What Is the FAR CPA Exam Format and Structure?

The Financial Accounting and Reporting (FAR) Certified Public Accountant (CPA) Exam spans 4 hours and consists of 5 testlets. Following the completion of the 3rd testlet, candidates have the option for a 15-minute break, which doesn’t count towards the 4-hour test duration.

The Multiple-Choice Question (MCQ) section consists of 2 testlets, each containing 25 questions, for a total of 50 questions. The Task-Based Simulations (TBS) section consists of 3 testlets: the 3rd testlet contains 2 TBS; the 4th testlet contains 3 TBS; and the 5th testlet contains 2 TBS. MCQs cover 50% of the score weight; the other 50% comes from the TBS section.

| 2026 FAR CPA Exam Structure | |

|---|---|

| Total Time | 4 Hours |

| Multiple Choice Questions | 50 |

| Task-Based Simulations | 7 |

Pre Exam

A welcome or launch code flashes on your screen for 5 minutes before you begin the exam. After that, another screen presenting the confidentiality code remains for 5 minutes. Hence, there is a total of 10 minutes for your pre-exam screen.

Exam

The 5 testlets of the FAR CPA Exam consist of 2 types of questions: Multiple-Choice Questions and Task-Based Simulations.

- Multiple-Choice Questions (MCQ): Each question has 4 potential answers. MCQs make up 50% of the FAR exam.

- Task-Based Simulations (TBS): These questions require you to apply practical knowledge. This could include filling out a document or finishing a research question. The TBS makes up 50% of the FAR exam.

Multiple Choice Questions: There are 50 MCQs divided equally into 2 testlets. Each testlet has a few pretest questions that aren’t graded. They are typically 1 sentence or a paragraph long and have 4 possible answer options.

Task-Based Simulations: TBS questions are practical and require candidates to type answers. These may include research-based questions, completing a financial statement, filling out a form, or making journal entries. The TBS is tested in 3 testlets containing 2 to 3 task-based simulation questions per testlet. There are 7 task-based simulations, 1 of which is pretested.

An optional 15-minute break that does not count toward the 4-hour test period is provided after the 3rd testlet.

Post Exam

Post Exam, you will be prompted to complete a 5-minute survey regarding your exam experience and acquire candidate feedback.

What Topics Are Tested in the FAR CPA Exam?

- General-Purpose Financial Reporting: For-Profit Business Entities

- General-Purpose Financial Reporting: Nongovernmental Not-for-Profit Entities

- State and Local Government Concepts

- Public Company Reporting Topics

- Special Purpose Frameworks

- Financial Statement Ratios and Performance Metrics

- Cash and cash equivalents

- Trade receivables

- Inventory

- Property, plant and equipment

- Investments

- Intangible assets

- Payables and accrued liabilities

- Debt (financial liabilities)

- Equity

- Accounting changes and error corrections

- Contingencies and commitments

- Revenue recognition

- Accounting for income taxes

- Fair value measurements

- Lessee accounting

- Subsequent events

What Skills are Tested On the FAR Exam?

The FAR CPA Exam will continue to follow the upgraded Bloom's Taxonomy of Educational Objectives regarding skills. Based on this, the skills tested on the CPA Exam are shown in the table below.

| Skill allocation | Weight |

|---|---|

| Evaluation | – |

| Analysis | 35-45% |

| Application | 45-55% |

| Remembering & Understanding | 5-15% |

How Do I Manage My Time on the FAR CPA Exam?

Time management is essential for passing the CPA Exam. Here, we will discuss a few strategies that will help you maximize your time and improve your chances of passing the FAR exam. We recommend that you adhere to the time management chart below to complete all your testlets on schedule.

| Testlet | Question Type | Suggested Time |

|---|---|---|

| Testlet 1 | 25 MCQ | 52 Minutes |

| Testlet 2 | 25 MCQ | 52 Minutes |

| Testlet 3 | 2 TBS | 36 Minutes |

| 15-minute break (does not count toward total exam time) | ||

| Testlet 4 | 3 TBS | 54 Minutes |

| Testlet 5 | 2 TBS | 36 Minutes |

| Extra Time | 10 Minutes | |

| Total Time | 240 Minutes | |

- There are 50 MCQs, combining the first 2 testlets. We suggest you allocate 2.08 minutes for each MCQ. Hence, it will take 52 minutes each to complete the MCQ testlets.

- The remaining 3 testlets contain 7 TBS in total. Our experts recommend allocating 18 minutes for each TBS. With this strategy, you can finish the 3rd testlet within 36 minutes, the next testlet in 54 minutes, and 36 minutes for the last testlet.

- A standard 15-minute break is allowed only after the 3rd testlet, during which the timer is paused.

- In addition, there are 2 more optional breaks as well. These optional breaks are not excluded from the total duration of your exam, so the timer continues to run during these optional breaks.

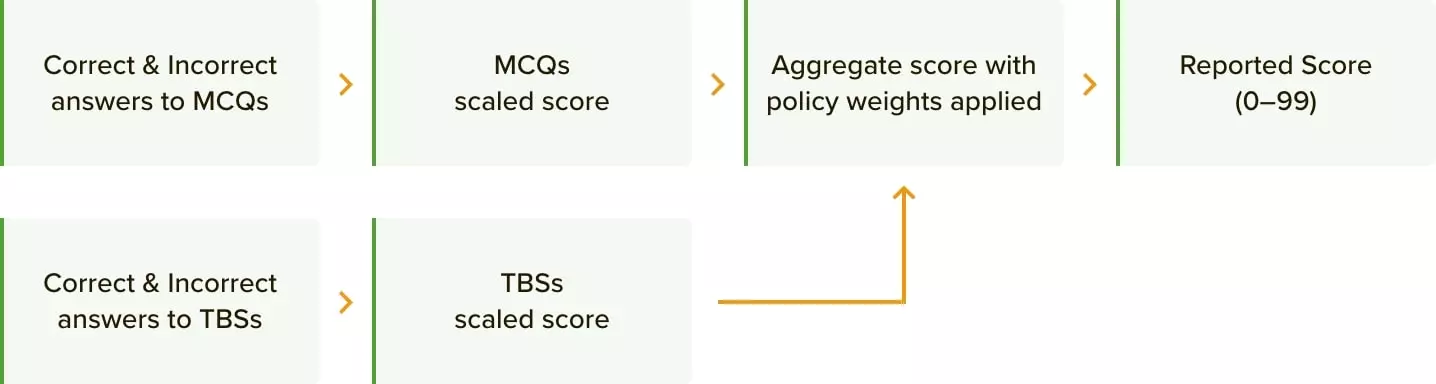

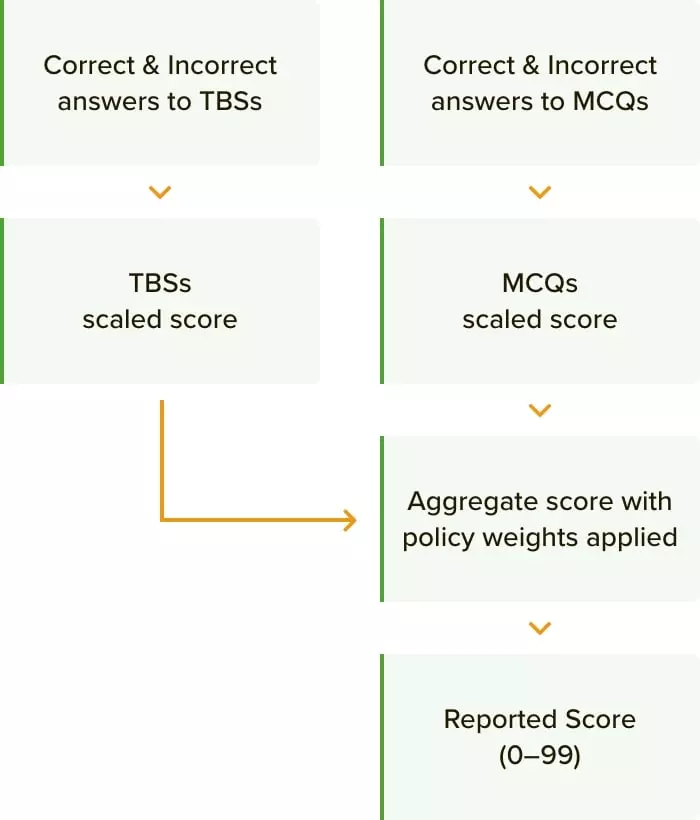

How is the FAR CPA Exam Scored?

Scores for the FAR exam are given on a scale of 0 to 99. All CPA Exam parts must be passed with a score of 75 or higher. It does not necessarily imply that you must answer 75% of the questions correctly. The difficulty level determines the numeric value of a question. It means difficult questions have more worth than easy or moderate questions. If you answer 5 difficult questions and 5 moderate or easy questions correctly, you will score more for the difficult questions.

The CPA Exam is not curved. The American Institute of Certified Public Accountants (AICPA®) employs question weights instead of altering your score based on your cohort’s performance. These weights are determined based on how candidates performed during the pre-testing of the questions.

The FAR CPA Exam’s MCQ testlets account for half the overall score. The remaining 50% comes from the TBS testlets.

The TBS scores are pre-programmed and are not modified based on the candidate’s performance. Partial scoring is also applied for TBS, as they include multiple responses. You are eligible to earn credit for each of them.

FAR CPA Exam Pass Rates

FAR has the lowest pass rate among the 3 core sections. It is likely due to the vast amount of material that FAR covers and the necessity of comprehending the concepts rather than simply memorizing them.

*Cumulative through Q2 2025.

Source: https://www.aicpa-cima.com/resources/article/learn-more-about-cpa-exam-scoring-and-pass-rates

The AICPA publishes the average CPA Exam Pass Rates every quarter, broken down by section. While pass rates vary by region and quarter, the average for Core sections is typically 45-50%, with Discipline sections often experiencing higher variability. View the pass rates for each section of the CPA Exam from prior years in CPA Exam Pass Rates.

How to Study for the FAR CPA Exam Section

Many candidates are intimidated by the FAR Exam content before they even begin studying. When studying for FAR, you must realize the importance of segmenting easy topics from the more difficult ones and allocating study time accordingly. For example, dedicate plenty of study time to topics that are more difficult to understand, such as pensions, and devote less study time to topics that you already have a firm grasp on.

Analyze the Study Material

Watch Lectures

Work on Multiple-Choice Questions

Manage Time

Focus on Governmental, NGO, and Non-Profit Accounting

Analyze the Study Material

Reading through every chapter of your study material is a great best approach when preparing for the FAR CPA Exam. You’ll be able to tell which portions of your study material require more attention and which are easier to grasp. Once you have a gauge of where your strengths and weaknesses lie, establish a study plan and concentrate on the hardest sections.

Watch Lectures

You will have a general comprehension of the topics once you have finished reading your basic study material. Watch lectures on the topics to gain a broad understanding of the subject and jot down the main aspects that will help you construct concrete exam answers.

Work on Multiple-Choice Questions

To effectively learn and retain information from a textbook or course, it is essential to actively engage with the material through various methods such as note-taking and practicing with quizzes. When completing multiple-choice questions, knowing the correct answer and understanding why the other options are incorrect is vital. Practice quizzes after each chapter help solidify knowledge and identify areas that require further review. Reading through answer explanations for correct and incorrect answers can enhance understanding of the concepts and improve retention.

Manage Time

Use a timer to practice FAR quizzes, as they involve more calculations than AUD, REG, and the other disciplines. Getting caught up in numbers and formulas under pressure is easy, so having the timer on ensures that you are managing time wisely. If you find that time is running out and you still haven’t decided on an answer, you can use the bookmark feature to go back and review the question(s) later.

Focus on Governmental, NGO, and Non-Profit Accounting

Not everyone is well-versed in specific governmental or non-profit accounting. If you are one of them, spend some significant time reviewing these topics. They account for a larger portion of the FAR CPA Exam. Knowing how they work and how they differ from for-profit businesses will be immensely helpful.

The multiple-choice questions for FAR can be daunting because most of them require calculations. So remember that lots of practice and patience are required for FAR. If you can figure out what’s easy and what’s hard for you and use your time wisely, you’ll get through it soon enough!

How Many Hours Should I Study for the FAR CPA Exam?

CPA candidates frequently ask about the number of hours they should study to pass the FAR section of the CPA exam. The AICPA recommends spending a minimum of 300 to 400 hours studying for the CPA Exam. That equates to 80 to 100 hours of study time for each section.

However, no 2 CPA candidates are alike. Each person learns at a different pace and has a unique learning style. Additionally, certain portions of the study material may take longer to complete than others. Take your study style into account and set a realistic expectation for how long it will take to study for the FAR CPA Exam. Understanding your own learning style and limitations is vital to passing.

Frequently Asked Questions (FAQs)

How do I pass the FAR CPA Exam?

Is the FAR the hardest CPA Exam?

What is most heavily tested on the FAR CPA Exam?

Do I have 18 months to pass the entire CPA Exam, or has that been extended?

Other CPA Exam Sections

Learn the format, structure, and pass rates of the AUD CPA Exam. And prepare yourself with study tips to pass the exam.

Discover REG CPA Exam's format, structure, and pass rates. Also, equip yourself with techniques to pass the exam.

Learn what to expect when you take the BAR discipline of the CPA Exam, including the exam’s topics, structure, question format, and more. Plus, see how this discipline section relates to the FAR core section.

Learn what to expect when you take the TCP discipline of the CPA Exam, including the exam’s topics, structure, question format, and more. Plus, see how this discipline section relates to the REG core section.

Learn what to expect when you take the ISC discipline of the CPA Exam, including the exam’s topics, structure, question format, and more. Plus, see how this discipline section relates to the AUD core section.

CPA Exam Sections, Format & Content