPA Exam’s core-plus-discipline model. According to the CPA Exam Blueprints, the following are some specific topics covered on the TCP section of the CPA Exam:

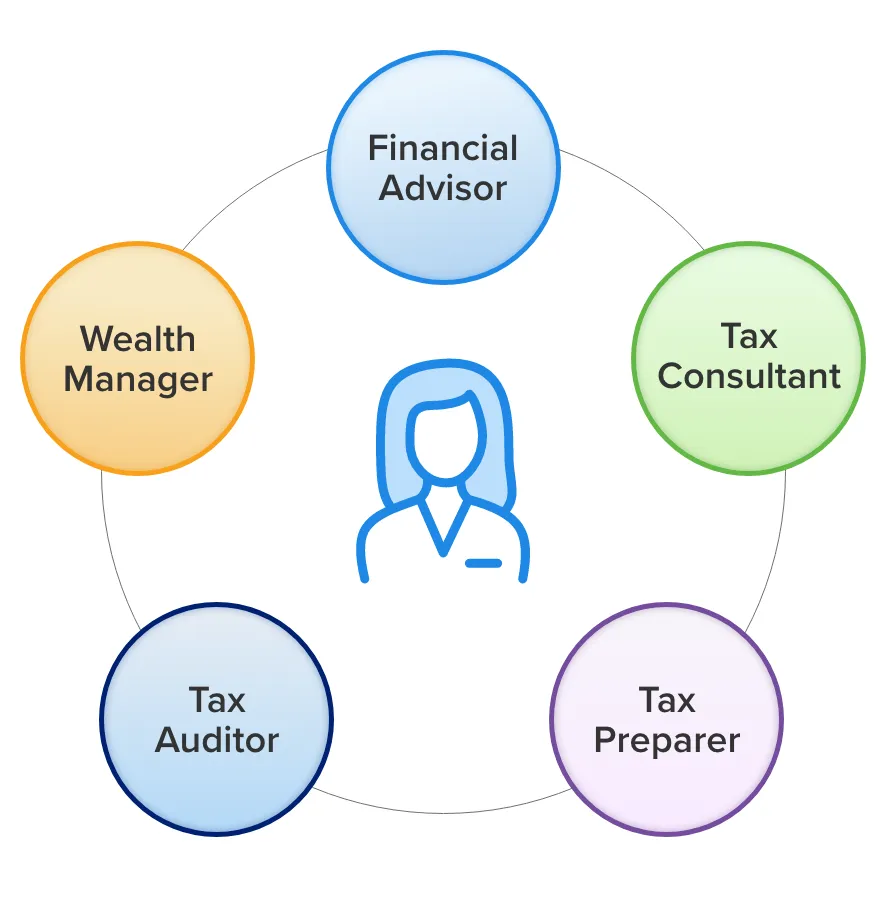

Candidates who choose this discipline are likely to consider roles as financial advisors, tax consultants, and wealth managers, among others. If this speciality interests you, read on to learn what to expect from the TCP CPA Exam.

How the TCP Discipline Is Related to the REG Core

The TCP CPA Exam is an extension of the REG CPA Exam, which is a core CPA Exam section that all candidates must take. The objective of the CPA Evolution is to ensure that the three core sections examine applicants' foundational knowledge, while the discipline sections examine applicants’ knowledge of advanced concepts within each domain. Thus, the REG core will test your general understanding of taxation and regulations, while the TCP discipline will test tax situations at a more granular level.

The TCP CPA Exam’s Structure and Format

The TCP discipline features five testlets in total. Testlets 1 and 2 consist of 34 multiple-choice questions (MCQs) each, totaling 68 MCQs for the full exam. Testlets 3, 4, and 5 consist of 2 to 3 task-based simulations (TBSs), of which there are 7 for the full exam. The MCQ section accounts for 50% of your score, while the TBS section accounts for the remaining 50%.

| Question Type | Number of Questions | Score Weighting |

|---|---|---|

| MCQs | 68 | 50% |

| TBSs | 7 | 50% |

TCP is a computer-based, 4-hour-long exam. Since you have limited time, you must allocate it wisely for each question. We suggest allocating approximately 1.3 minutes for each MCQ, which results in roughly 45 minutes per testlet. For the TBS testlets, we suggest allocating about 20 minutes for each TBS. That way, all TBSs will be completed within 140 minutes. This leaves you with 10 extra minutes to recheck answers, or simply gives you a cushion in case you fall behind on a testlet.

| Testlet | Question Type | Suggested Time |

|---|---|---|

| Testlet 1 | 34 MCQ | 45 Minutes |

| Testlet 2 | 34 MCQ | 45 Minutes |

| Testlet 3 | 2 TBS | 40 Minutes |

| 15-minute break (does not count toward total exam time) | ||

| Testlet 4 | 3 TBS | 60 Minutes |

| Testlet 5 | 2 TBS | 40 Minutes |

| Extra Time | 10 Minutes | |

| Total Time | 240 Minutes | |

TCP Exam Blueprint: Content Areas & Allocation

As laid out in the AICPA blueprints, the TCP Exam includes four content areas that cover advanced concepts pertaining to tax compliance and planning. You can learn about each subject area and topic weight in the table below:

Area I (30-40%): Tax Compliance and Planning for Individuals and Personal Financial Planning

Area I of the TCP blueprint addresses federal tax compliance for nonroutine transactions and issues, tax planning, and personal financial planning. The content area consists of the following:

- Individual compliance and tax planning considerations for gross income, adjusted gross income, taxable income, and estimated taxes

- Compliance for passive activity and at-risk loss limitations (excluding tax credit implications)

- Gift taxation compliance and planning

- Personal financial planning for individuals

Area II (30-40%): Entity Tax Compliance

Area II of the TCP blueprint addresses federal tax compliance pertaining to non-routine entity tax transactions and concerns. The content area consists of the following:

- C corporations

- S corporations

- Partnerships

- Trusts

- Tax-exempt organizations

Area III (10-20%): Entity Tax Planning

Area III of the TCP blueprint addresses federal tax planning for organizations. The content area consists of the following:

- Formation and liquidation of business entities

- Tax planning for C corporations

- Tax planning for S corporations

- Tax planning for partnerships

Area IV (10-20%): Property Transactions (Disposition of Assets)

Area IV of the TCP blueprint addresses federal tax compliance concerns associated with asset dispositions. The content area consists of the following:

- Nontaxable disposition of assets

- Amount and character of gains and losses on asset disposition and netting process

- Related party transactions, including imputed interest

TCP Section Assumptions

When sitting for the TCP section of the exam, candidates should base their answers on the information provided within the question. You will not be tested on specific tax rate percentages, amounts, or limitations indexed to inflation. Regarding questions that could have different tax treatments based on timing (e.g., net operating losses), you will be provided with all necessary information (e.g., actual dates in order to reference specific portions of the IRC or Treasury Regulations). In the absence of timing indications or other stated assumptions, you should assume that transactions or events referenced in questions occurred in the current year, and apply the most recent provisions of tax law in accordance with the timing outlined in the CPA Exam Policy on New Pronouncements.

Skills Tested on the TCP Exam

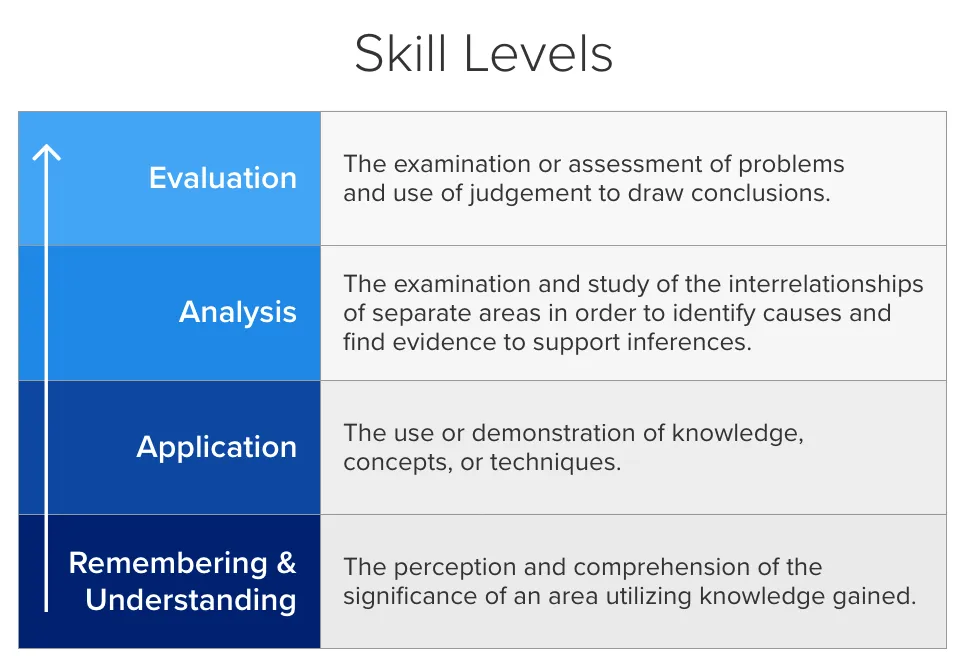

The TCP CPA Exam follows Bloom's Taxonomy of Educational Objectives as a skill-set parameter. The table below depicts necessary skills to pass the TCP Exam:

The TCP section of the CPA Exam evaluates information at the first three skill levels of Bloom's Taxonomy:

- Remembering and Understanding (5-15%): Mainly concentrated in Areas I and II, containing nonroutine compliance issues encountered by newly-licensed CPAs.

- Application (55-65%) and Analysis (25-35%): Examined across all Areas, containing day-to-day planning tasks that newly-licensed CPAs must perform related to tax, personal financial planning, and the preparation and review of tax returns.

TCP CPA Exam Pass Rates

| TCP CPA Exam Pass Rates | |

|---|---|

| Q1 2024 | 82% |

| Q2 2024 | 76% |

| Q3 2024 | 73% |

| Q4 2024 | 72% |

| Q1 2025 | 75% |

Source: https://www.aicpa-cima.com/resources/article/learn-more-about-cpa-exam-scoring-and-pass-rates

View the pass rates for each section of the CPA Exam from prior years in CPA Exam Pass Rates.

Accounting Roles Related to Tax Compliance & Planning

Aspiring CPAs have many career-path options, but candidates who choose to take the TCP discipline will be uniquely positioned to excel in the following accounting careers:

As a financial advisor, CPAs may advise on estate planning, retirement planning, risk management, and investing, among other topics. Some CPAs may offer various services, while others may opt to specialize in a certain field, such as tax planning. The majority of these skills are tested in TCP Area I.

A tax consultant researches tax matters, suggests solutions to minimize and address tax liability, prepares and submits tax returns, and represents clients before the IRS during audits. To advise clients on tax-planning measures, tax advisors must keep abreast of tax law changes. These skills are at the heart of what TCP covers; when you pass TCP, you will have the skills and knowledge to successfully consult across a wide variety of tax matters.

A tax preparer prepares tax returns for everything from individuals, businesses, and organizations to complex enterprises, trusts, and nonprofits. Individual taxes are tested in TCP Area I, while entity taxes are tested in Areas II and III.

A tax auditor is a trained professional who looks over financial records to see if they follow tax rules. All tax auditors employ accounting principles in the course of their duties. They endeavor to ensure compliance with federal, state, and local tax laws by firms, people, agencies, and organizations. Similar to a tax consultant, a tax auditor must possess a wide-ranging skill set of tax knowledge. Most of the skills necessary for a tax auditor are tested in TCP Areas II, III, and IV.

Wealth managers take care of their clients’ money and plan their finances. This often includes helping clients plan their lifestyle by making a budget, planning cash flow, and saving money for college and retirement. Similar to a financial advisor, the majority of the skills relevant for a wealth manager are tested in TCP Area I.

TCP CPA Exam FAQs

What is on the TCP CPA Exam?

Is TCP harder than REG?

How long is the TCP CPA Exam?

How to pass the TCP CPA Exam

How to study for the TCP CPA Exam

Other CPA Exam Discipline Pages

Information Systems and Controls (ISC)

Learn what to expect when you take the ISC discipline of the CPA Exam, including the exam’s topics, structure, question format, and more. Plus, see how this discipline section relates to the AUD core section.

Business Analysis and Reporting (BAR)

Learn what to expect when you take the BAR discipline of the CPA Exam, including the exam’s topics, structure, question format, and more. Plus, see how this discipline section relates to the FAR core section.