CPA Exam & CPA License Requirements

The requirements needed to apply and sit for the CPA Exam and to obtain a CPA license.

Download our free eBook: How to Qualify & Apply to the CPA Exam

Get step-by-step guidance on eligibility requirements and how to apply to take the CPA Exam

Get it NowEach of the 55 US jurisdictions has its own Board of Accountancy that is responsible for licensing the CPAs who practice in that state or jurisdiction. Both the requirements for the CPA Exam and the licensure requirements for each state differ slightly.

How to Get a CPA License

Education Requirements

Each state requires the completion of a certain number of educational semester or quarter units to work towards the CPA credential. Check with your state to determine educational requirements needed to sit for the CPA Exam.

CPA Exam Requirements

Successfully passing all four parts of the CPA Exam is a key requirement for obtaining your CPA license. Upon passing the CPA Exam, you will receive your CPA certificate, but this is not a license to practice. You still have a few more steps to go.

Experience Requirements

Many states require that CPA candidates complete a certain number of hours working under a licensed CPA. Some states also require that candidates take Continuing Professional Education (CPE) hours, as well.

Ethics Requirements

Most states require a CPA applicant to complete an ethics course or ethics exam before licensure. Be sure to check with your State Board of Accountancy as you work towards the CPA credential.

Education Requirements

Generally, each state board requires a total of 150 semester or 225 quarter units from a state accredited college or university. Many colleges and universities try to meet this unit’s requirement by offering bachelor’s and master’s degree programs in Accounting with a mix of accounting, business, and general education classes that count towards CPA licensure.However, there are several other ways to obtain the extra educational units that don’t require completing a master’s degree. In order to meet the unit requirement for licensure, candidates may choose to enroll in an MA, MBA, or 5 year integrated BA/MA program. However, these options are not necessarily requirements in your state as you may be able to attain the extra units through a minor, BA elective courses, or community college classes. Check with your state to determine their CPA Exam educational requirements.

The "150 Hour Rule" to Get Your CPA License

What is the 150 Hour Rule?

One of the first things to consider when working towards the CPA credential is what your state board of accountancy’s educational requirements are. Every state has different educational requirements that must be met to sit for the CPA Exam and become a licensed CPA in that state. It’s important to ensure that you’re fulfilling those requirements, so we recommend that you get in touch with your state board of accountancy early in the CPA process.

There is something called the 150-hour rule that many states enforce as a requirement for CPA candidacy. This means that you’ll need to successfully complete 150 educational credit hours or units before sitting for the CPA Exam.

Other Ways to Meet the 150-credit Hour Educational Requirement

- First, calculate all the eligible college semester hours you have. Your hours from your undergraduate institution will probably be your main source credit, but that doesn’t mean that they are the only ones you can count.

- Remember those AP classes from high school? If your college offers units for AP exams, you can use these units towards the 150-unit requirement if the AP credit units are listed on your transcript. To get credit for your AP exams, check in with an academic counselor at your college and ask them if you can submit your AP exam scores for unit credit. Many universities, colleges, and community colleges give credit for AP exams, so it doesn’t hurt to ask. Also, if you’ve already submitted your AP scores to your college, they may have already given you credit for them! Check your transcript to see if the units are listed. If you need help, consult with an academic counselor at your school.

- Have you taken any community college courses? Community college courses count towards your 150 credit hours, so send your community college transcripts to the Board of Accountancy when you apply for licensure.

In summary, taking additional courses in the summer or during the school year will help you reach the 150-unit requirement once you graduate. Also, finishing the 150-unit requirement by the time you graduate with a bachelor’s degree will give you an edge in recruiting, since many firms look for candidates who have completed or will soon complete 150 units.

Should I Get a Master’s Degree in Accounting (MAcc)?

Master’s in accounting (MAcc) programs are becoming much more common. Universities are encouraging their students to pursue a master’s degree to ensure that their students are properly prepared to gain CPA licensure. Some schools offer what they call a BMAcc, which is a bachelor’s and master’s dual degree in accounting. This option offers a way for students to get their 150 credits without having to deal with the added rigors of applying to a master’s program. However, if you enroll in a dual degree program, you will not be receiving your degrees until the completion of the entire program. Depending on your state’s requirements, you may not be able to sit for the CPA Exam until full completion of the program. In comparison, if you applied to a traditional master’s program with a background in accounting, you can begin to register for the CPA Exam and sit while you are pursuing your master’s degree.

If you are interested in pursuing a master’s degree in accounting and do not come from an accounting program, it can take between one to two years to complete the program. This includes completing all the prerequisites you may need to take before you start your program. The good news is that many of the prerequisites like Financial and Managerial Accounting can also be taken at your local community college to save you some extra time and money!

Other universities offer a summer intensive program that consists of eight weeks of accounting and tax classes (hence the term intensive) to provide you with a core understanding before beginning your one-year MAcc program.

A student can also just continue into a master’s program after they graduate with their bachelor’s degree. An accounting master’s program is a one-to-two-year program where students can dive deeper into accounting concepts and gain an in-depth knowledge of tax principles. A master’s program in accounting also entails a lot of studying, group work, and opportunities to work on real case examples. These are all great skill sets to take to your new job and coupled with hard work, will ensure your career success.

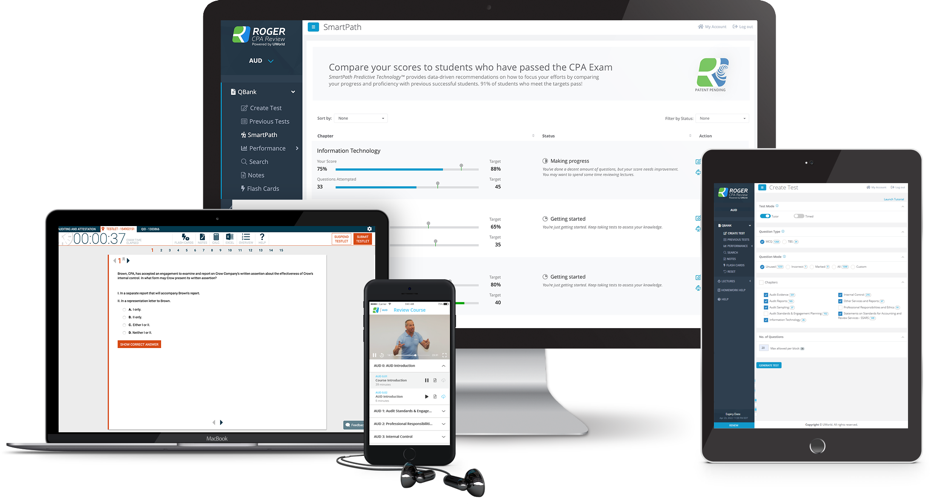

Get Started with a 7-Day Free Trial

Choosing a CPA Review course is a big investment of both time and money. Make sure you choose one that’s right for you. Try our course for free for 7 days, and you’ll experience the UWorld Roger CPA Review difference—where quality is what separates us from the rest.Learn More

CPA Exam Requirements

Each CPA Candidate must successfully pass each section of the CPA Exam with a score of 75 or higher. There are four sections of the CPA Exam: Auditing & Attestation (AUD), Business Environment & Concepts (BEC), Financial Accounting & Reporting (FAR), and Regulation (REG). You are allowed to take any section of the CPA Exam in any order, but you must complete all four parts within 18 months.

Experience Requirements

Most states require at least one to two years of public accounting experience. While non-public accounting experience is also widely accepted, the number of required years is generally higher. Work experience from before, during, or after passing the CPA Exam will count if it was done under the management of a licensed CPA. Most states will count part-time work and internships by hours as well. Make sure to have the appropriate experience forms filled out by your employer based on the sector of accounting you have chosen, such as attestation or tax. To maintain your CPA license, most State Boards require CPAs to take a specified number of Continuing Professional Education (CPE) hours within a certain period. Check your State Board for more information.

Important to note: NASBA provides a service to help make the CPA credential more available to both domestic and international accounting professionals worldwide. Learn about the Experience Verification service here.

Ethics Requirements

Most states require a CPA applicant to complete an Ethics course or Ethics exam before licensure. The exam is often administered online at home and a passing score is considered a 90% or better. This exam generally must be completed within two years of passing the CPA Exam. Check your State Board for details.

Qualify & Apply for the CPA Exam

In order to take the CPA Exam, you must first meet a specific set of requirements. We’ll walk you through the necessary qualifications you must have to sit for the Exam. Then, once you’re well-versed in what’s required of you, continue on to learn your state’s CPA Exam application process.

How to Qualify for the CPA Exam

To sit for the CPA Exam, you’ll need to ensure you’ve covered the qualifying requirements for sitting for the CPA Exam. Each state and jurisdiction have its own educational requirements to take the Exam so be sure to check your jurisdiction’s specific CPA Exam requirements. Typically, a minimum of a bachelor’s degree in Accounting is required and if your degree isn’t in accounting, most states require an additional 15 credit hours or less to sit for the Exam. Also, it’s important to note that most State Boards of Accountancy require a minimum of 150 hours of post-secondary education. A bachelors’ degree normally provides 120 credit hours, so in order to obtain an extra 30 hours some CPA Candidates choose to complete a Master’s in Accounting (MAcc) program or take additional classes from an accredited university. (If you are in a provisionary state you may be able to sit for the exam a few months before completing all education units but will have to prove that you are close to completion).

Steps to Apply for the CPA Exam

In general, the application process for the CPA Exam follows a few basic steps:

1. Apply Online to sit for the CPA Exam

Navigate to the NASBA website and choose your jurisdiction to begin the process. Depending on your location, this is done through either your State Board of Accountancy or NASBA CPA Examination Services (CPAES).

2. Submit transcripts and application fee

Based upon the requirements of your state board of accountancy, you will submit your University transcripts and pay the associated application fees.

3. Receive an Authorization to Test (ATT)

This is your approval to take the CPA Exam. Your ATT is only valid for 90 days, so make sure to register for your exams promptly.

4. Choose which CPA Exam section to take first

For first time CPA Candidates, choosing which CPA Exam section to take first comes down to personal preference. If you’re looking for some guidance on which CPA Exam section to take first, here is our recommended sequence.

5. Pay NASBA Exam Section Fees

It’s important to note that once you sign up to sit for a section with NASBA, you’ll have 6 to 12 months access before access and fees are forfeited.

Take the SmartPath

Prepare for success with the highest quality in CPA Exam prep. Join the 91% of UWorld Roger CPA Review students who pass the CPA Exam.

Recommended Articles

Free CPA Review Resources

CPA Candidates know passing the CPA Exam requires time, money, and strong mental fortitude. Here is a list of the best free CPA review resources.

Four Tips to Pass the CPA Exam the First Time

If you want to pass the CPA exam the first time, consider these four expert tips to help with your CPA exam success.

How to Enter Accounting as a Second Career

Thinking about going the accounting route for a change of career? Learn what you can do to help yourself in the process!

Why I’m Not Waiting to Sit for the CPA Exam

Are you waiting to sit for the CPA Exam? Our guest writer describes why it's best to schedule your exam and sit sooner!

Top 5 Reasons People Fail the CPA Exam

Some CPA candidates struggle when preparing for the CPA exam. Find out the top 5 reasons candidates fail, and how you can avoid making these mistakes.

Balancing Life, Work, and the CPA Exam

Do you find it difficult to study for the CPA Exam while working and trying to maintain a personal life? Find out how one CPA Candidate is able find the balance while working towards her CPA goals.

Why Now — More Than Ever — Is the Best Time to Become a CPA

In these uncertain times, one thing is for sure: CPAs are going to be in high demand now more than ever. Find out why.

Why You Should Take the CPA Exam Right After You Graduate

Why do accounting grads who take the CPA Exam right after they graduate more successful at passing? Find out why.

How Current CPA Candidates Are Managing Stress in a Changing World

Find out how current CPA Candidates are managing stress and the CPA Exam during a changing world.

You Should Rethink Your Role as an Accountant

Professor of Accounting at USC gives us a sneak peek of his keynote speech and makes us rethink our roles as accountants.

CPA Requirements Q&A

You can obtain 150 units in order to meet the CPA Exam education requirements and/or CPA licensure requirements in two ways:

- Complete a master’s degree program.

OR - Earn the necessary units by taking additional classes from an accredited college or university.

Each state/jurisdiction requires that a certain number of the credits be from accounting courses.

Depending on your jurisdiction, you will either need 120 or 150 semester units to be eligible to sit for the CPA. Most states/jurisdictions now require or will require 150 semester hours of education for CPA licensure. Contact your state board to know the requirements to apply for licensure.

NASBA CPA Examination Services (CPAES) provides a comprehensive array of services to state boards of accountancy related to the Uniform CPA Examination (Exam). Using this service means that some processes like application processing, credential evaluations and score reporting are managed through the website. There are 32 states/jurisdictions that utilize this service. Visit the NASBA website in order to check if your jurisdiction participates.

If your jurisdiction does not participate in the CPAES service, then you will have to visit your state board’s accountancy website. You may be able to submit items online or you may be required to mail them. Also, communication regarding scoring may occur through the website or through mail.

You will be able to submit your transcripts to your state board by completing your application online through the National Association of State Boards of Accountancy (NASBA) website. Once you have selected your jurisdiction and paid the fees, you will be able to submit your transcripts through the website.

International Students CPA Requirements Q&A

The International Qualification Examination (IQEX) is for accounting professionals who are members of non-U.S. professional associations and have entered into mutual recognition agreements with the U.S. International Qualifications Appraisal Board (IQAB).

Through a mutual recognition agreement (MRA), qualified professional accountants from another country can practice in the United States without having to completely re-credential. Similar recognition is given to U.S. CPAs who wish to practice in that same country. The exam covers ethics, professional and legal responsibilities, business law and taxation related specifically to U.S. accounting practice.

- Select which state in which you would like to become a CPA.

- Research and complete the state’s qualifications for citizenship, residency, and education requirements to sit for the U.S. CPA Exam. Each state is different and may have specific requirements. However, the most important thing you will need to have is following: A bachelor’s degree and completion of a minimum of 150 credit hours in business or accounting.

- After you have met the educational requirements, contact the Board of Accountancy or CPA Examination Services (CPAES) through NASBA, depending on your jurisdiction. Get application materials, submit completed applications and pay required fees.

For more information about taking the US CPA Exam as an International student, check out our intertanational students page.

For CPA Exam applicants who have completed education outside the United States,The National Association of State Boards of Accountancy (NASBA) offers academic evaluation services. These services are available for CPA examination and licensing only.

CPA Exam Resources

Our CPA Exam Resource Center provides candidates with study materials and resources needed to prepare for the CPA Exam.

Career Resources

Our Career Center provides information to assist candidates with everything they need to start out their CPA career.

Learning Center

Our Learning Center is a valuable resource for students, practicing accountants, and CPA candidates.

CPA Review Courses

See why 94% pass! Our world-class CPA Review platform provides you with everything you need to succeed.