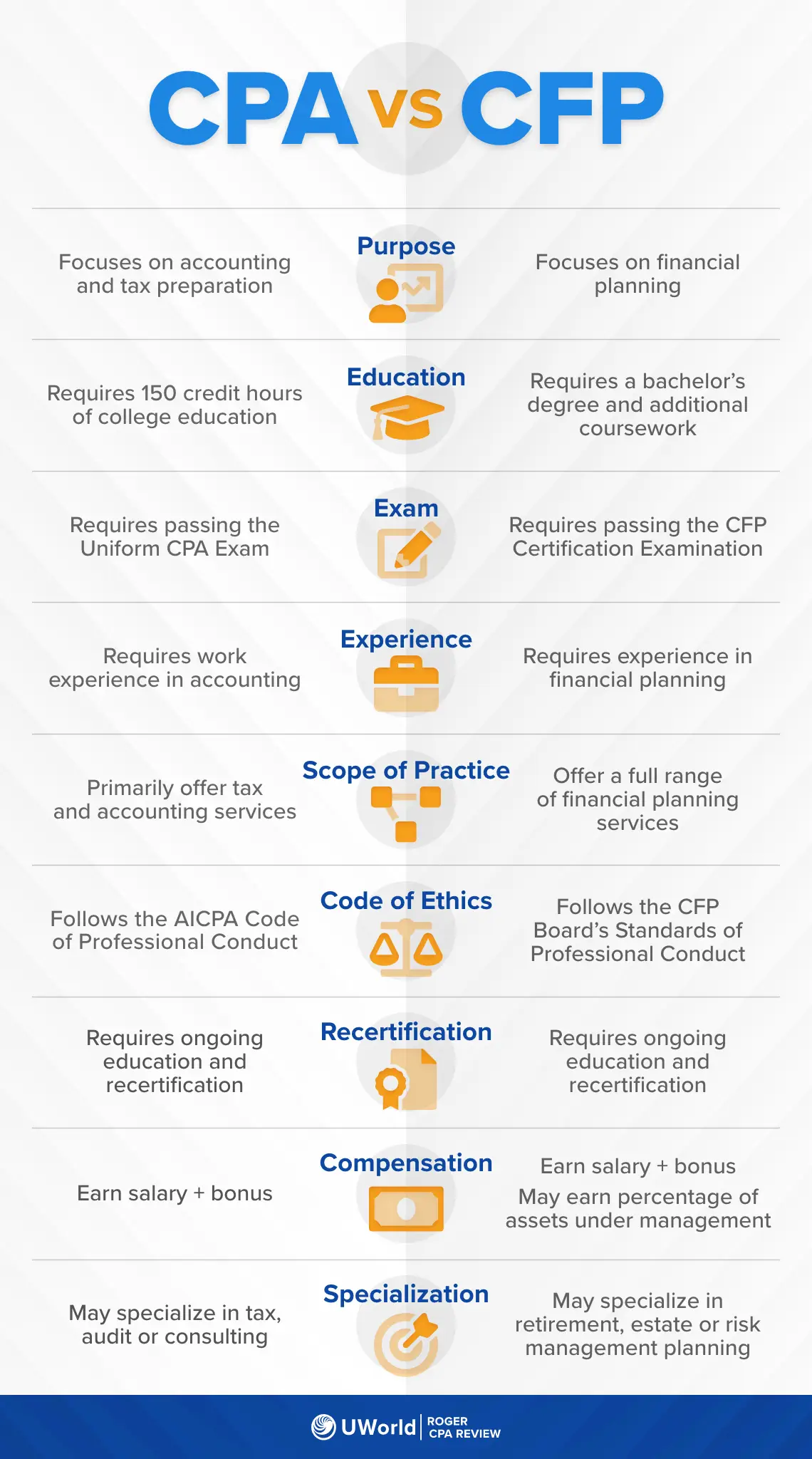

If you intend to settle in the United States and pursue a career in public accounting, becoming a CPA is your best option. If you want to become a financial advisor and help people with financial planning, choose a CFP career.

Certification and License - CPA vs CFP

To obtain the CPA or CFP license, you must pass the respective exams. But, the first step to preparing for the exams is understanding the certification requirements for each. Here’s a look at what you can expect:

CPA Exam and License

The CPA Exam consists of three core sections and three discipline sections. Candidates need to sit for all the core exams and any one discipline. The duration of each section is four hours, for a grand total of sixteen hours dedicated to the examination.

The core sections are:

- Auditing and Attestation (AUD)

- Financial Accounting and Reporting (FAR)

- Regulation (REG)

The Discipline sections are:

- Business Analysis and Reporting (BAR)

- Information Systems and Controls (ISC)

- Tax Compliance and Planning (TCP)

All four sections must be passed within a 30 or 36-month window with a score of 75 or higher in each section. CPA state licensure requirements vary but typically require 150 hours of schooling (30 hours more than the standard 120-hour accounting bachelor's degree). In addition to verifiable experience and a passing score on the Uniform CPA Examination, the qualifications for obtaining a license are always a passing grade on the Uniform CPA Examination.

A CPA might take up to three years to complete. This includes a year to complete your additional credit hour requirements and one to two years of relevant work experience.

CFP Certification and License

The CFP certification can take anywhere between 18 to 24 months. The CFP exam is developed, managed, and scored by The Certified Financial Planner Board (CFP Board) of Standards, Inc., in the United States. It is a substantially less time-consuming program than the CPA because only one comprehensive exam must be passed.

Before you qualify for the CFP designation, you must have substantial professional experience. This requires either 4,000 hours of CFP-compliant apprenticeship or 6,000 hours of financial planning-related professional experience. Candidates must complete the required hours of experience between five and ten years prior to taking the CFP examination.

Exam Fees - CPA vs CFP

CPA Exam costs vary depending on your jurisdiction – when and where you take the exam, and which CPA Review course you decide to use, the total cost of obtaining licensure can range anywhere from $2000- $6000 (including applicable taxes).

| Typical CPA Exam Costs | |

|---|---|

| Education Evaluation Application Fees | $90 (Approx) |

| Examination Fees | $1450 (Approx) |

| CPA Exam Retake Fee | $50-$200 |

| CPA Review Course | $1000-$4000 |

| Total | $2590- $5740 |

Depending on when you sign up for the class, the total cost of the complete CFP program will range anywhere from $825 to $1,025 (including applicable taxes). The fees for early registration are $825, the regular registration charge is $925, and the late registration fee is $1,025 accordingly.

Exam Difficulty - CPA vs CFP

The CPA Exam is regarded as one of the most difficult professional examinations. It is considered challenging because of the complexity of topics covered in the four sections of the exam. Each section of the exam has several question types and topics that cover a variety of accounting concepts. Answering the questions correctly requires critical thinking and higher-order skills -- tasks that are now expected from newly-licensed CPAs (nlCPAs).

The CPA Exam pass rate is indicative of the difficulty of passing the examination. In order to excel on the exam, extensive study, regular practice, and the utmost dedication are essential.

Comparatively, CFP is easier than CPA. The historical pass rate has been above 60%, which indicates that the tests are of a difficulty level that is considered to be moderate.

Job Opportunities - CPA vs CFP

A Certified Public Accountant (CPA) is a highly valuable certificate for accountants seeking to progress in their careers. It also opens the door to a vast array of job prospects. In addition, the certification demonstrates to employers that they have the confidence and skills needed to achieve challenging objectives. The overall job of a CPA consists of helping companies, individuals, and organizations make sense of financial data. Many CPAs aspire to work for one of the world's four largest professional services firms - PwC, Deloitte, EY, and KPMG.

Chartered Financial Planners (CFP) help individuals and families on a regular basis. Their work is predominantly educational. CFPs often assist customers in achieving retirement-related financial objectives and advising consumers on their insurance needs. CFPs can work for firms, but they typically operate their own enterprises. While a CFP’s advice is essential in the final decision-making process for individual and family investments, their work is ultimately more beneficial if they can transition from making financial decisions to empowering their clients to "take the wheel".

| CFP Services | CPA Services |

|---|---|

| Investment portfolio and asset allocation | Tax advice, planning and filing |

| Estate planning | Audit and assurance services |

| Retirement planning | Bookkeeping |

| Education planning | Business management and consultation |

| Debt management | Forensic accounting |

Salary and Career Path - CPA vs CFP

According to the Bureau of Labor Statistics (BLS), an accountant with a bachelor's degree can earn more than $78,000 per year on average, but a CPA can earn around $119,000. Certified Financial Planner (CFP) salaries in the United States range from $39,300 to $187,200.

However, numbers do not always reveal the entire picture. Identifying the optimal career path in any sector can be challenging. Since entrepreneurs, top executives, and entry-level professionals contribute to the "average" pay, the average is skewed. Check out local labor and employment statistics for more insight so you can make an informed decision about your future career.

Top 5 Careers for CPA and CFP

If you intend to settle in the United States and pursue a career in public accounting, becoming a CPA is your best option. If you want global mobility, however, choose CFP. Here’s a list of the top 5 careers in CPA and CFP:

| CFP Careers | CPA Careers | ||

|---|---|---|---|

| Top 5 Roles | Average Salary | Top 5 Roles | Average Salary |

| Lead adviser | $163,000 | Personal Financial Adviser | $100,000 |

| Personal financial planner | $127,000 | Finance Director | $101,300 |

| Client services adviser | $97,000 | Information Technology Accountants | $102,910 |

| Associate adviser | $68,000 | Corporate Controller | $112,000 |

| Wealth management adviser | $125,000 | Teacher in Accounting | $127,000 |

The Bottom Line

When it comes to providing financial advice, CFPs, and CPAs share some similarities. Both professionals are assisting people with financial management.

A certified public accountant's primary concentration is on clients' tax needs. CPAs are experts in handling matters that are significantly more complicated. Businesses, affluent individuals, and people with complicated financial situations can all benefit from the assistance of certified public accountants.

On the other hand, financial planners provide clients with guidance on a wider range of financial topics, including savings and investments. Customers frequently want simple general guidance or assistance in getting out of debt, or a solid plan to save for retirement. CFP’s are accountable for any concerns that pertain to your finances in a manner that is easy for you to comprehend. A CFP will help you evaluate the potential downsides of those investments before you make any.

Frequently Asked Questions (FAQs)

Is CPA better than the CFP designation?

If you are thinking of pursuing a career in public accounting, being a CPA is the ideal option for you. However, if you are interested in mobility across the globe, your best bet is to pursue CFP.

CPAs are crucial for auditing a company’s records and drafting complex tax filings. A CFP specialist has knowledge of financial planning, taxes, insurance, retirement, and estate planning. Both are different certifications, so your program selection will depend on what you choose.

Is the CFP exam harder than the CPA Exam?

The CPA Exam is more challenging than the CFP based on historical pass rates.

Should I get both CPA and CFP?

The CFP Board has discovered that a large number of CPA practitioners also have a CFP certification. Having both a CPA license and a CFP certification will certainly boost your career opportunities.

A CPA license displays an accountant’s profound understanding of accounting procedures. Also, as a CPA, you are deemed to “go the extra mile” to keep things going, much like an esteemed leader of a profound company. CFP on the other hand, is the gold standard in personal financial planning and primarily entails guiding clients towards a secure financial future. Having both qualifications helps you build excellent client relations.

Read More about the CPA Exam

Learn about CPA earnings, average CPA salaries, and current market standards for entry-level and experienced CPAs. Discover a CPA's real-time net worth and explore new opportunities!

What does it take to become a successful CPA? Find out the four most important requirements. Each state has a unique set of regulations. To learn more, see what each state's criteria are.

Explore your one-stop guide to the CPA Exam Format! Learn about the four-part exam with sample testlets from previous years! Look for the recent updates and get one step closer to becoming a CPA!

What’s the difference between a CPA and a CFA? One is a certified accountant, the other is a financial planner. Learn more about what’s the best choice for your career!