What Is the REG Exam Format and Structure?

The Regulation (REG) section of the CPA Exam spans 4 hours and consists of 5 testlets. Following the completion of the 3rd testlet, candidates have the option for a 15-minute break, which does not count toward the 4-hour test duration.

| 2026 REG CPA Exam Structure | |

|---|---|

| Total Time | 4 Hours |

| Multiple Choice Questions | 72 |

| Task-Based Simulations | 8 |

Pre Exam

At the beginning of your REG CPA Exam, you will encounter 2 sets of welcome screens. The first set verifies your personal details, including name, ID, exam portion, and launch code. Following this, you must accept the confidentiality declarations. Each screen allows a maximum of 5 minutes for completion.

Exam

Pretest questions are not scored, but operational questions are. The REG exam is composed of multiple-choice questions (MCQs) and task-based simulations (TBS). Each testlet contains questions from only 1 of the following question types.

- Multiple-Choice Questions (MCQs): The first 2 testlets on the REG exam consist of MCQs, with 36 questions per testlet. With a total of 72 MCQs, 60 are operational, meaning they contribute to the exam score, whereas the remaining 12 are pretested and do not contribute to the exam score.

- Task-Based Simulations (TBS): The remaining 3 testlets consist of TBS questions. There are 8 TBS in total: 7 are operational, and 1 is pretested.

Post Exam

Following the exam, you will be asked to complete a 5-minute survey regarding your exam experience.

What Topics Are Tested in the REG CPA Exam?

- Ethics and responsibilities in tax practice

- Licensing and disciplinary systems

- Federal tax procedures

- Legal duties and responsibilities

- Government regulation of business, specifically employment taxes, worker

classification laws, the Bankruptcy Abuse Prevention and Consumer Protection

Act of 2005, the Foreign Corrupt Practices Act of 1977, and the Patient

Protection and Affordable Care Act - Areas of agency, contracts, debtor-creditor relationships, and business structure

- Basis of assets

- Cost recovery (depreciation and amortization)

- Gross income (inclusions and exclusions)

- Reporting of items from pass-through entities

- Adjustments and deductions to arrive at adjusted gross income and taxable income

- Loss limitations

- Filing status

- Computation of tax and credits

- Differences between book and tax income (loss)

- C corporations

- S corporations

- Partnerships

- Limited liability companies

- Tax-exempt organizations

What Skills Are Tested on the REG CPA Exam?

The CPA Exam continues to follow the revised Bloom’s taxonomy of educational objectives.

Analysis is the investigation of the interrelationships of separate areas to identify causes and find confirmation to support implications.

Application is the use or exhibition of knowledge, concepts, or techniques.

Remembering & Understanding is the observation and understanding of the significance of an area utilizing knowledge gained.

| Skill Allocation | Weight |

|---|---|

| Analysis | 25-35% |

| Application | 35-45% |

| Remembering and Understanding | 25-35% |

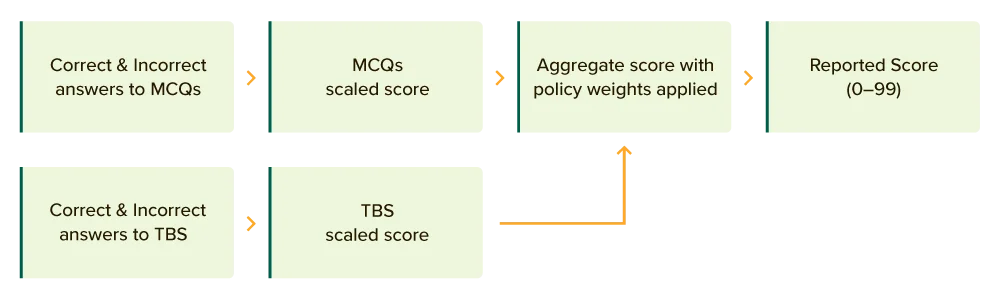

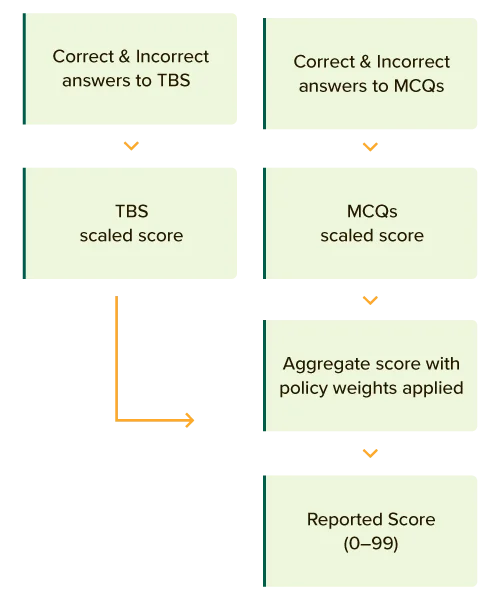

How is the REG CPA Exam Scored?

Scores for the REG exam are given on a scale of 0 to 99. Candidates must score 75 or higher to pass. These aren’t percentages, and they shouldn’t be treated as such. Scaled scores on the exam’s MCQs and TBS are determined using algorithms that take into account whether the question was successfully answered, as well as the difficulty level of each question.

For example, a candidate who answers 10 difficult questions correctly will receive a higher score than a candidate who answers 10 easy (lower value) questions correctly. Therefore, answering 75% of the questions on the exam correctly does not translate into a score of 75. Many factors contribute to a CPA Exam Score. Learn more about how the CPA Exam is scored here.

The 1st half of a candidate’s REG exam score is made up of MCQs, while the 2nd half is made up of TBSs. The weight of a candidate’s final score will be evenly allocated between MCQs and TBS. This means that the weightage for MCQs and TBS is 50% each.

Credit for the REG exam MCQs is weighted by difficulty level; candidates who answer more difficult questions correctly receive more credit than those who answer less difficult questions correctly. While an MCQ can be answered correctly or incorrectly, non-research-based TBS receive partial credit. Research-based TBS are assessed as correct or incorrect, with no partial credit provided.

REG CPA Exam Pass Rates

REG has the highest pass rate of the core sections. Here’s a look at the REG CPA Exam pass rates over the years:

Source: https://www.aicpa-cima.com/resources/article/learn-more-about-cpa-exam-scoring-and-pass-rates

UWorld candidates who meet SmartPathTM performance benchmarks achieve an impressive 90% average pass rate across all sections of the CPA Exam — a figure that substantially exceeds the national average.

How To Study for the REG CPA Exam Section

We estimate approximately 84-112 hours of study are required to pass REG, but each student is unique and has their own time requirements.

The order in which a candidate takes the sections of the CPA Exam will vary depending on several individual factors. REG is the most standalone of all 4 sections and can be taken at any time during your CPA Exam process.

Establishing a study plan and sticking to it is essential to passing the CPA Exam. Break up your study topics and content areas into manageable pieces, and allocate a specific amount of time to study each section. The best way to prepare for the REG CPA Exam is to read every chapter of your study material. Soon, you will identify which topics need the most attention and work accordingly.

Practice, practice, practice. Make sure your CPA review course includes access to top-quality MCQs and TBS that match the content and format of the actual REG exam.

Time management is key to your success on the REG exam. You can hone this skill by completing practice exams with a timer. This will help you stay aware of the time, allowing you to adjust your pace and manage time effectively throughout the exam.

A CPA Review course will help you effectively study for the CPA Exam. The UWorld CPA Review Course has customizable quizzes and digital flashcards with spaced-repetition technology to help you learn efficiently.

How To Manage Your Time in the REG CPA Exam

The format and structure of the 2026 REG CPA Exam require a time management strategy to help you optimize your time. Here is the amount of time we recommend you spend on each question, based on the question type:

- 72 Multiple-Choice Questions: 1.30 minutes each

- 8 Task-Based Simulations: 18 minutes each

| Testlet | Question Type | Suggested Time |

|---|---|---|

| Testlet 1 | 36 MCQ | 47 Minutes |

| Testlet 2 | 36 MCQ | 47 Minutes |

| Testlet 3 | 2 TBS | 36 Minutes |

| 15-minute break (does not count toward total exam time) | ||

| Testlet 4 | 3 TBS | 54 Minutes |

| Testlet 5 | 3 TBS | 54 Minutes |

| Extra Time | 2 minutes | |

| Total Time | 240 minutes | |

Frequently Asked Questions (FAQs)

How hard is the REG CPA Exam?

How many hours do I need to study to pass the REG CPA Exam?

What should I focus on for the REG CPA Exam?

How long do I have to pass the entire CPA Exam?

Read More Related Articles

Your one-stop shop for everything you need to know about the AUD section of the CPA Exam. To ace the AUD CPA Exam, learn about format, content, length, current revisions, scoring, pass rates, and study tips.

The Financial Accounting and Reporting (FAR) section is one that almost every CPA candidate is intimidated by. It is considered to be the longest, most difficult, and highly comprehensive section of the CPA Exam. Here’s all you need to know about FAR.

BAR CPA Exam

Learn what to expect when you take the BAR discipline of the CPA Exam, including the exam’s topics, structure, question format, and more. Plus, see how this discipline section relates to the FAR core section.

Learn what to expect when you take the TCP discipline of the CPA Exam, including the exam’s topics, structure, question format, and more. Additionally, explore the connection between this discipline section and the REG core section.

Learn what to expect when you take the ISC discipline of the CPA Exam, including the exam’s topics, structure, question format, and more. Plus, see how this discipline section relates to the AUD core section.

CPA Exam Sections, Format & Content

Get all the information you need about the CPA Exam’s format, structure, and content for each exam section.